Asset Retirement Processing

Retire an asset when it is no longer in service. For example, retire an asset that was stolen, lost, or damaged, or that you sold or returned. This guide will provide a detailed process of retiring the asset by cost or units in Oracle Fusion.

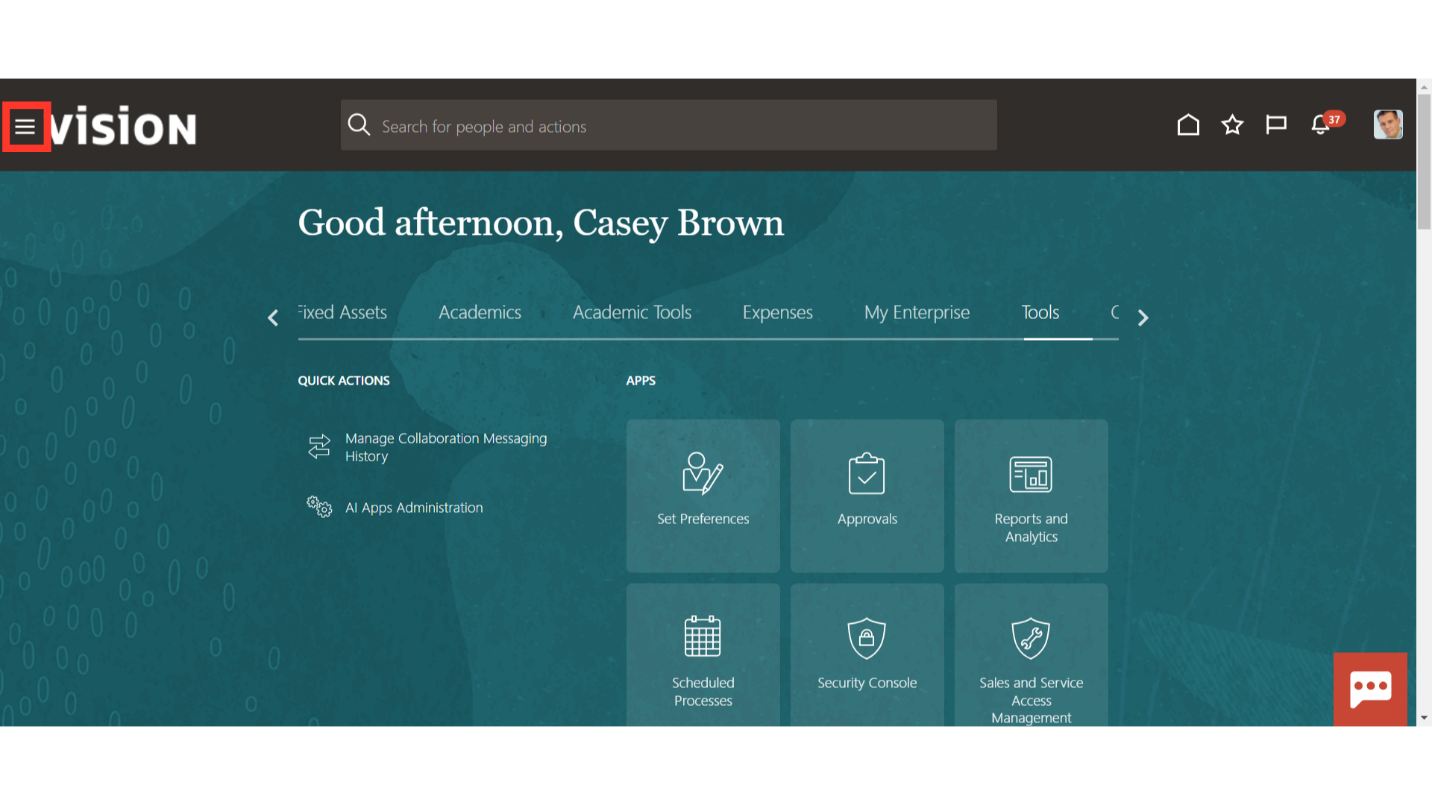

Click on Navigator Icon to access the Fixed Assets module.

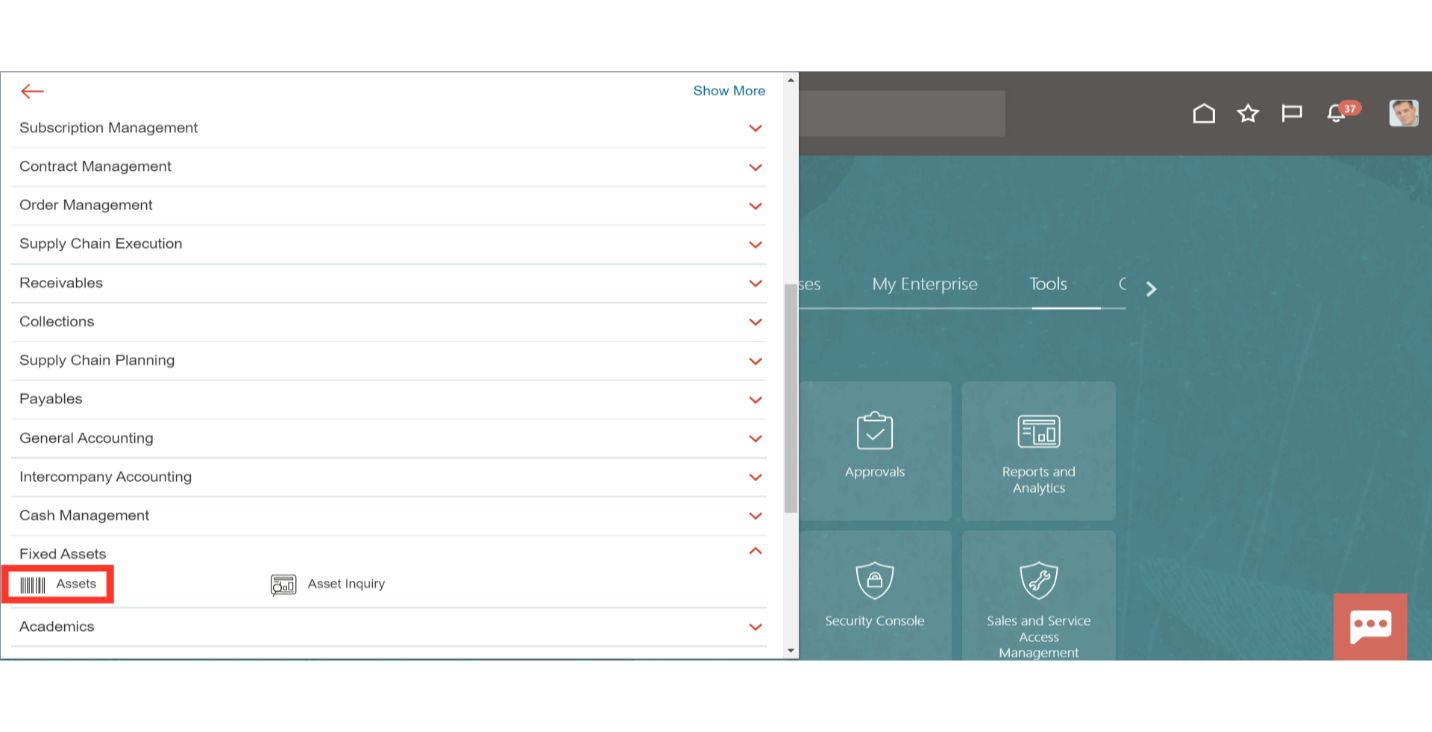

Click on the Assets submenu by expanding the Fixed Assets menu.

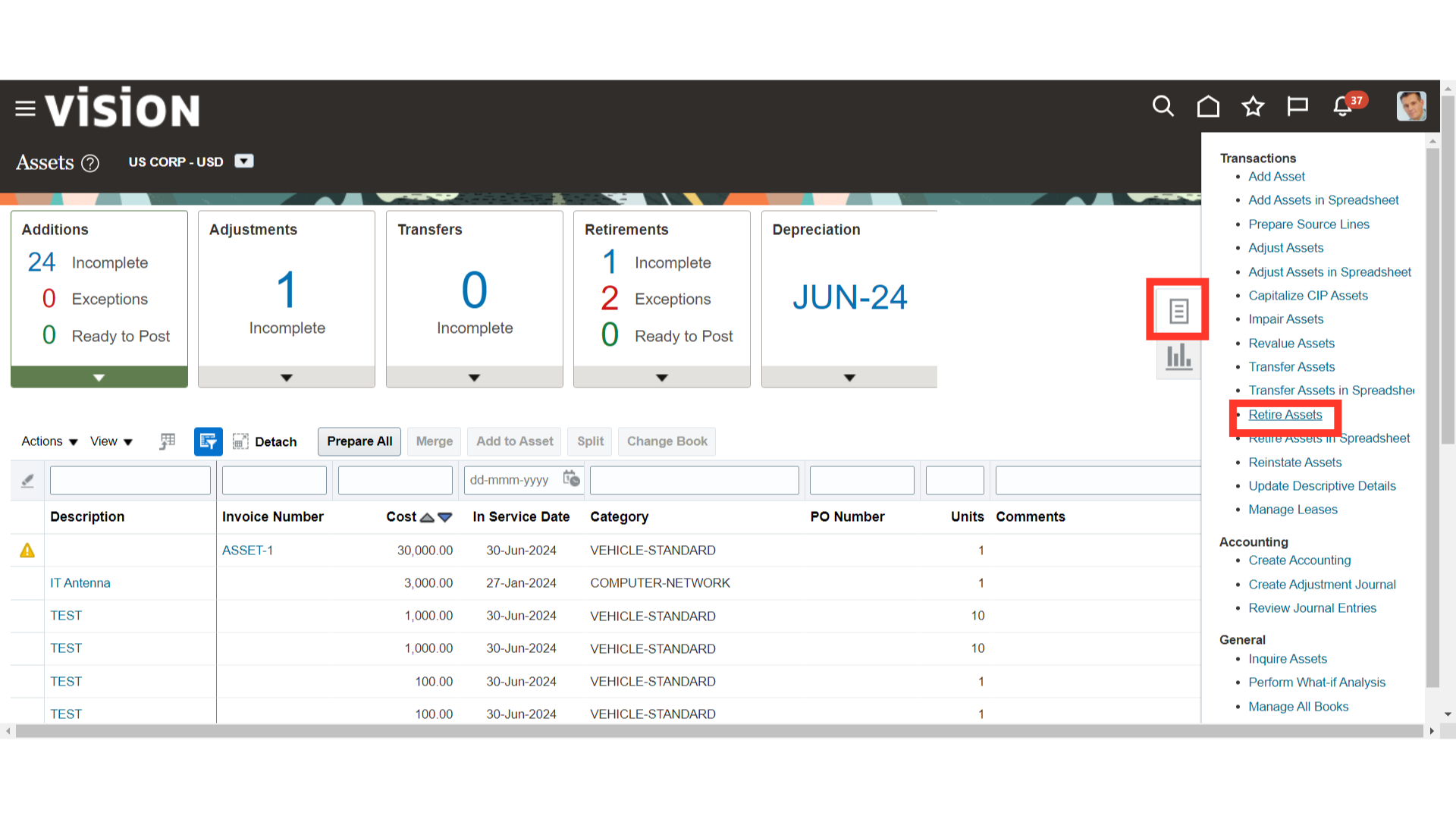

Click on the Retire Assets from the task list to retire the assets.

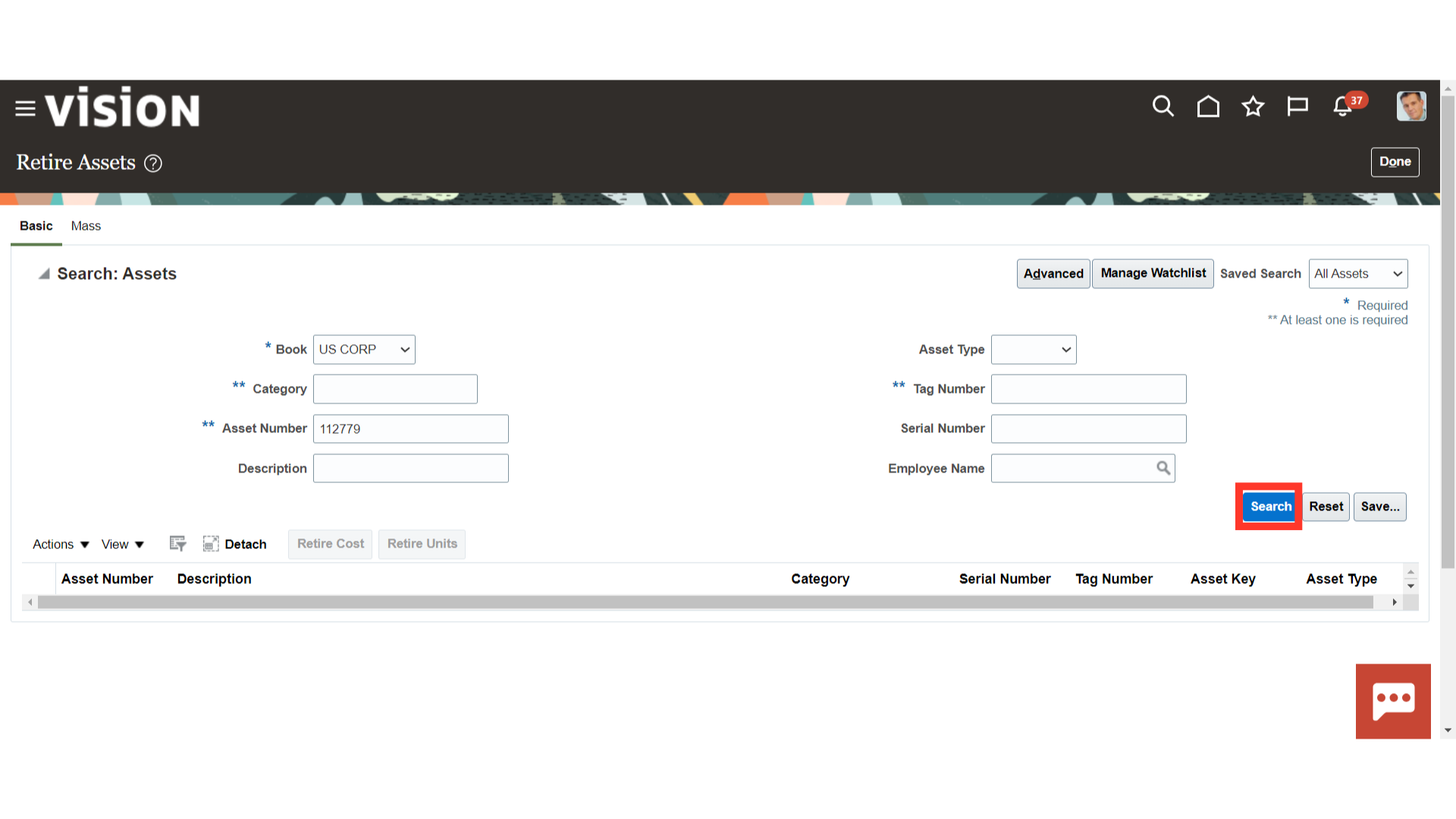

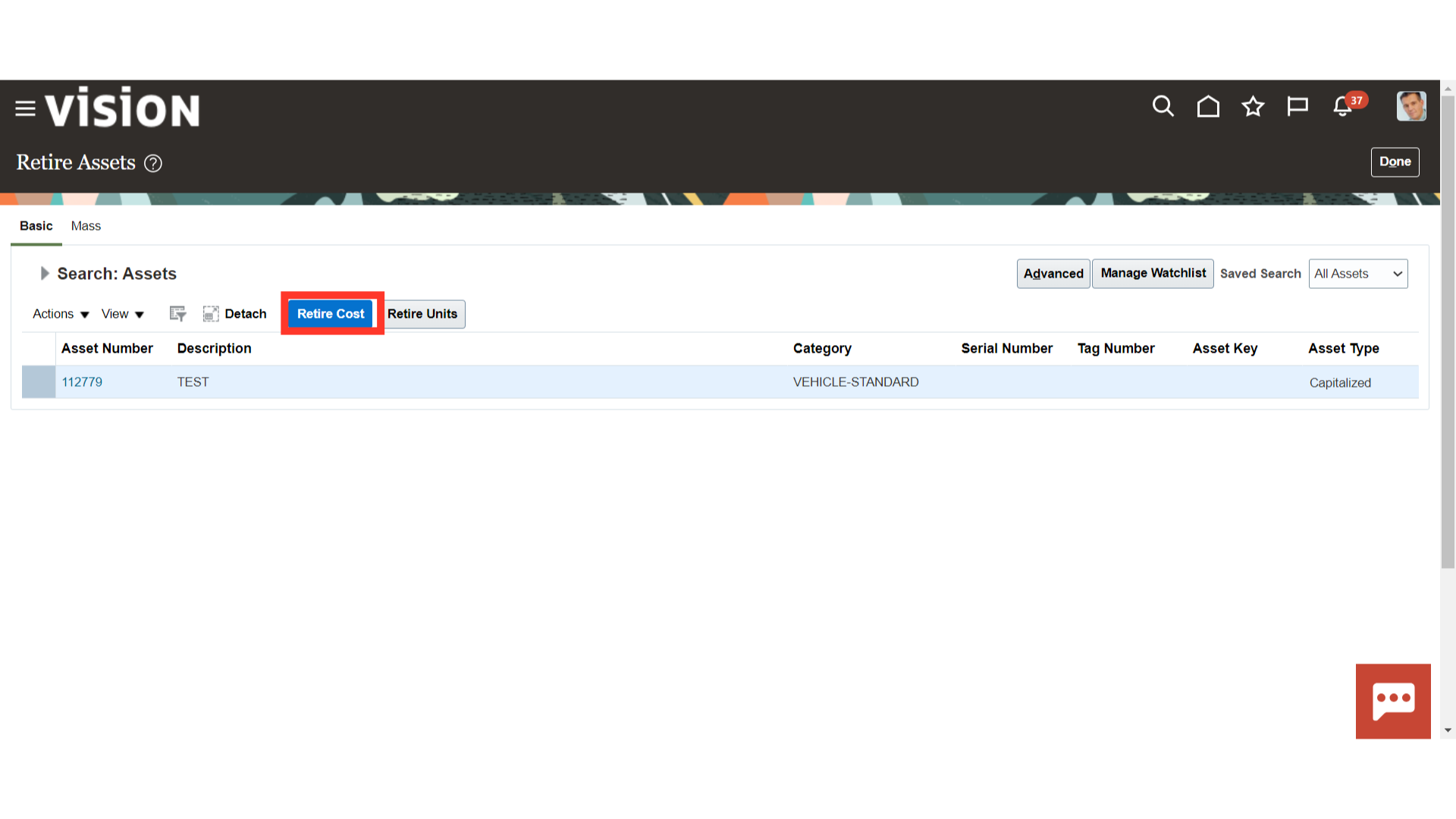

Enter the Asset number to be retired, and then click on the search button.

Click on the Retire cost button to retire the cost of the asset.

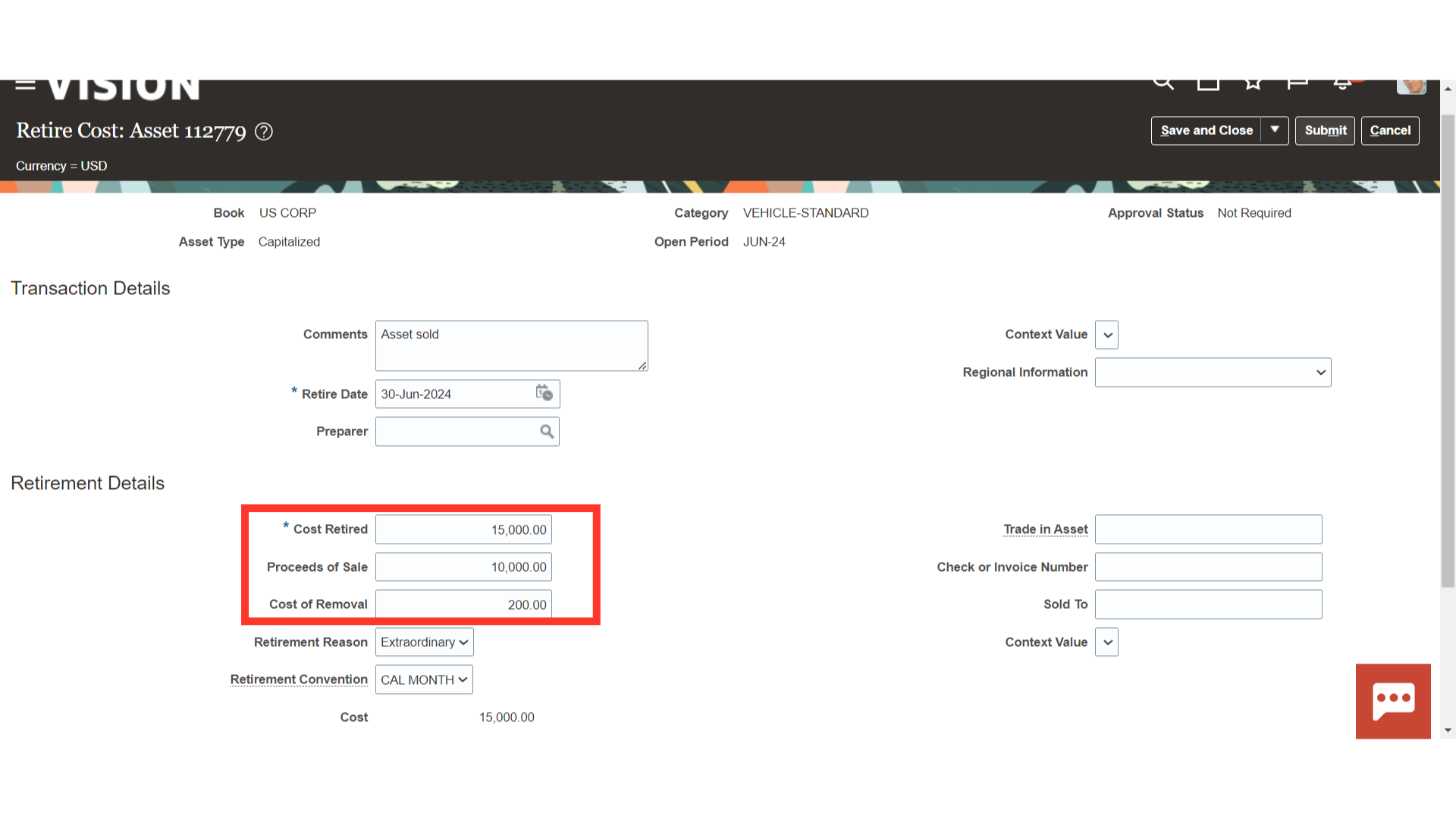

In the cost retired field when the full amount of cost is mentioned it means Full Retirement otherwise if the mentioned amount is less than the cost of the asset then it means partial retirement. Also, enter the sale proceeds and Cost of removing the asset if any.

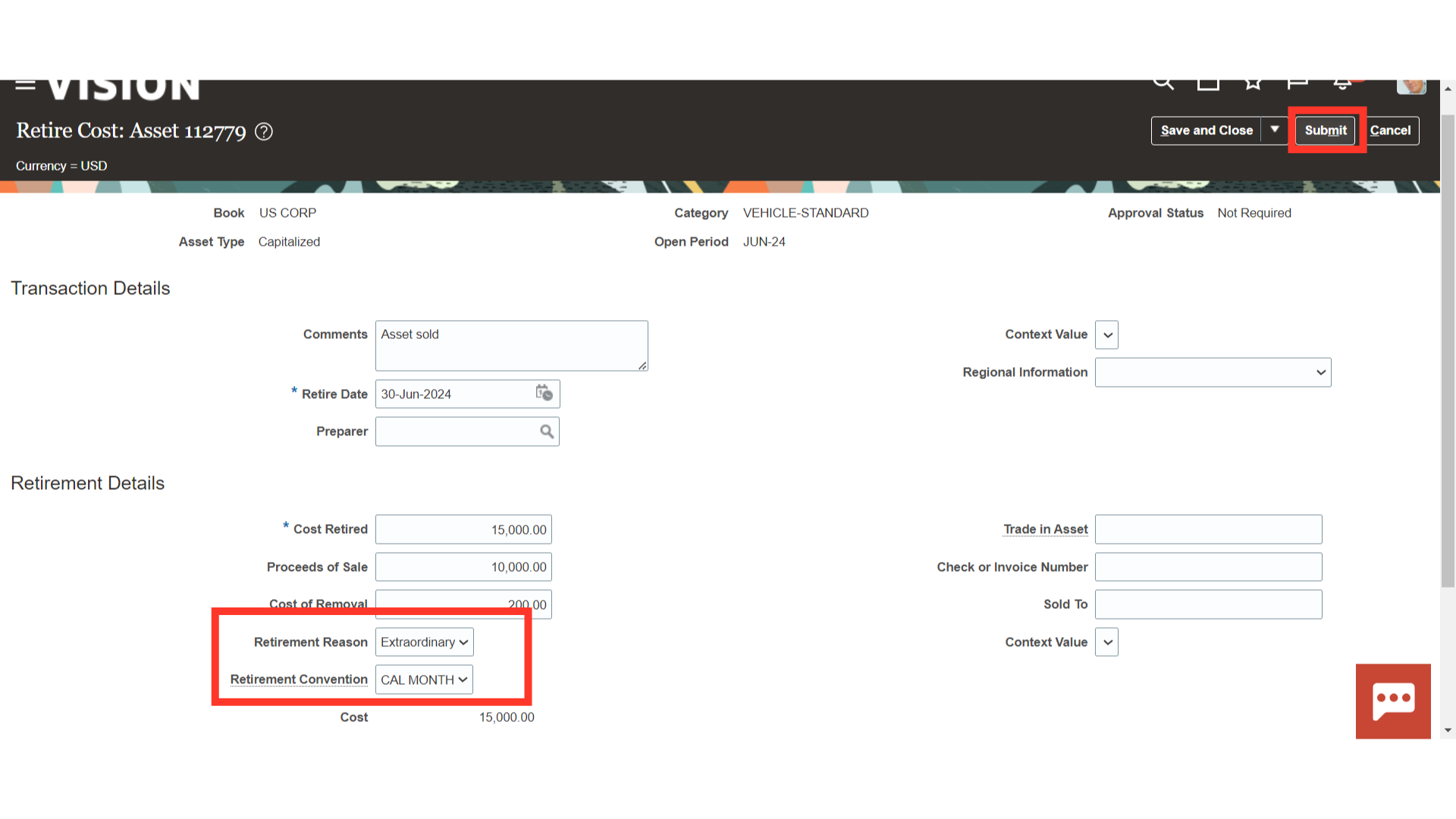

The Retirement Reason field allows you to specify why the asset is being retired. Decide which retirement convention to use starting on the date that depreciation is to be computed. Once all the details are verified, click on the Submit button.

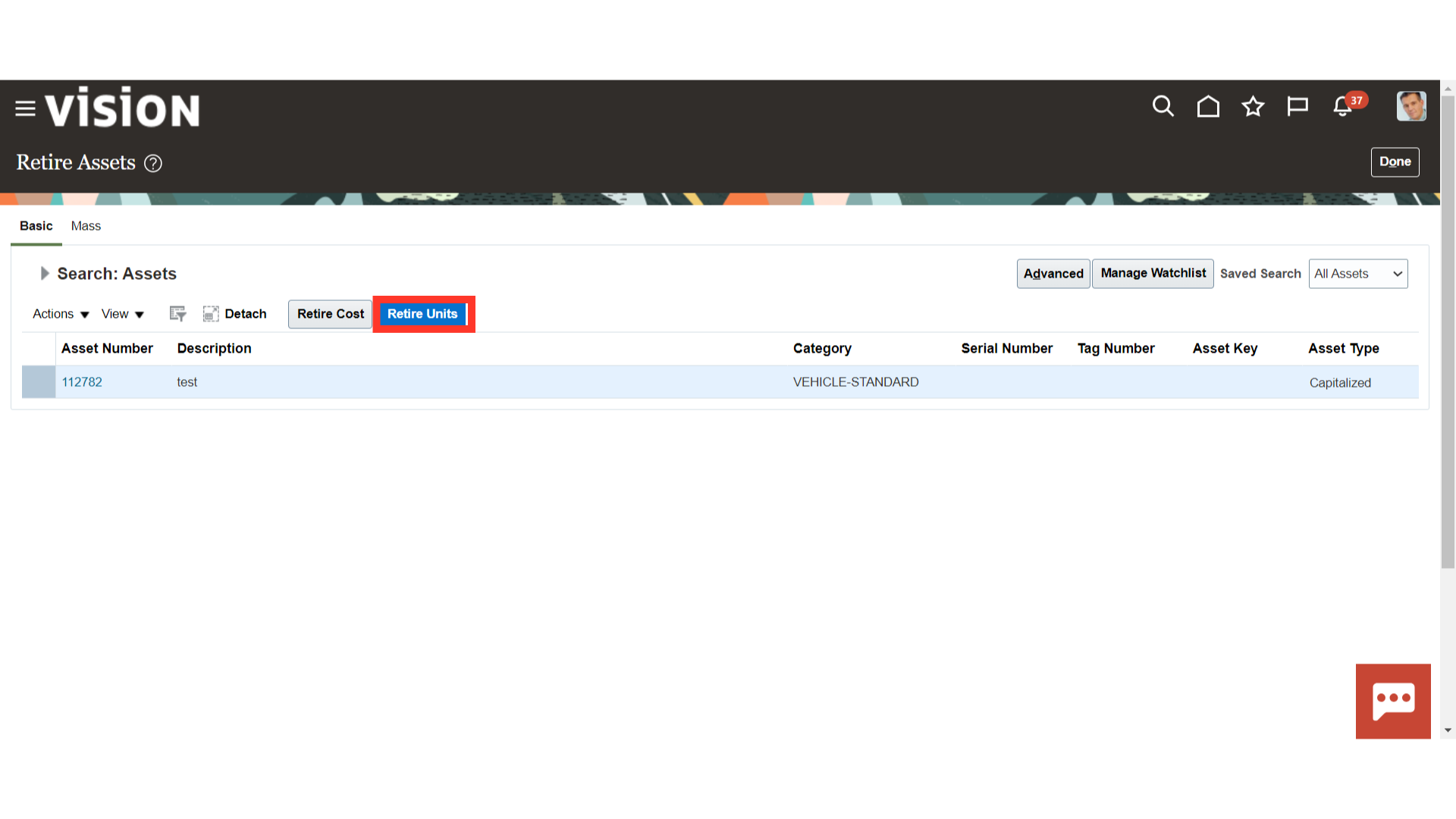

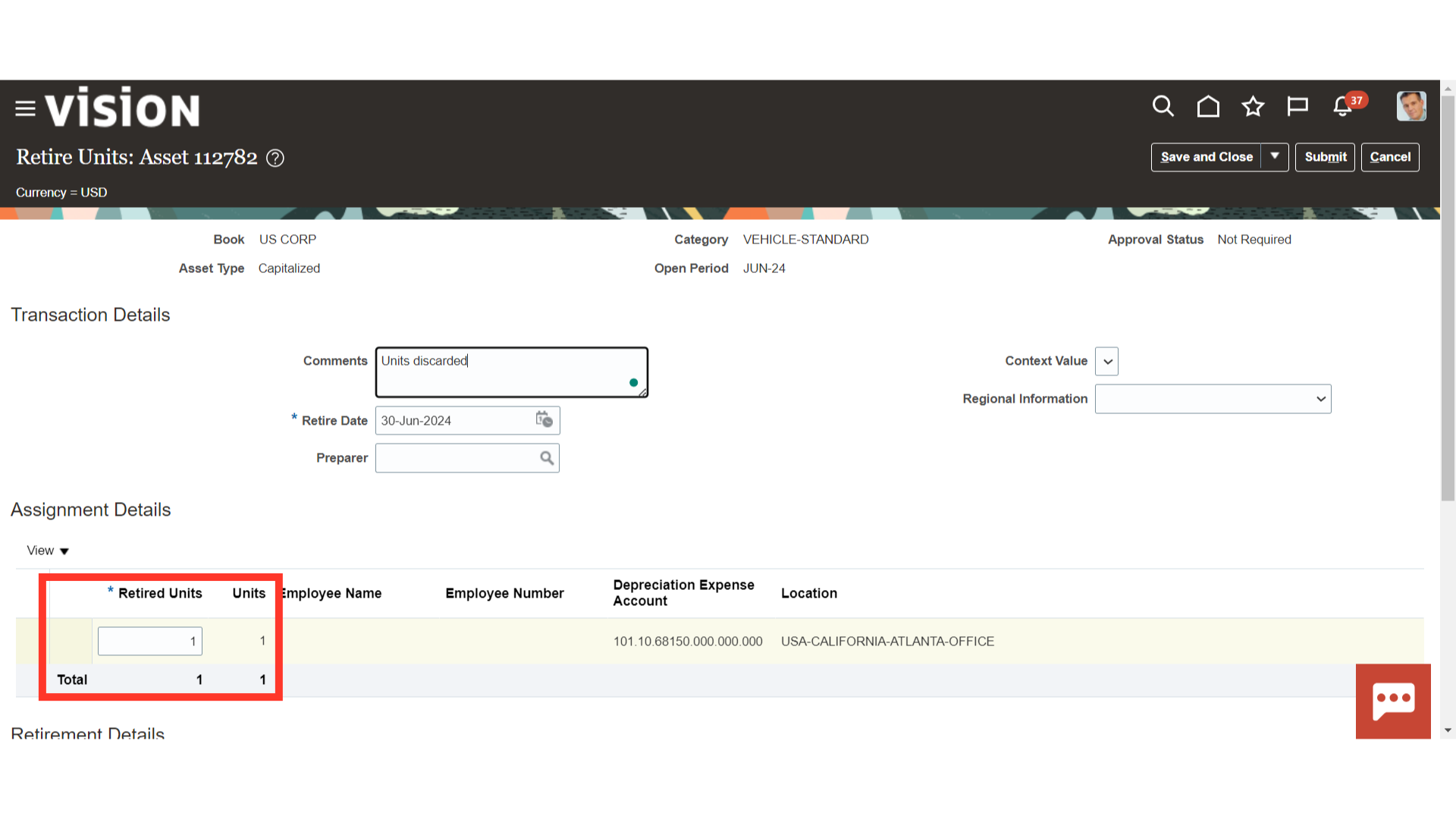

Click the Retire Units tab to retire the asset’s units.

In the Retired units column, enter the units of the assets that are going to be retired. Full retirement is indicated if every unit has been retired; partial retirement is indicated otherwise.

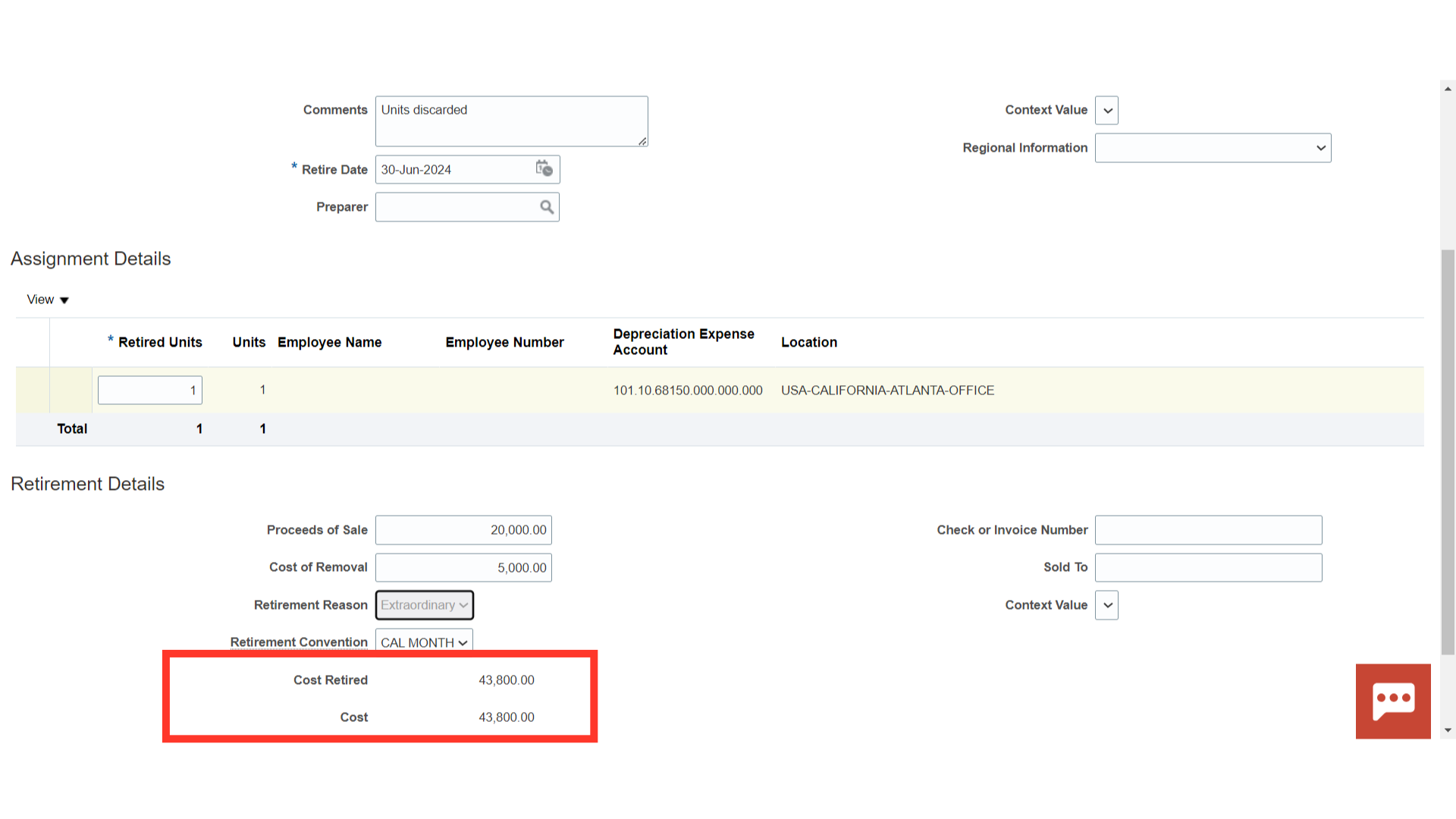

Based on the units retired, the cost of retirement is automatically determined. Add more information, such as the cost of removal and the proceeds from the sale.

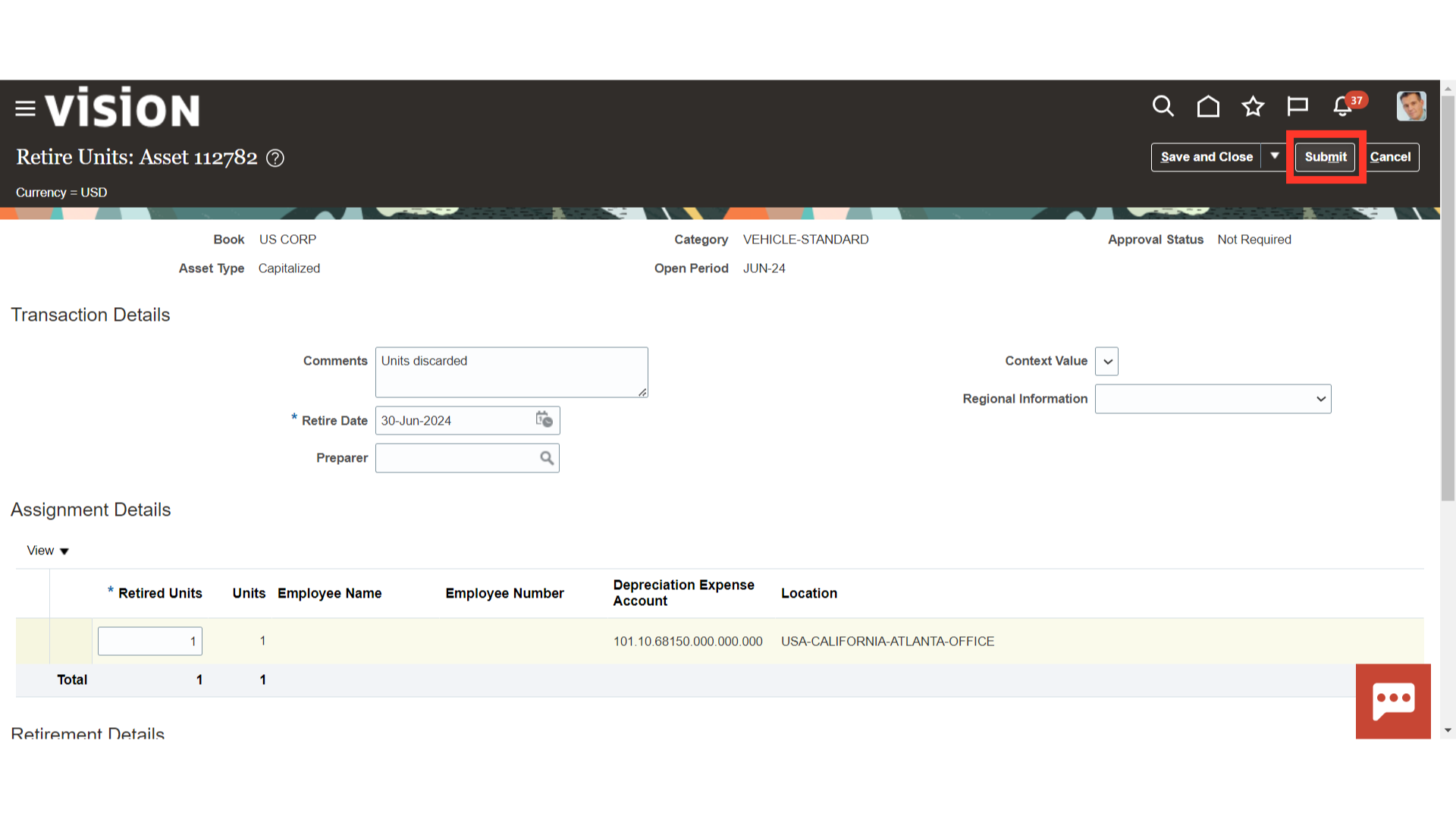

After entering all the details, click on the Submit button.

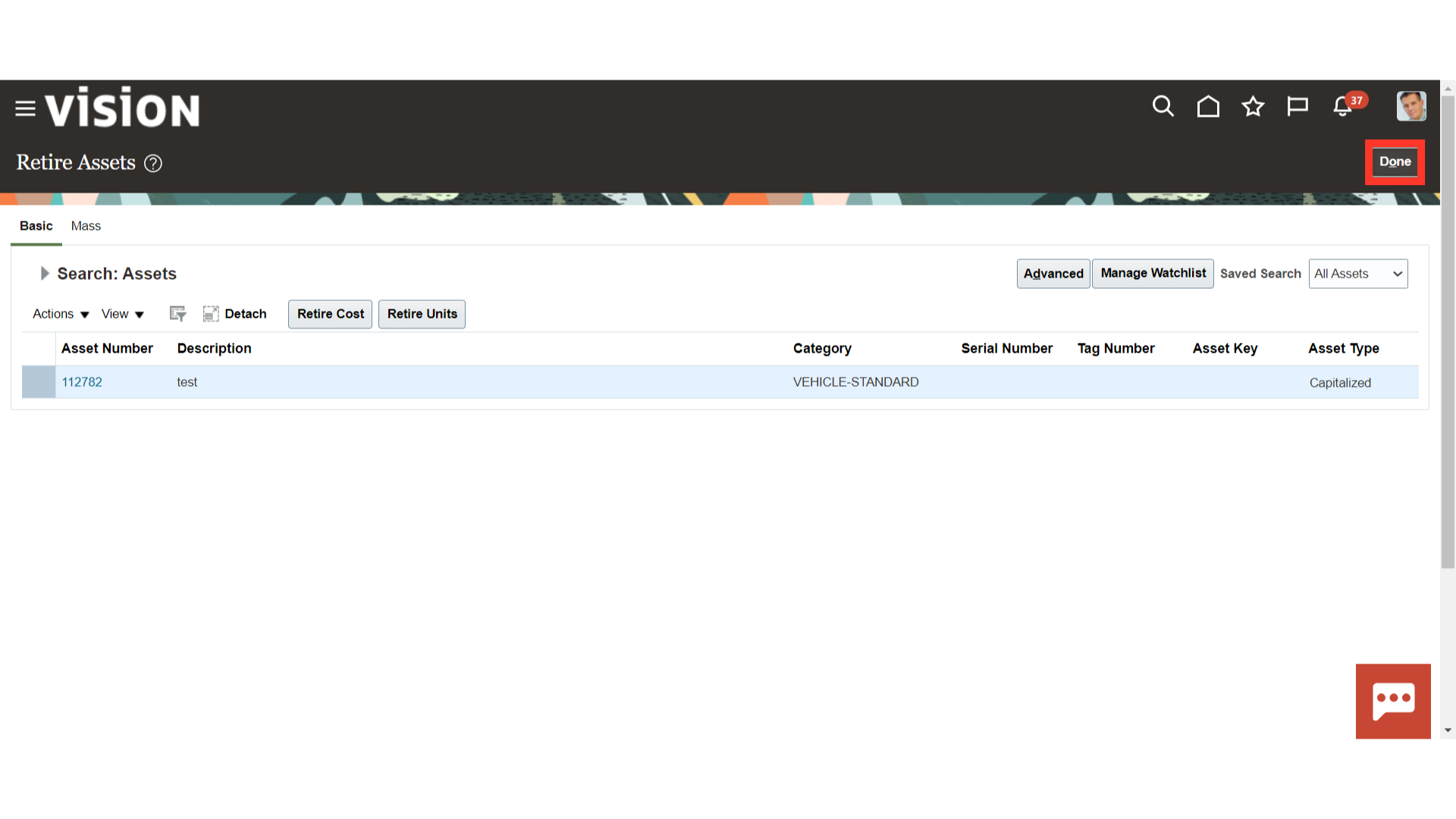

Click on the Done button to return to the Fixed Asset workbench.

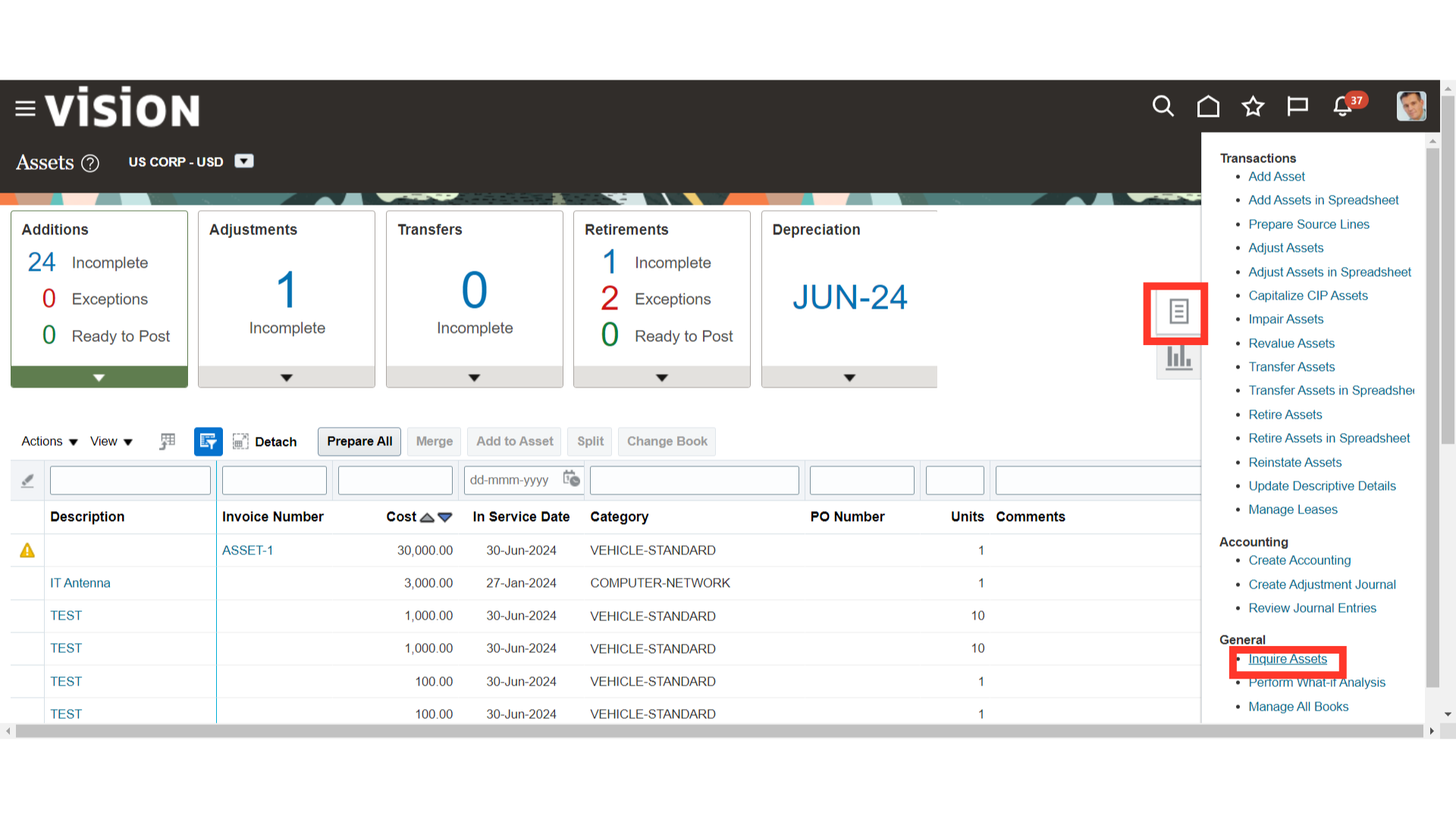

Click on the Inquire Assets from the task list to search the assets retired.

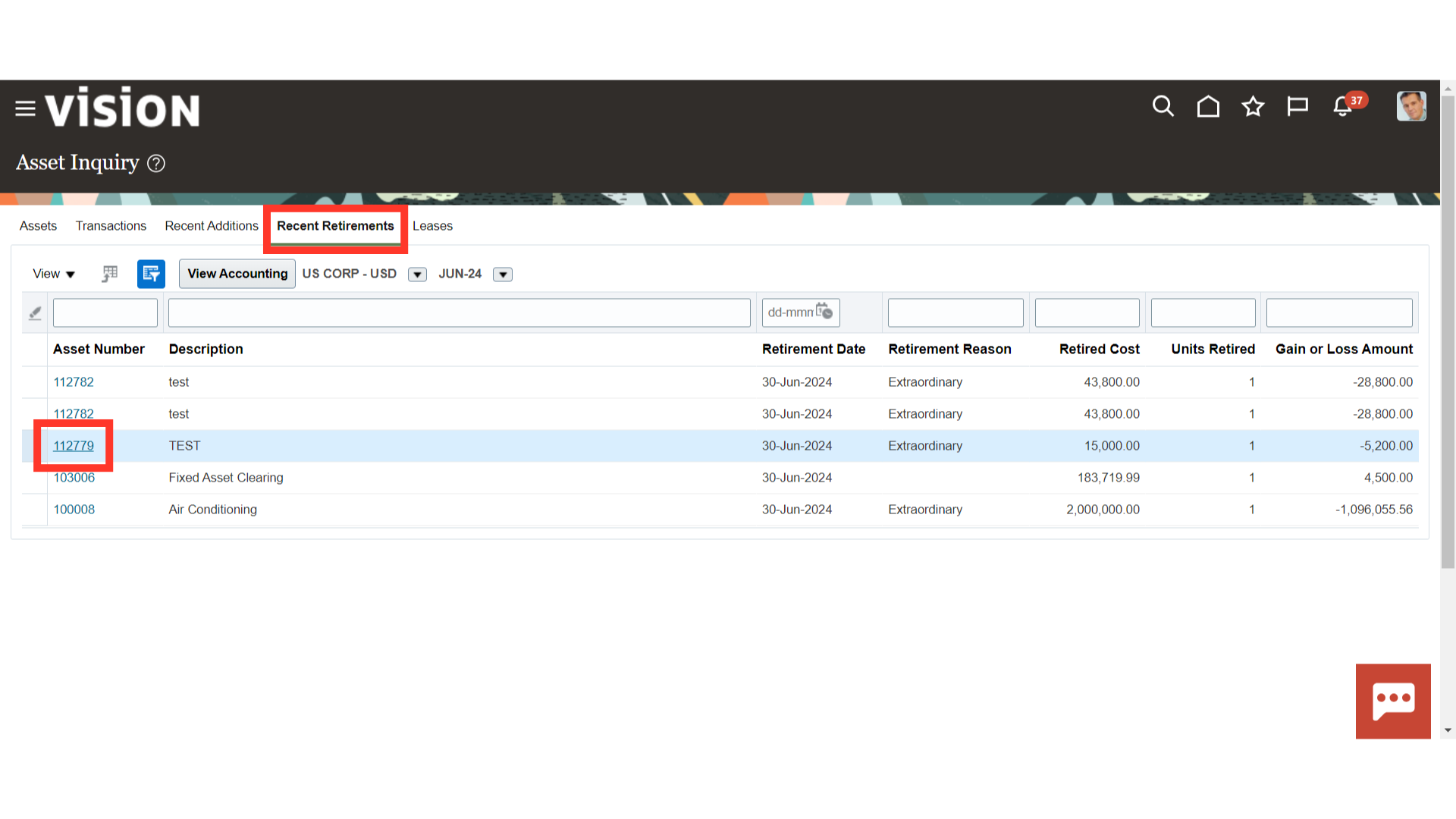

Click the Asset number hyperlink under Recent Retirements to open the assets recently retired.

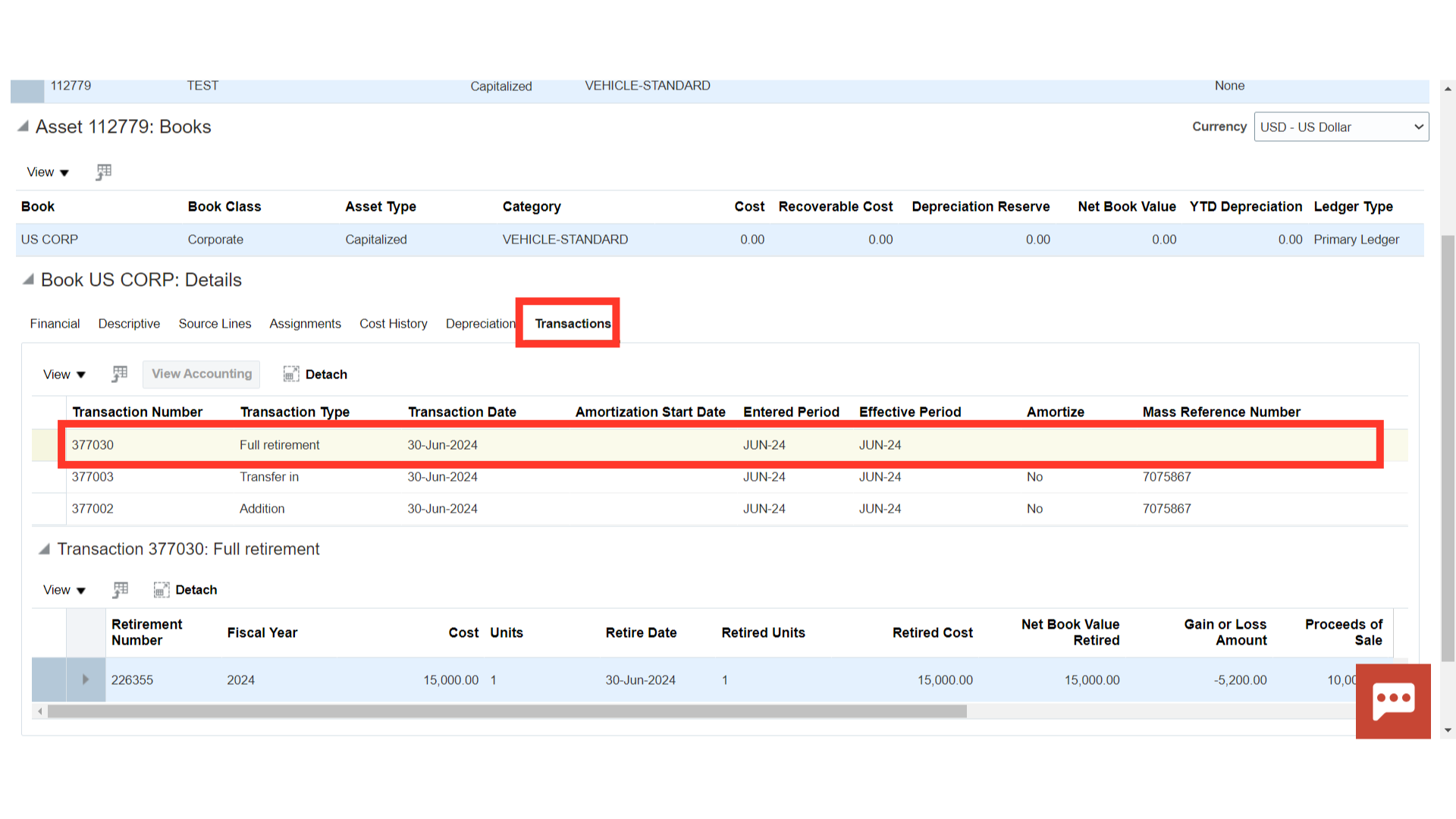

Under the Transactions tab click on the Retirement Transaction type, and select the View Accounting button to see the details of the accounting entry.

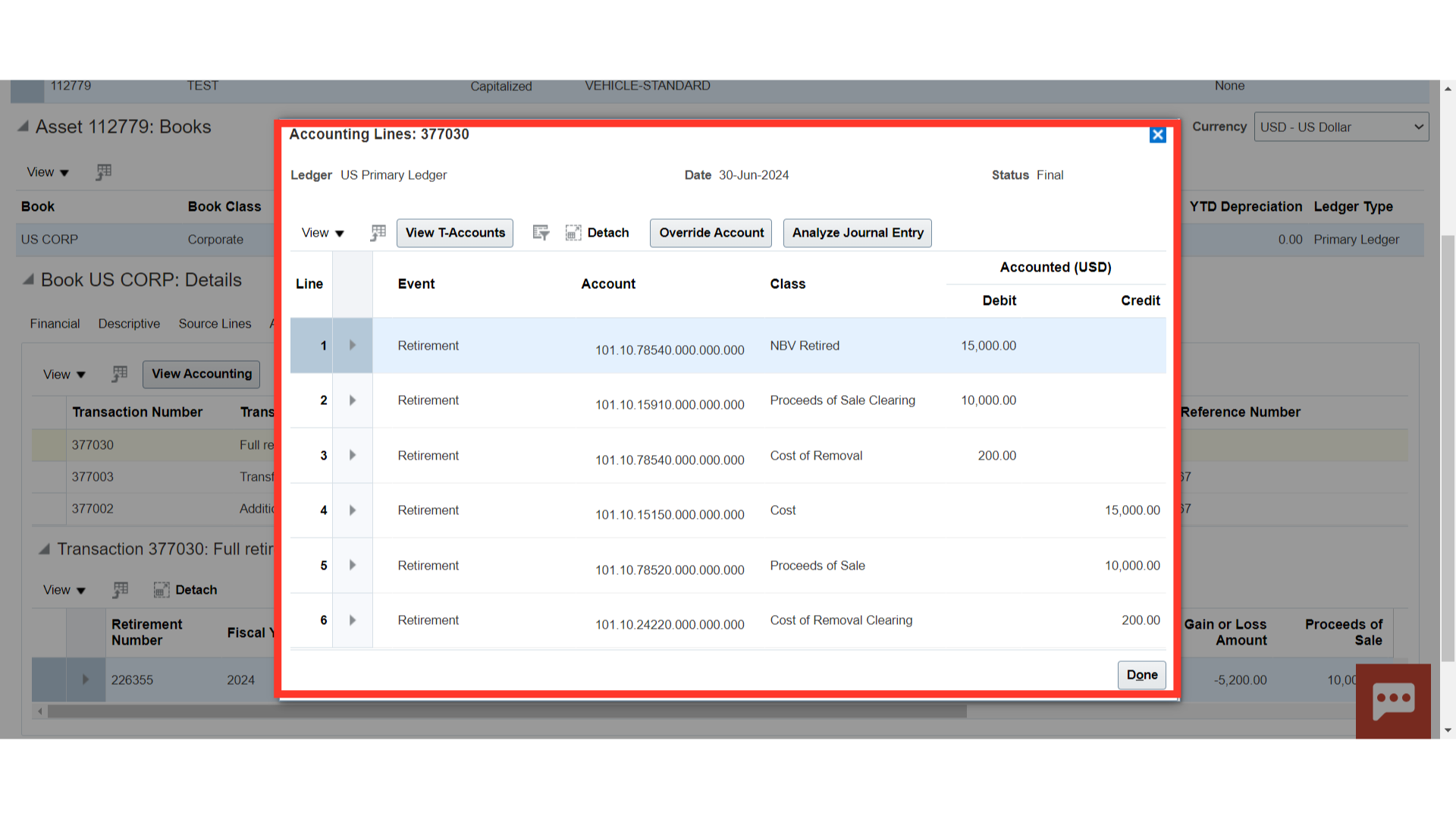

This is the accounting entry generated for Full Retirement. Proceeds of sale clearing and Cost of Removal Clearing can be closed from Receivable and Payables or directly by passing manual journal entries in the General Ledger. Click on the Done button to close this accounting entry window.

Along with discussing how to view the accounting entries, this guide has demonstrated how to retire assets based on both cost and units.