VAT Only Invoices

This guide will provide detailed step-by-step explanation of create the invoices with only Tax line details in Oracle fusion.

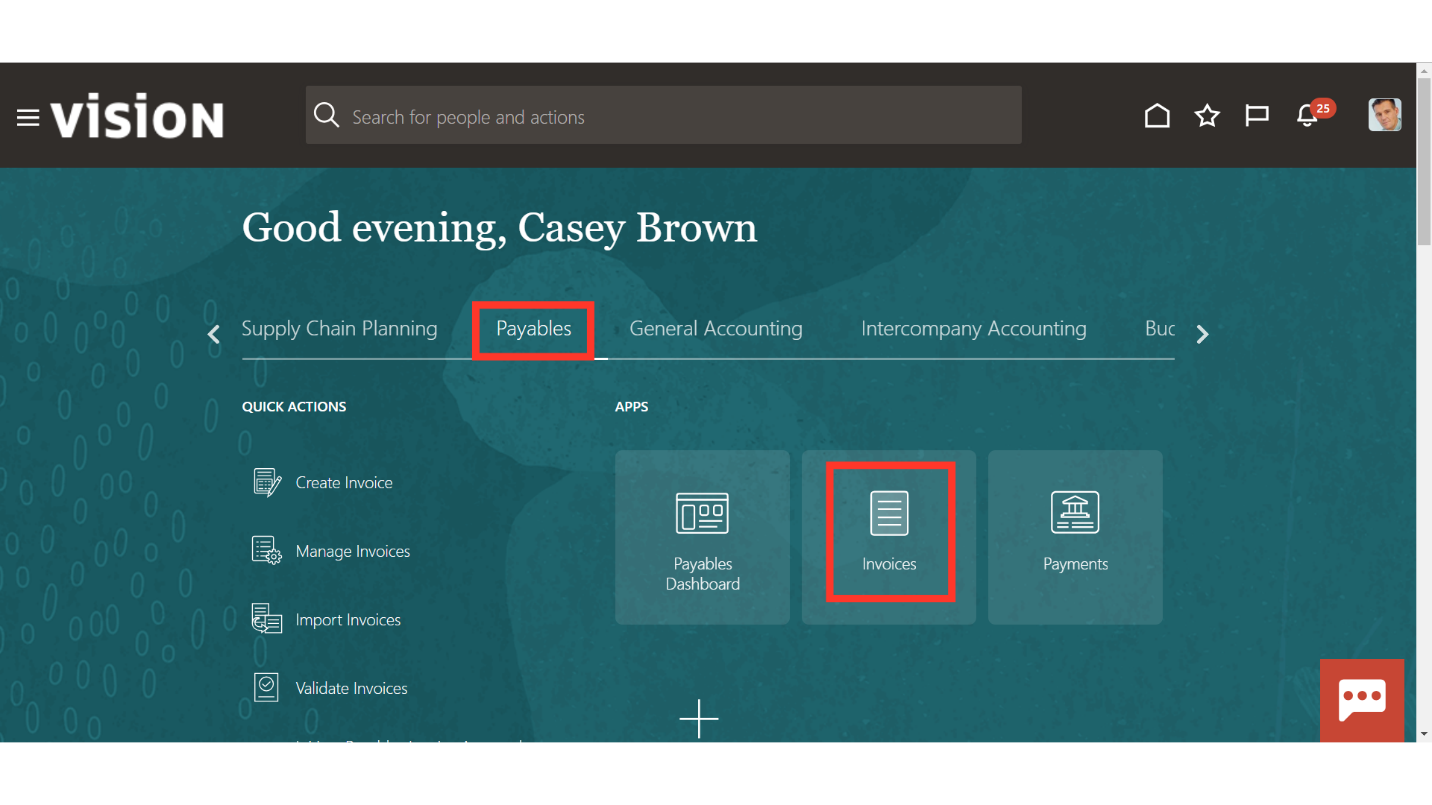

After landing to home page, click on the Invoices submenu under the Payables menu.

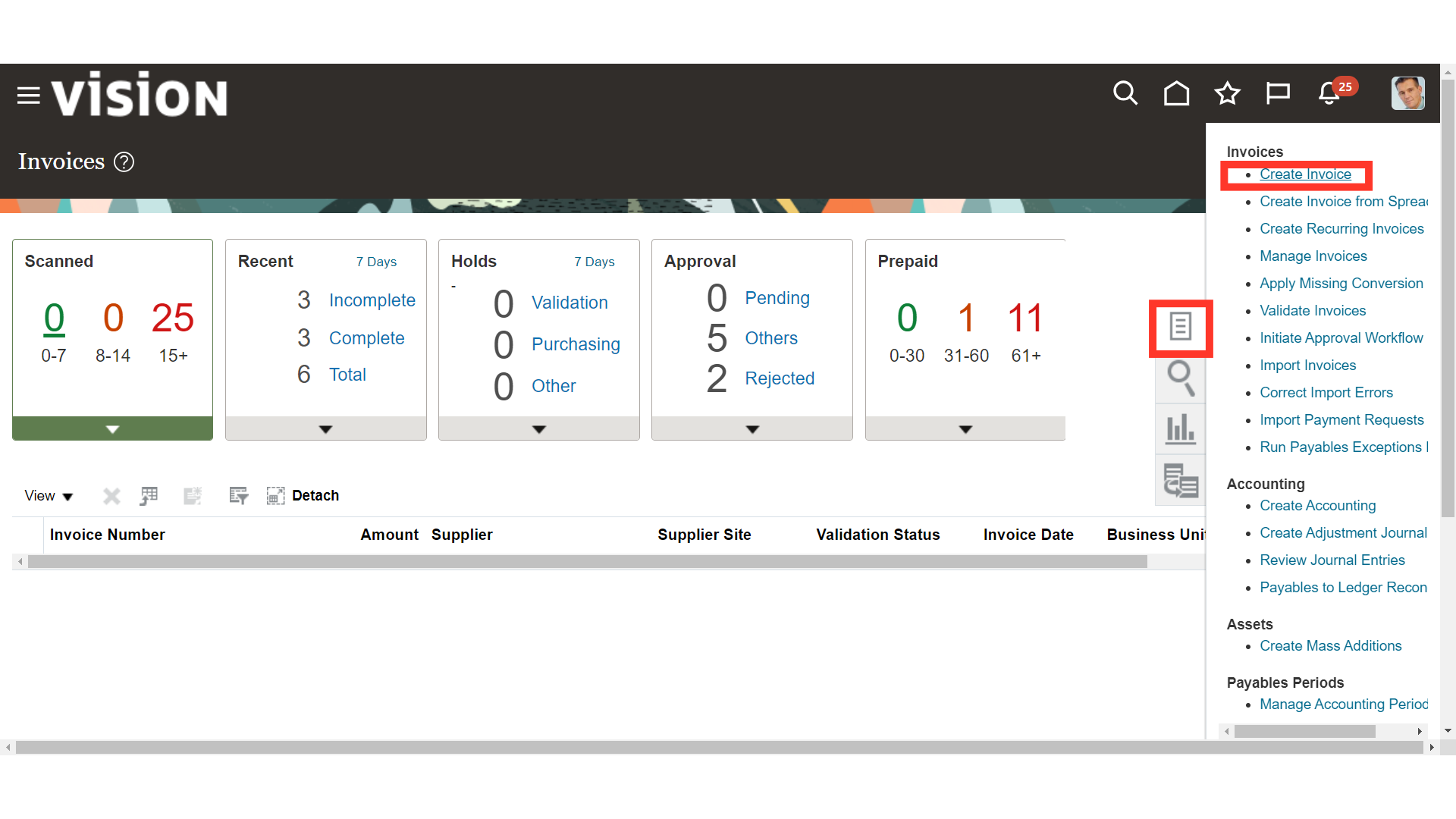

Once you land into the Invoice work area, select the “Create Invoice” from the Task list for recording the invoice.

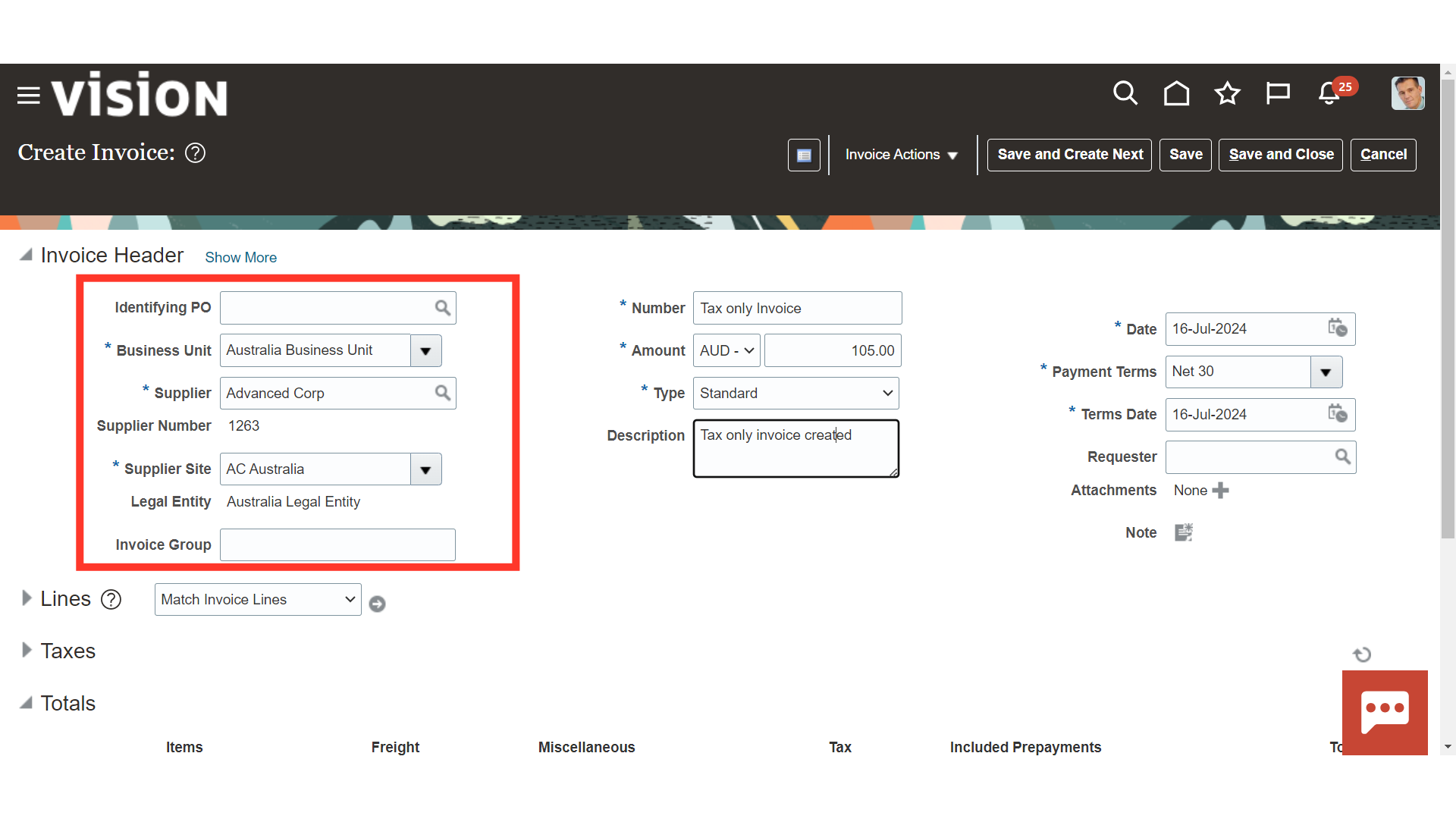

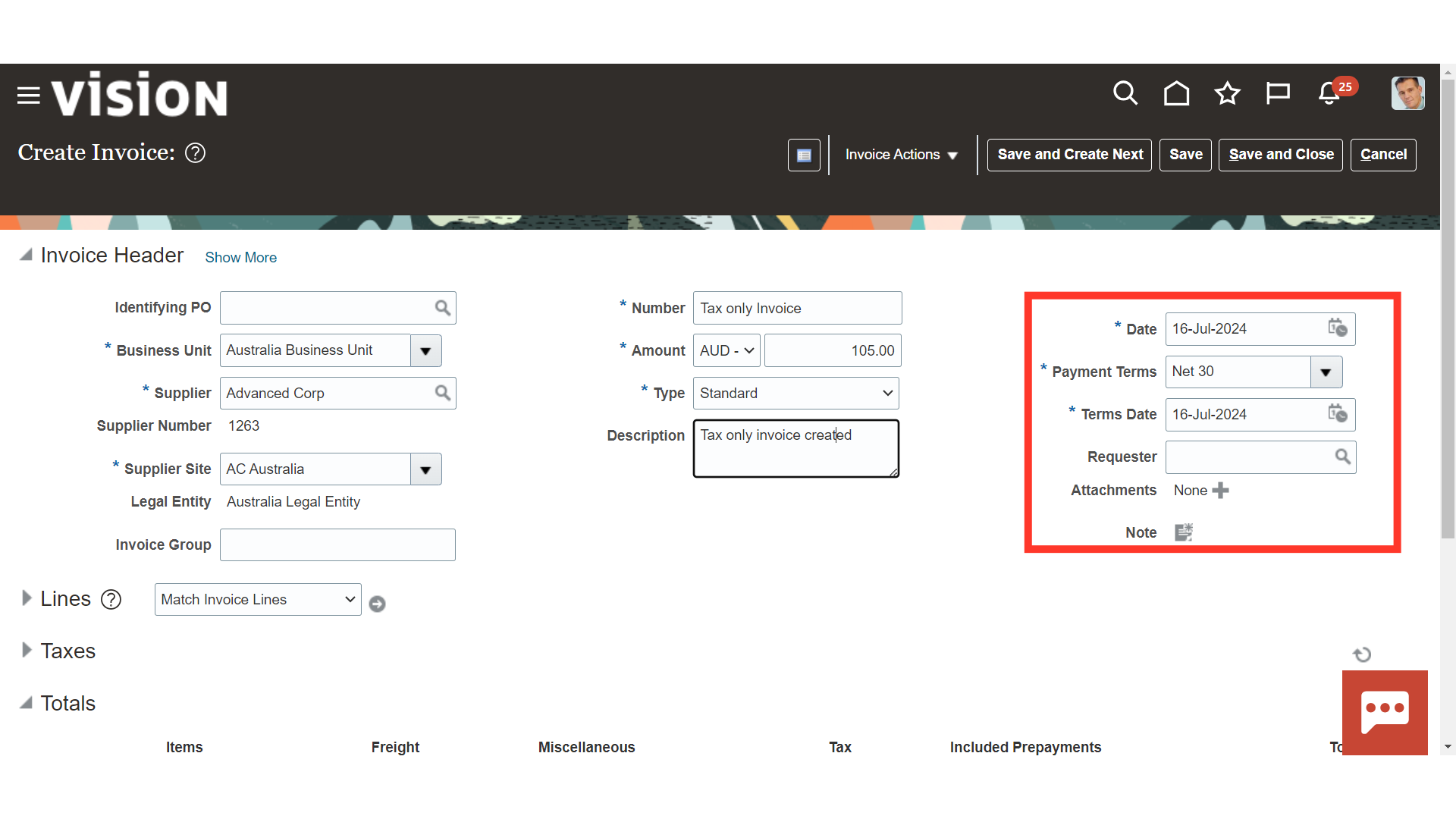

Enter the details in Invoice headers such as Business unit, Supplier details under which this invoice is to be created.

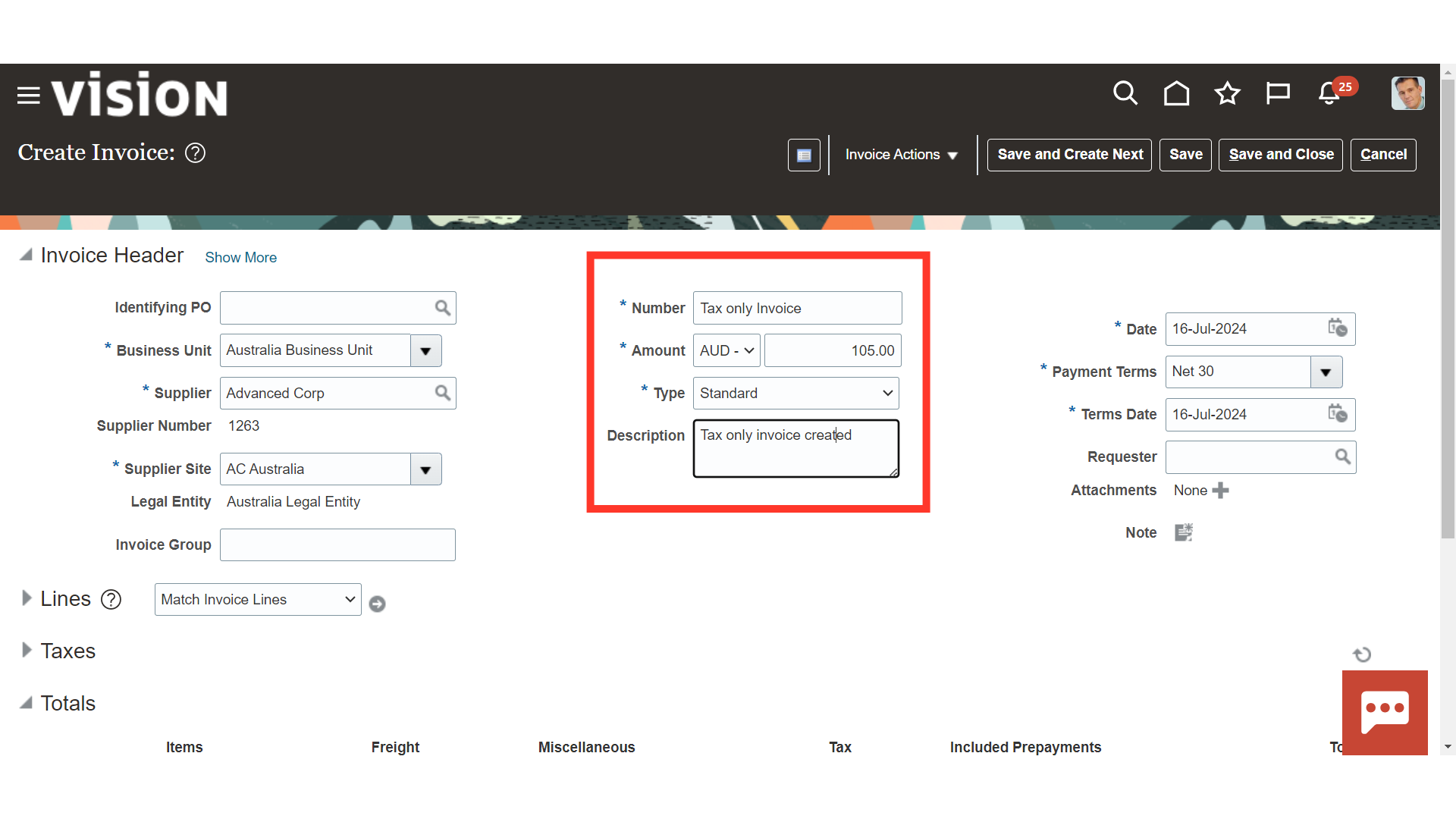

Enter the Invoice number, tax amount in the Amount field, and select the type of invoice as Standard. Additionally, enter the meaningful information in the Description field.

Current system date is defaulted as ” Invoice date”, you can change the date manually or by selecting date from the calendar. Terms date is calculated based on the Invoice Date and Payment Terms.

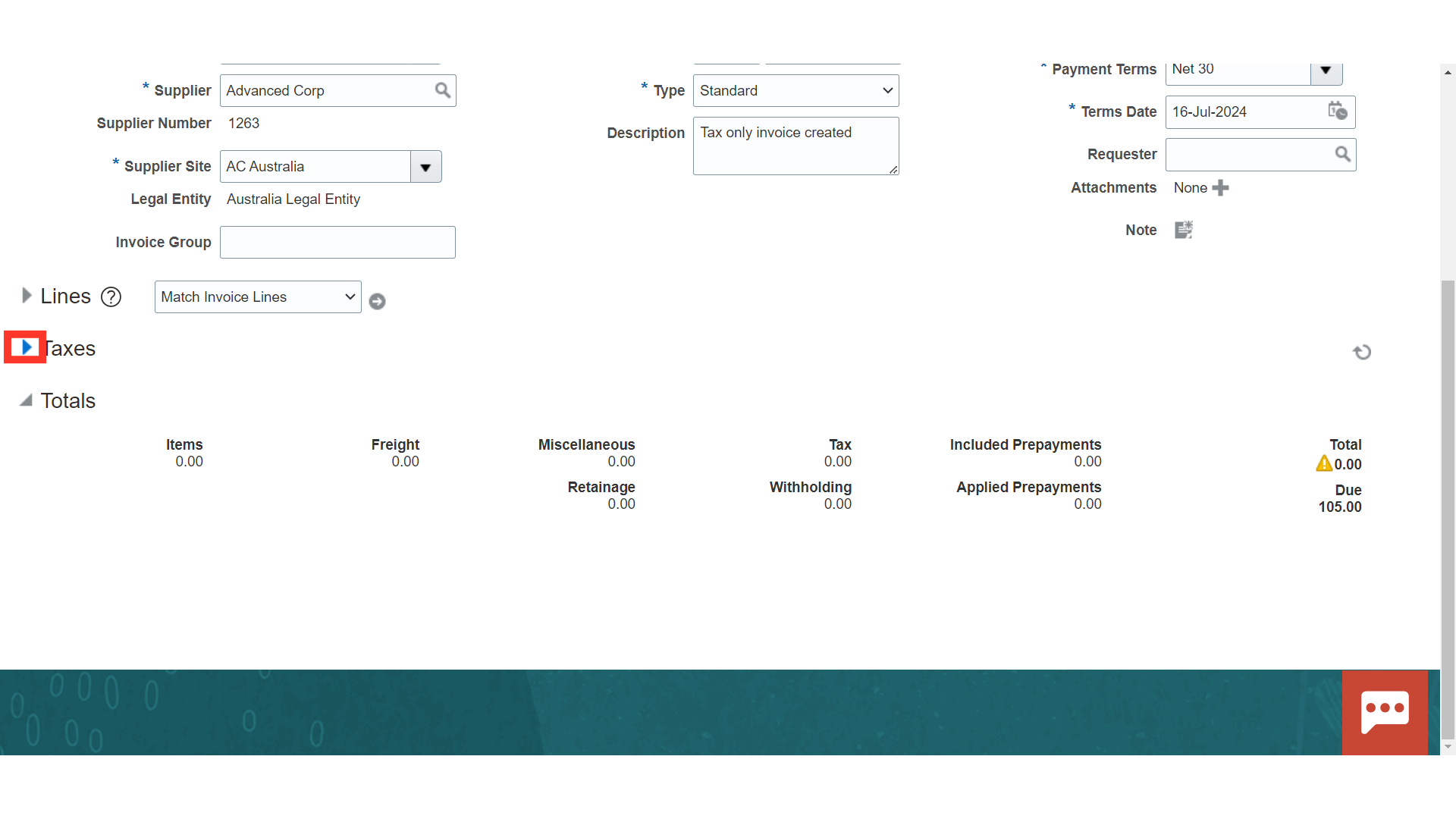

To enter the tax details, expand the Taxes section.

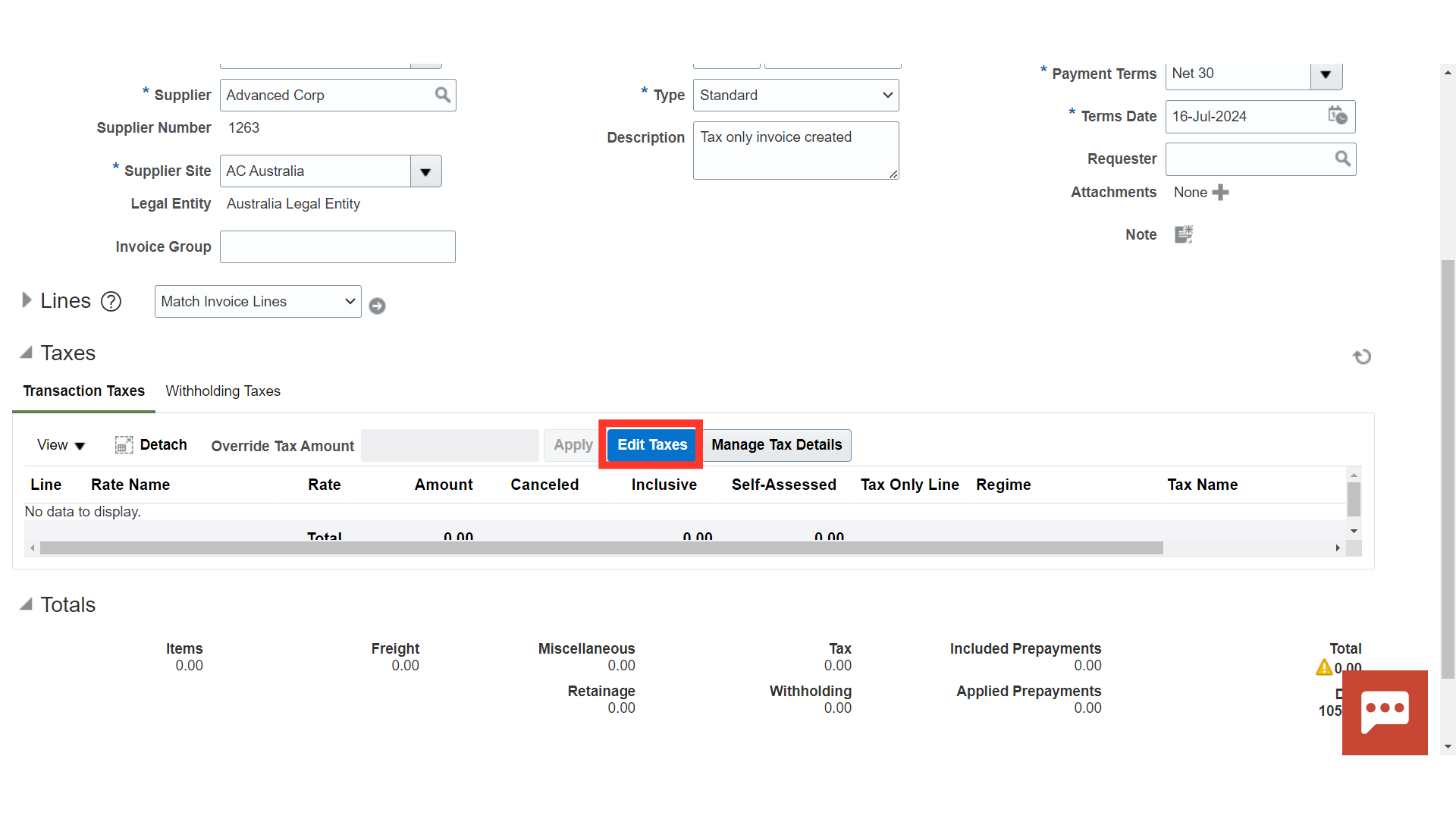

Click on the Edit Taxes button to create Tax details.

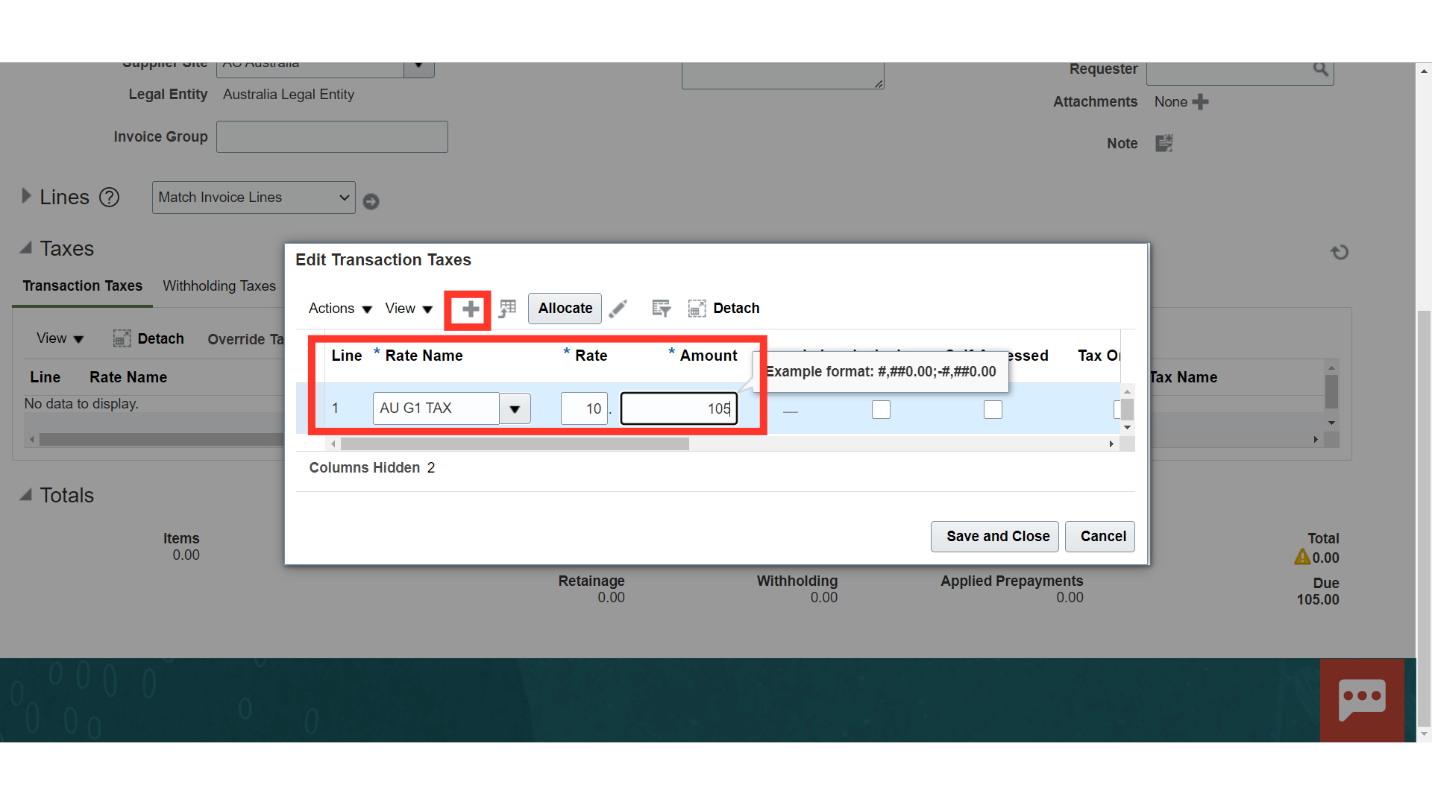

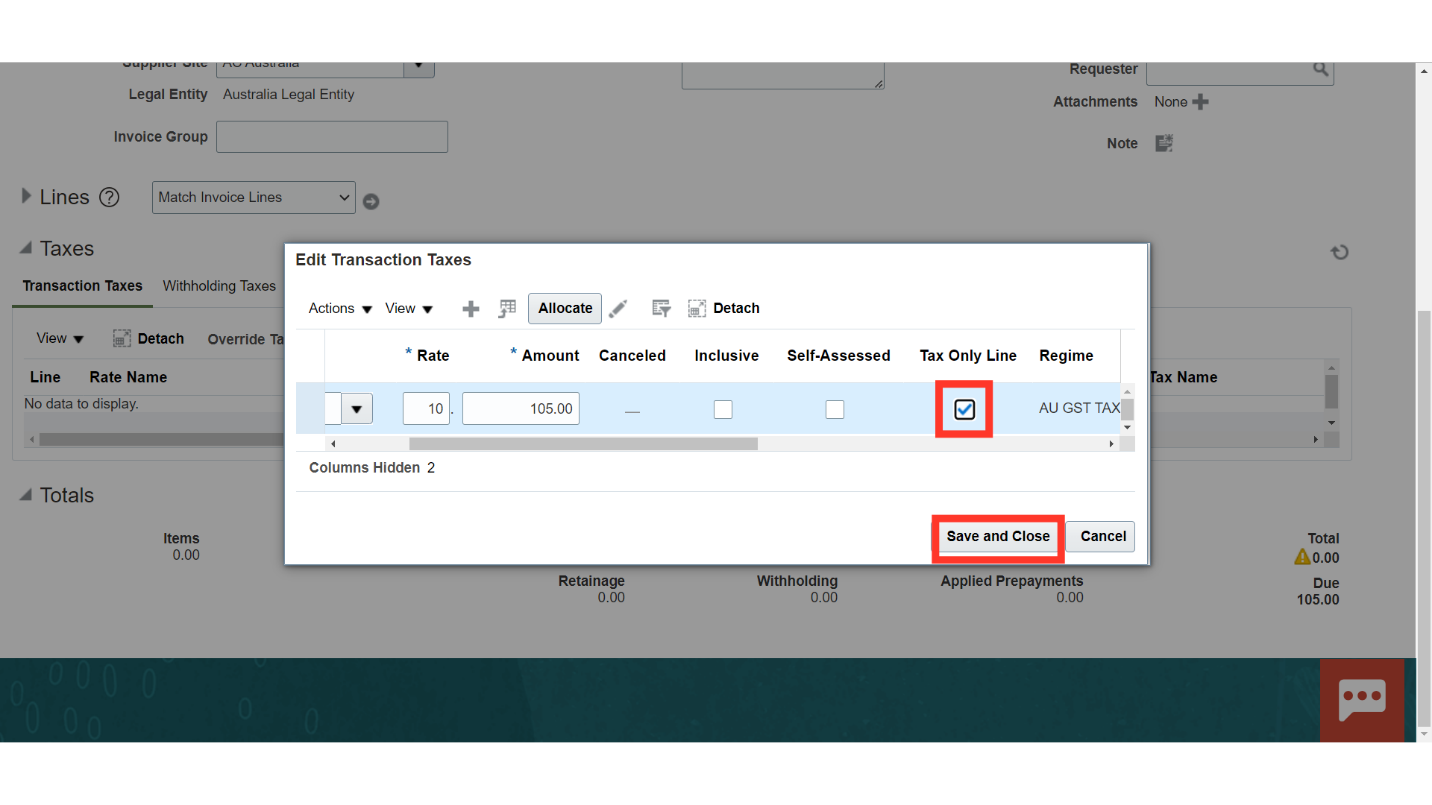

After clicking on the Plus button, Select the Tax rate from the list of values and enter the Tax amount

Enable the checkbox under the Tax only line for creating the Tax Only amount. To close this window, click on Save and Close button.

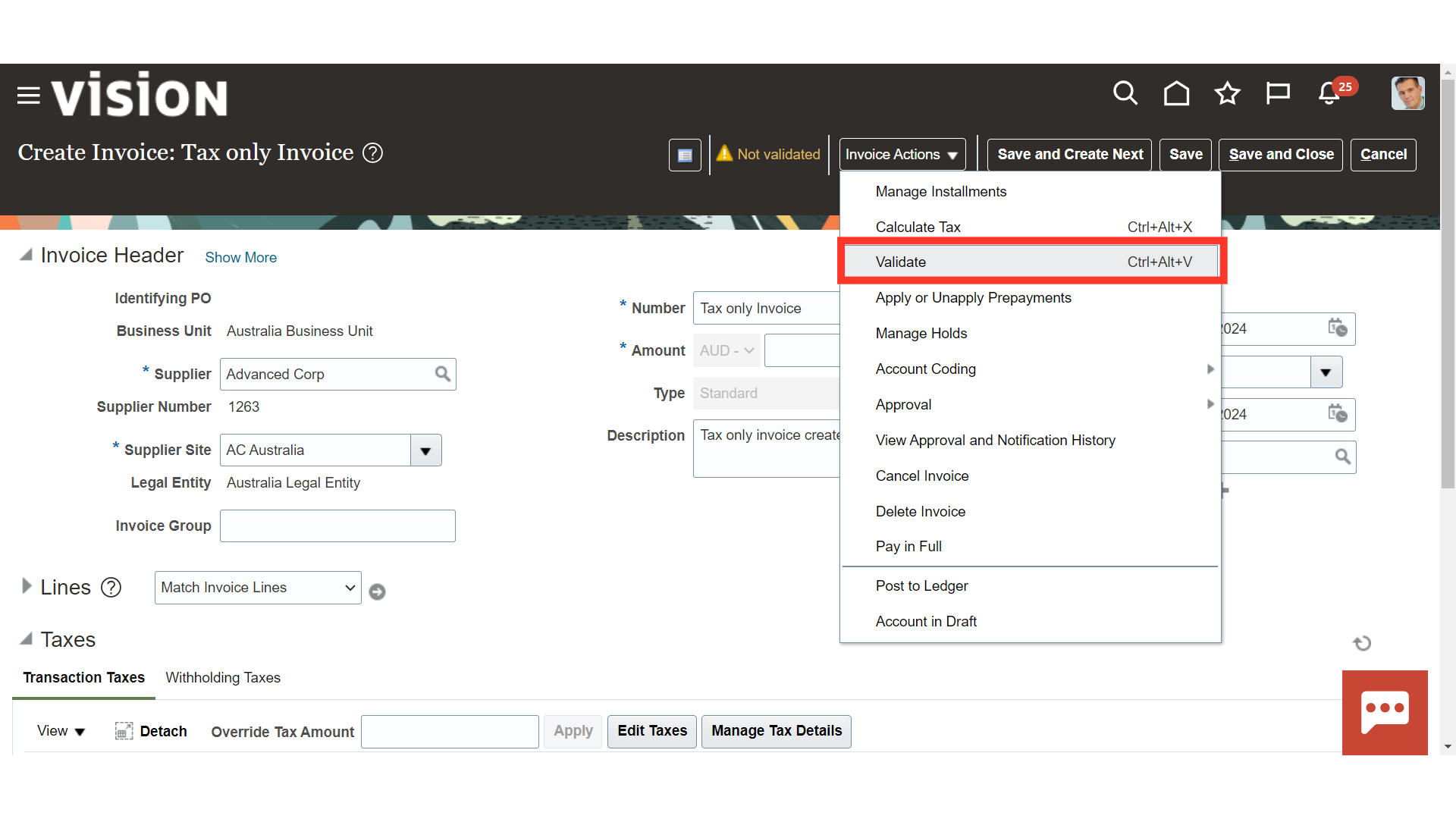

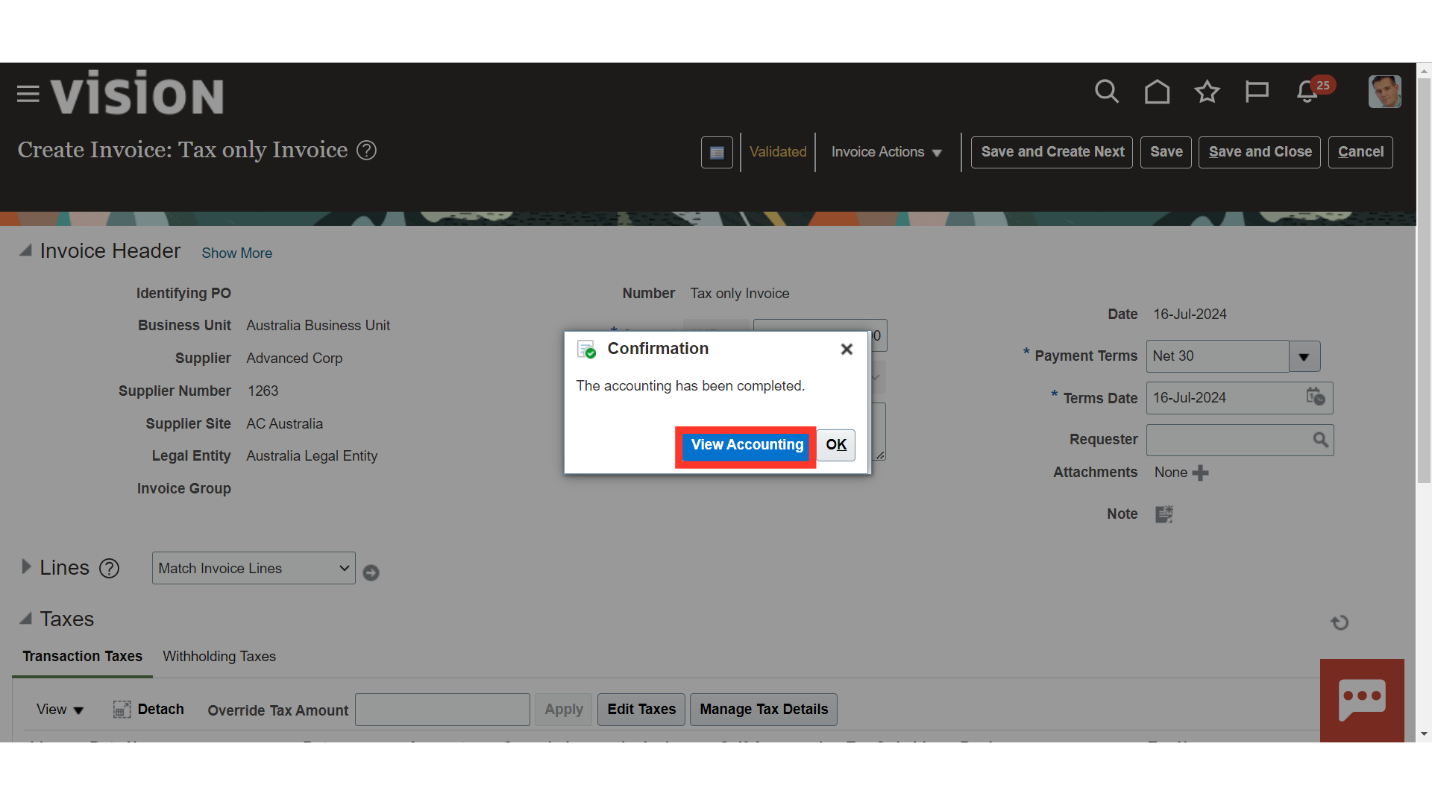

For validating the invoice click on “Validate” after clicking on the Invoice Actions.

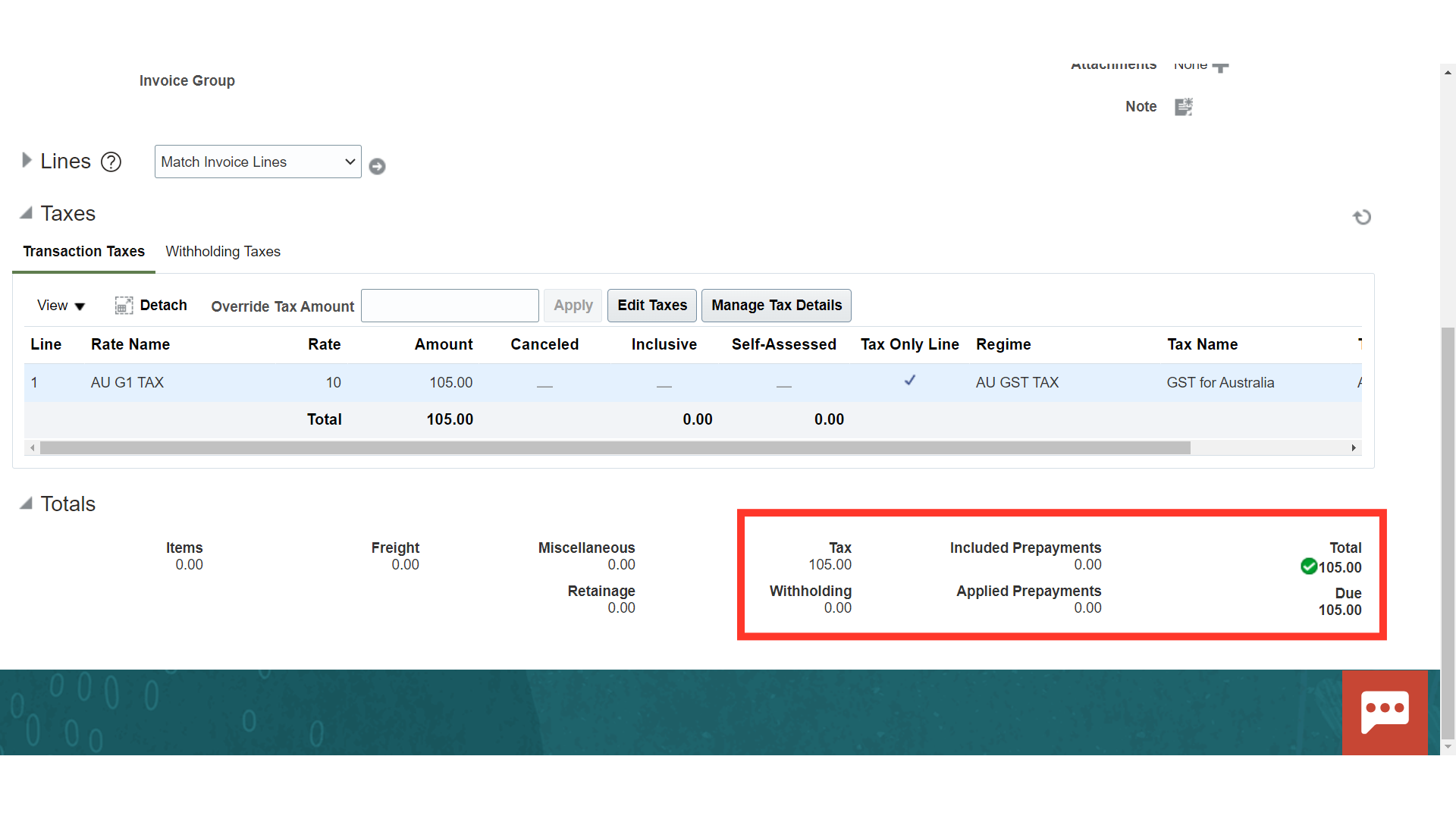

Scroll down to bottom to see the Totals section under which Tax amount, Total amount etc are displayed.

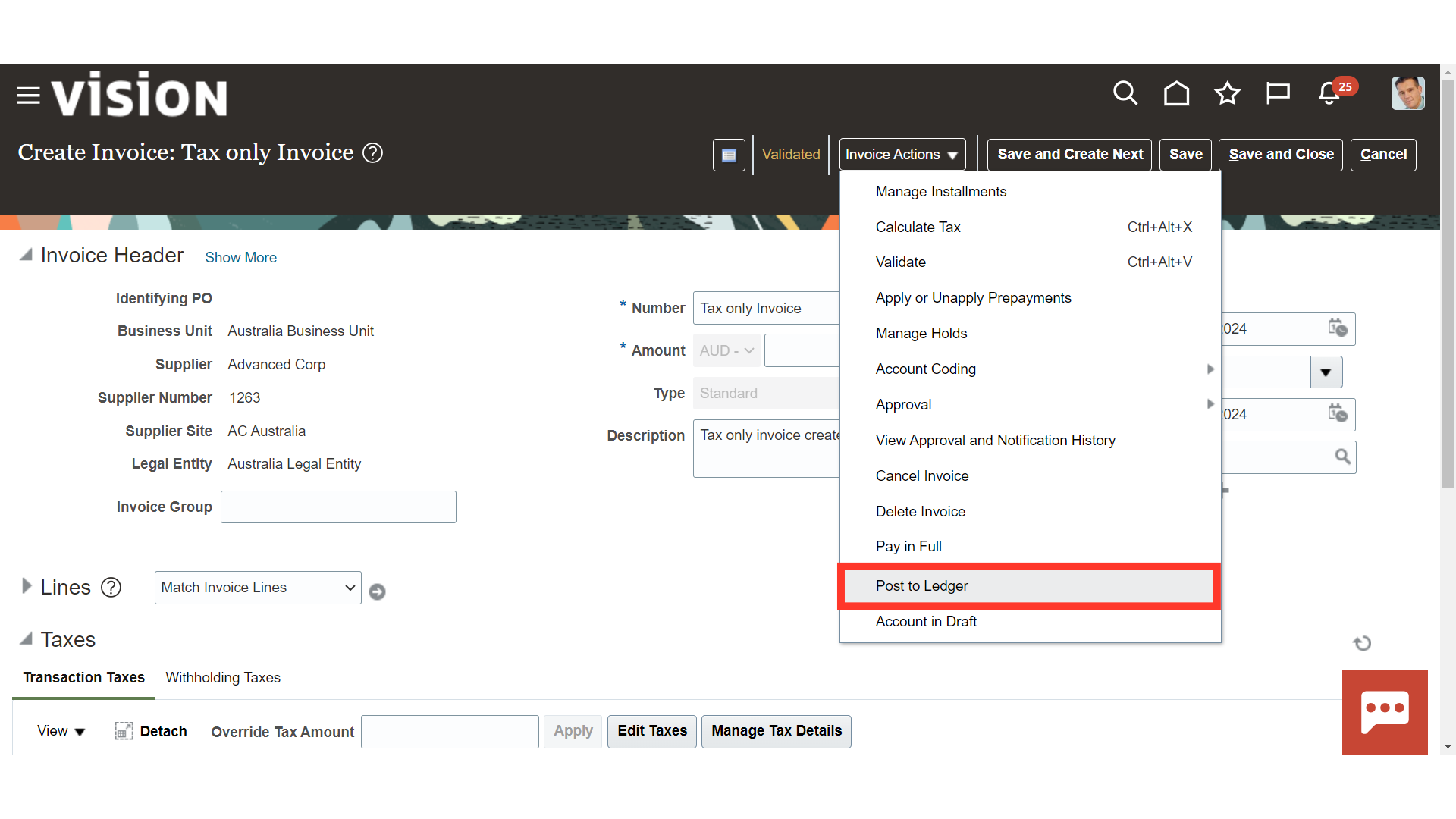

To generate accounting click on “Post to ledger” after clicking on the Invoice Actions.

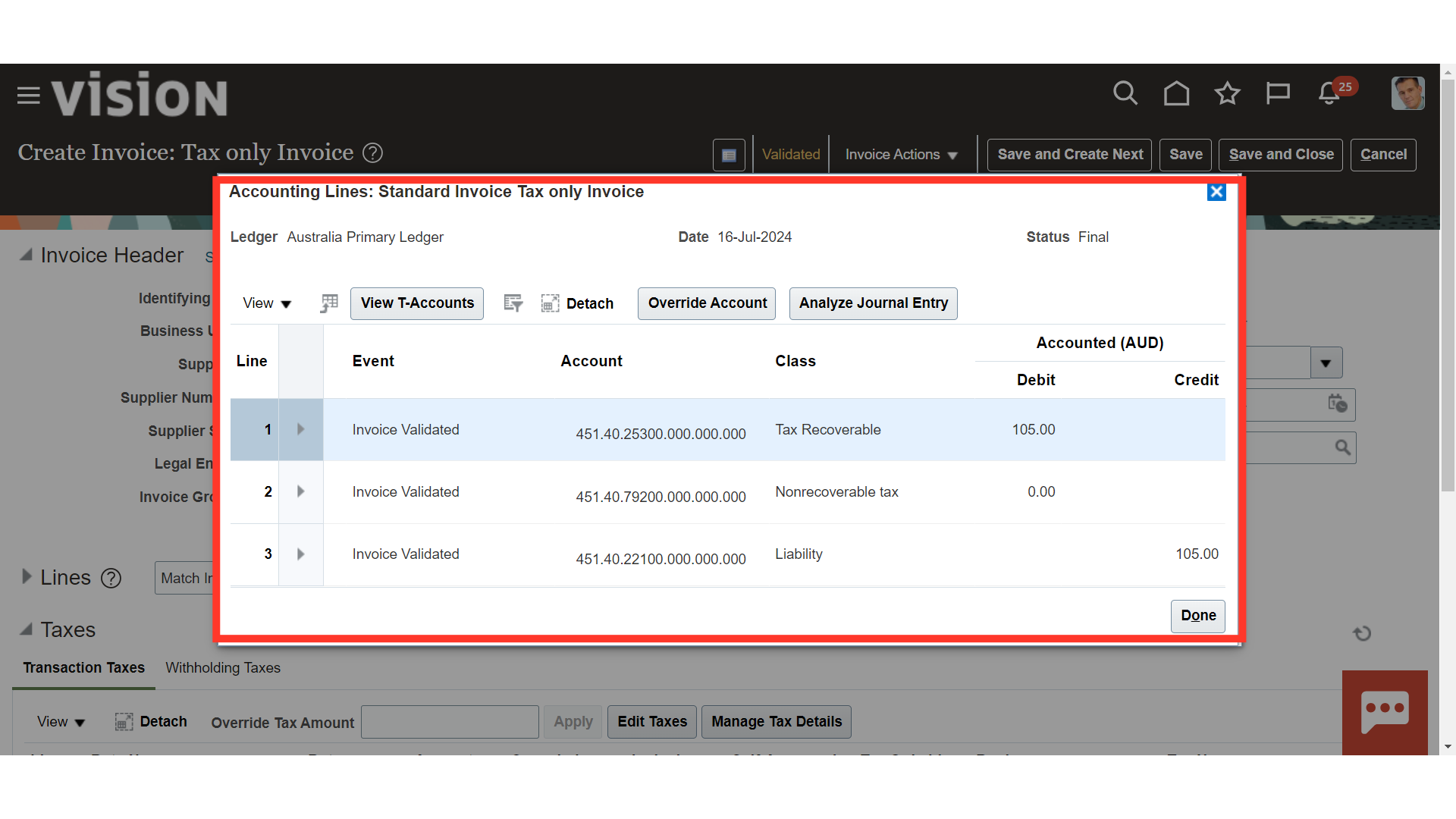

Select “View Accounting” button to see the more details of journal entry.

This accounting entry, which credits the Liability account and debits the Tax account, was created for this invoice.

The process of creating invoices with only tax lines was demonstrated in this guide, and it also covered how to generate accounting entries.