Depreciation Processing

This guide will walk you through the steps involved in executing the depreciation process and viewing the accounting entry and depreciation amount in Oracle Fusion Fixed Assets.

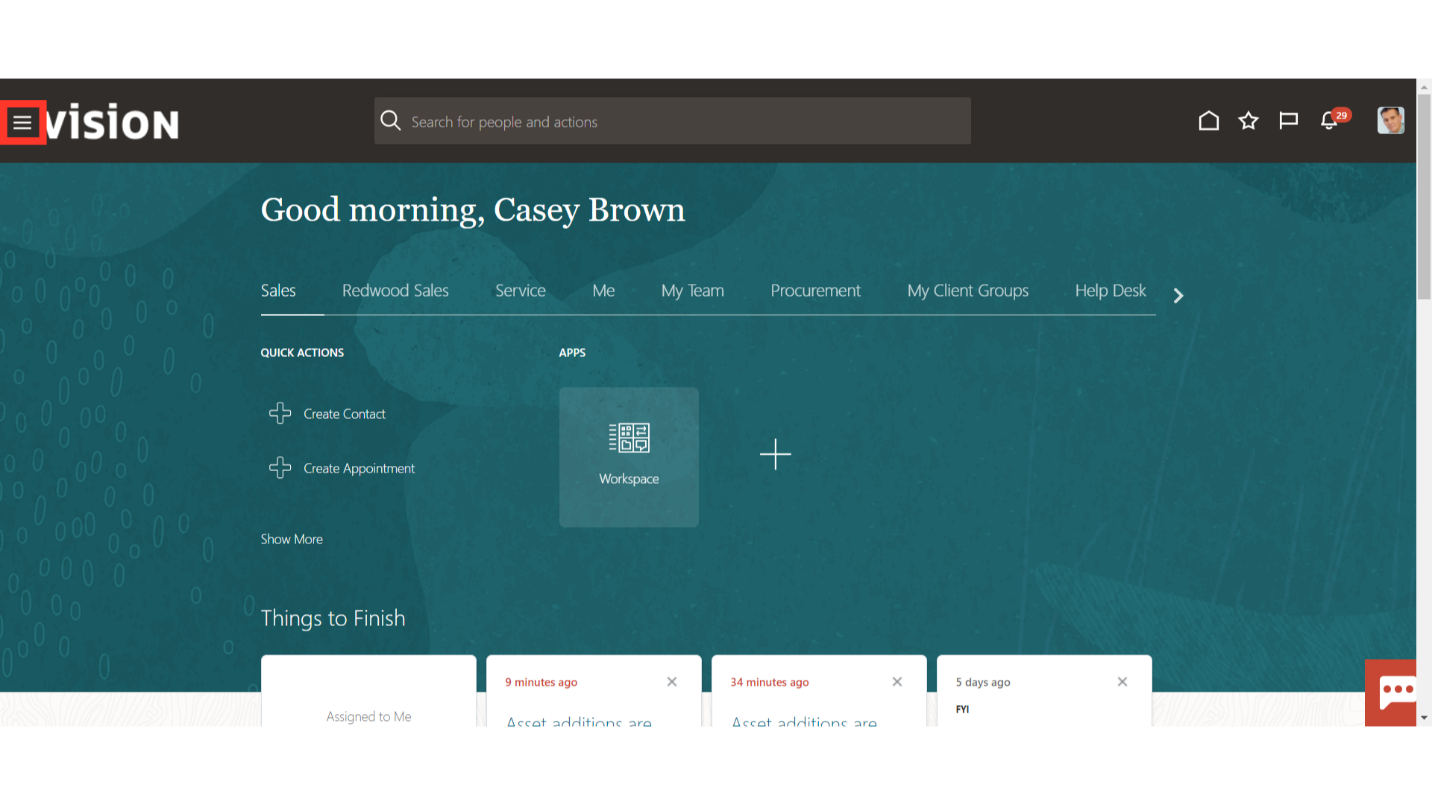

Click on Navigator icon to access the Fixed Assets Module.

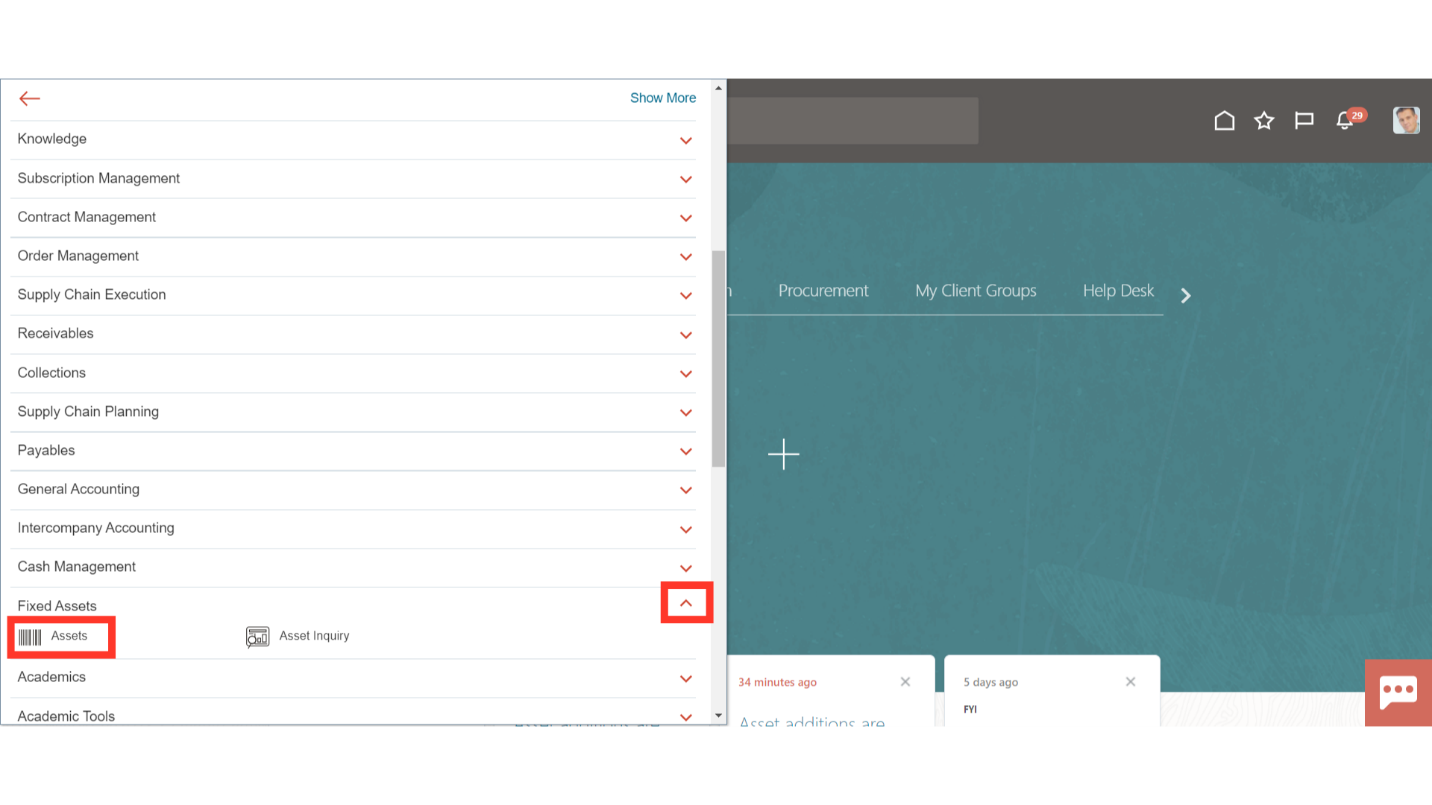

Click on the Assets submenu by expanding the Fixed Assets menu.

Click on the Assets submenu by expanding the Fixed Assets menu.

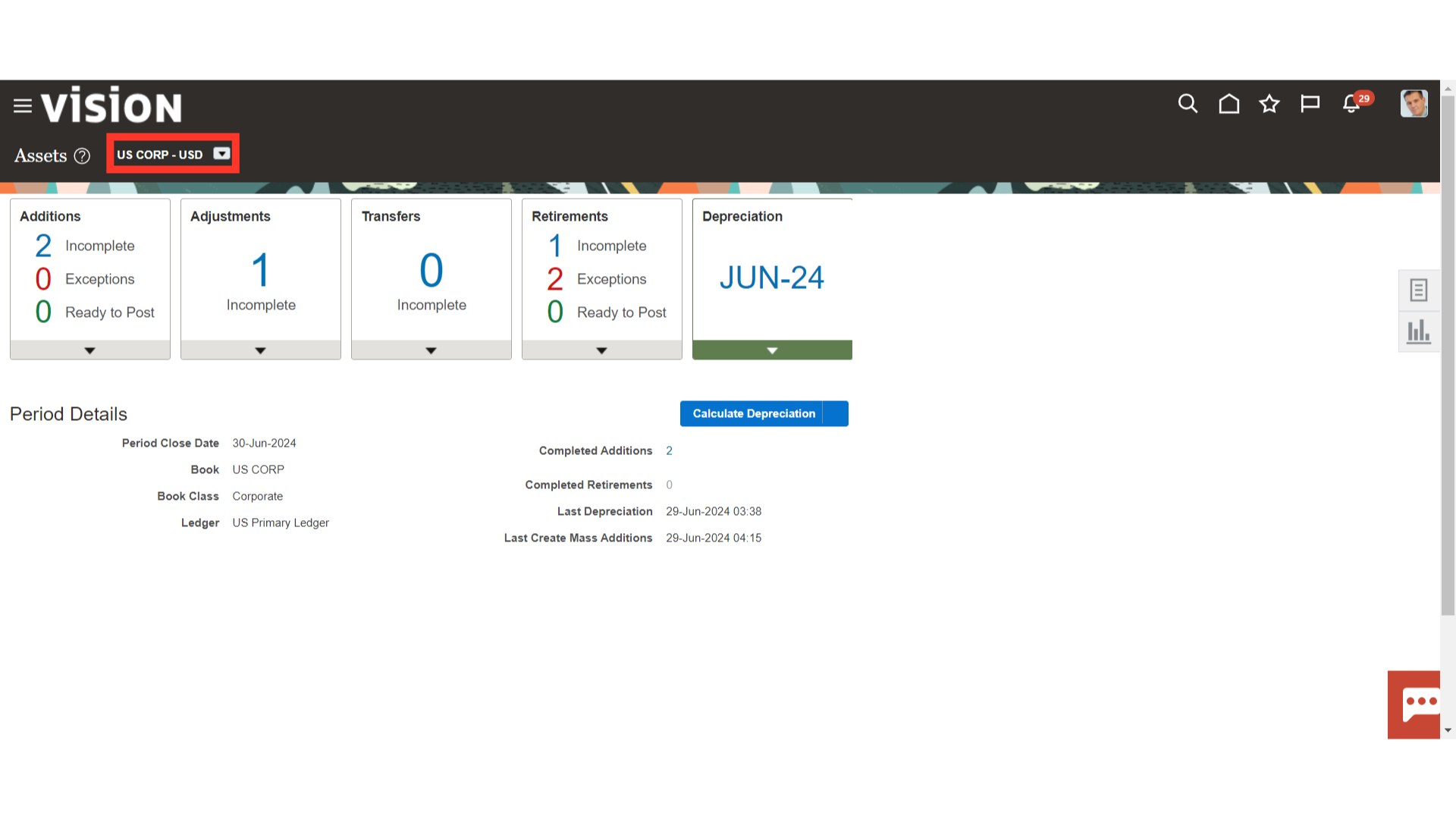

After landing in the fixed asset work area, select the Asset book for which depreciation is to be run from the list of values if more than one asset book is assigned to the user.

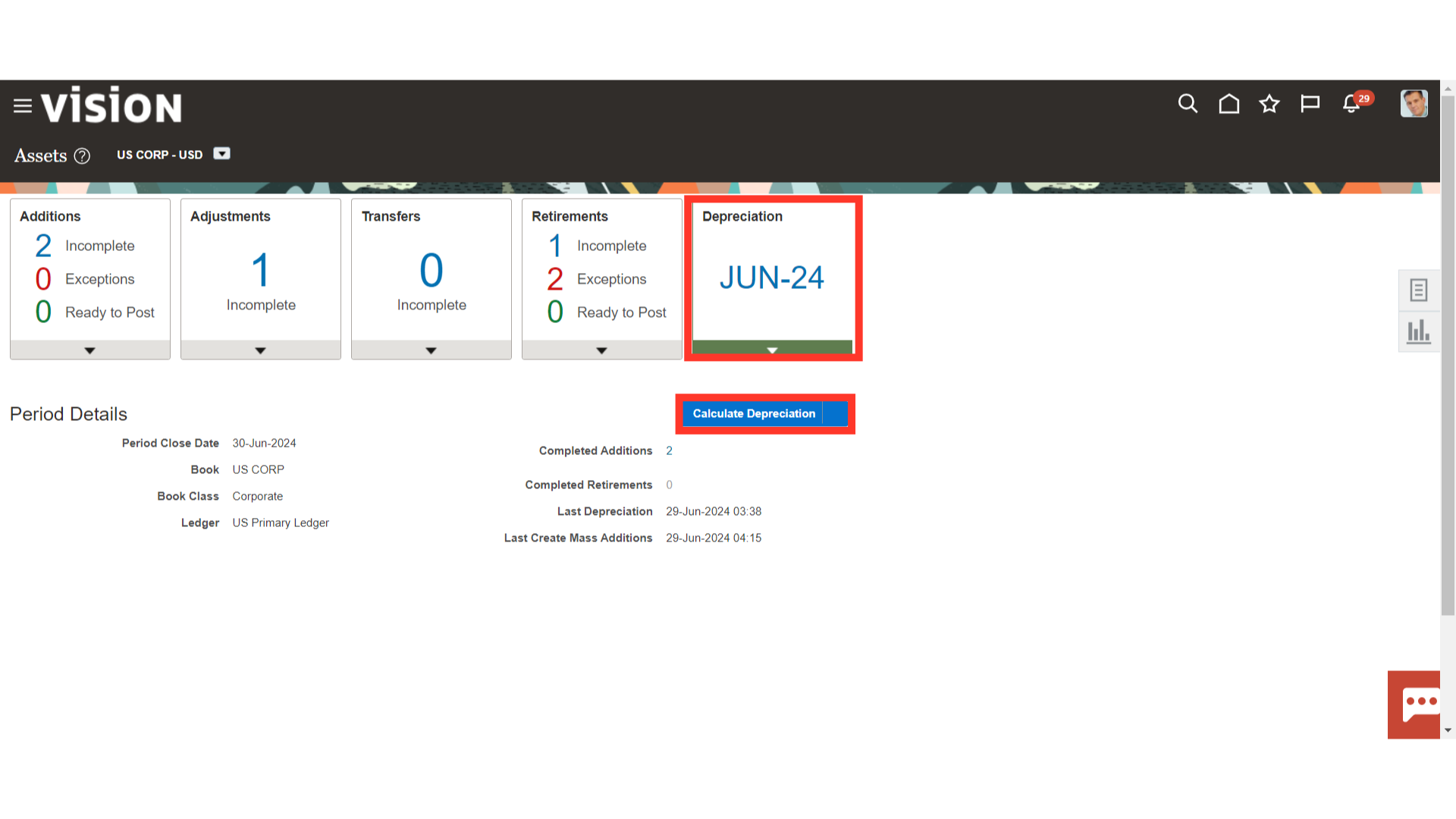

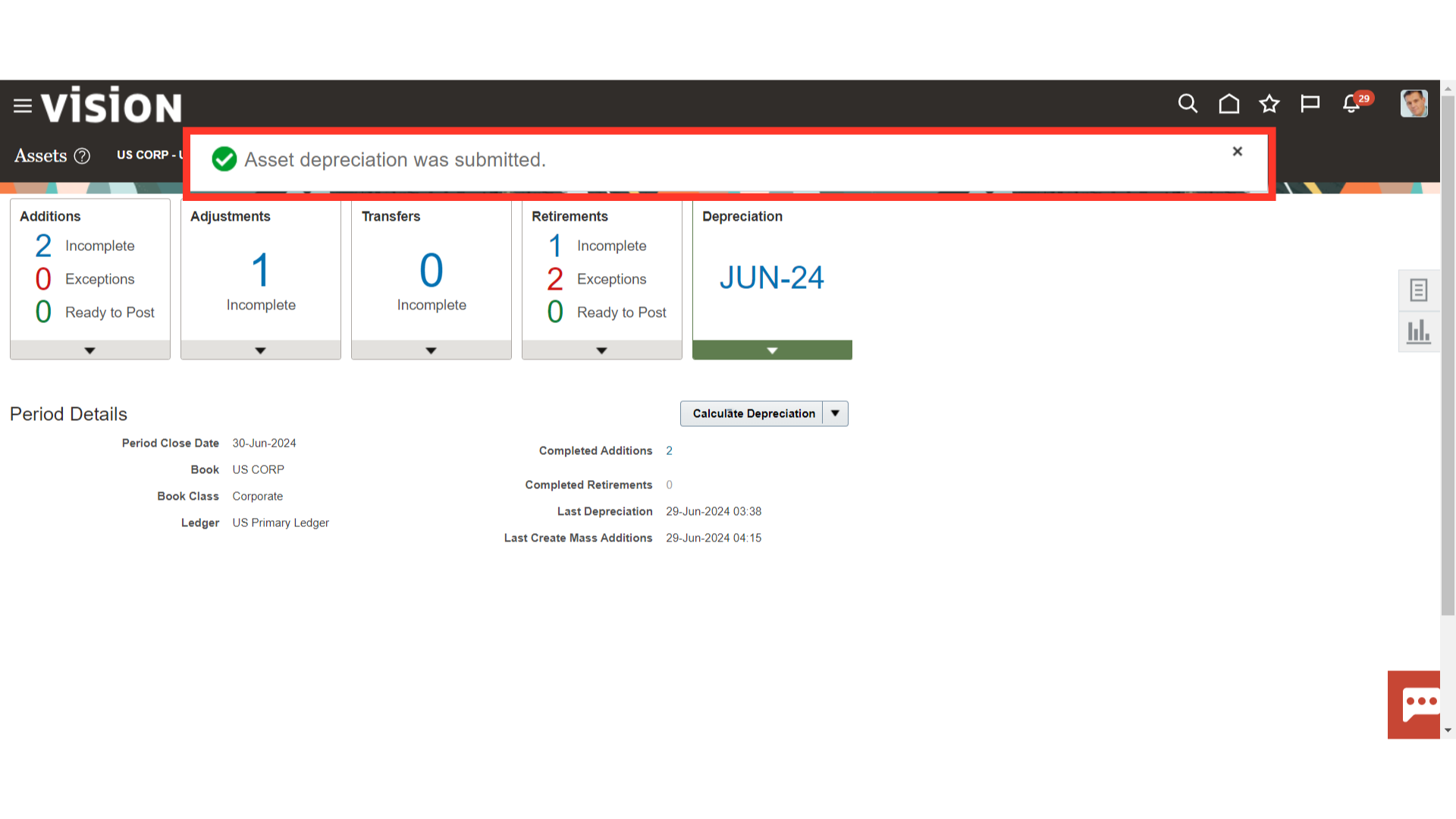

Click on the Calculate Depreciation button after clicking on the Depreciation Infotile.

A confirmation message is displayed as Asset Depreciation was submitted.

Click on the Home page icon to access the Tools menu.

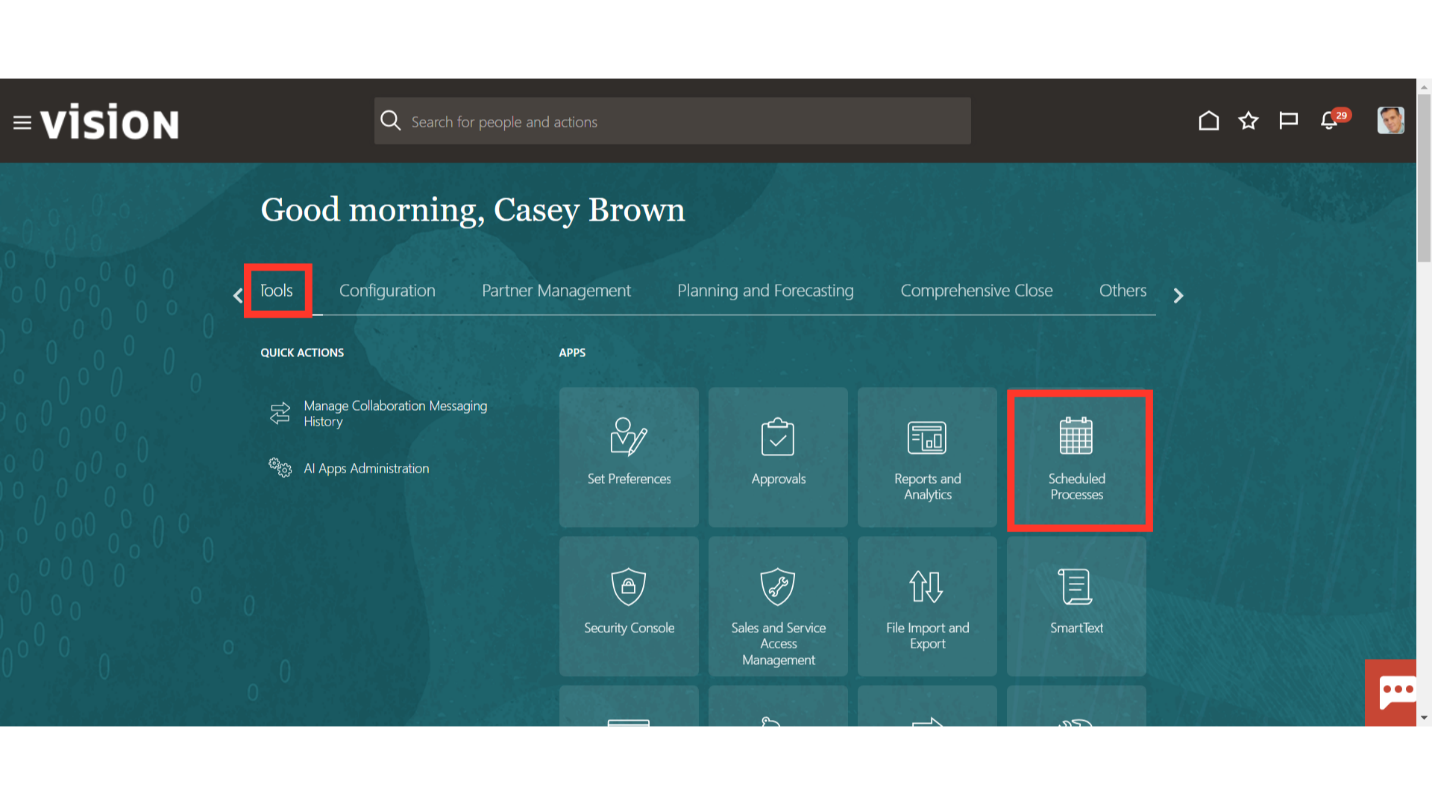

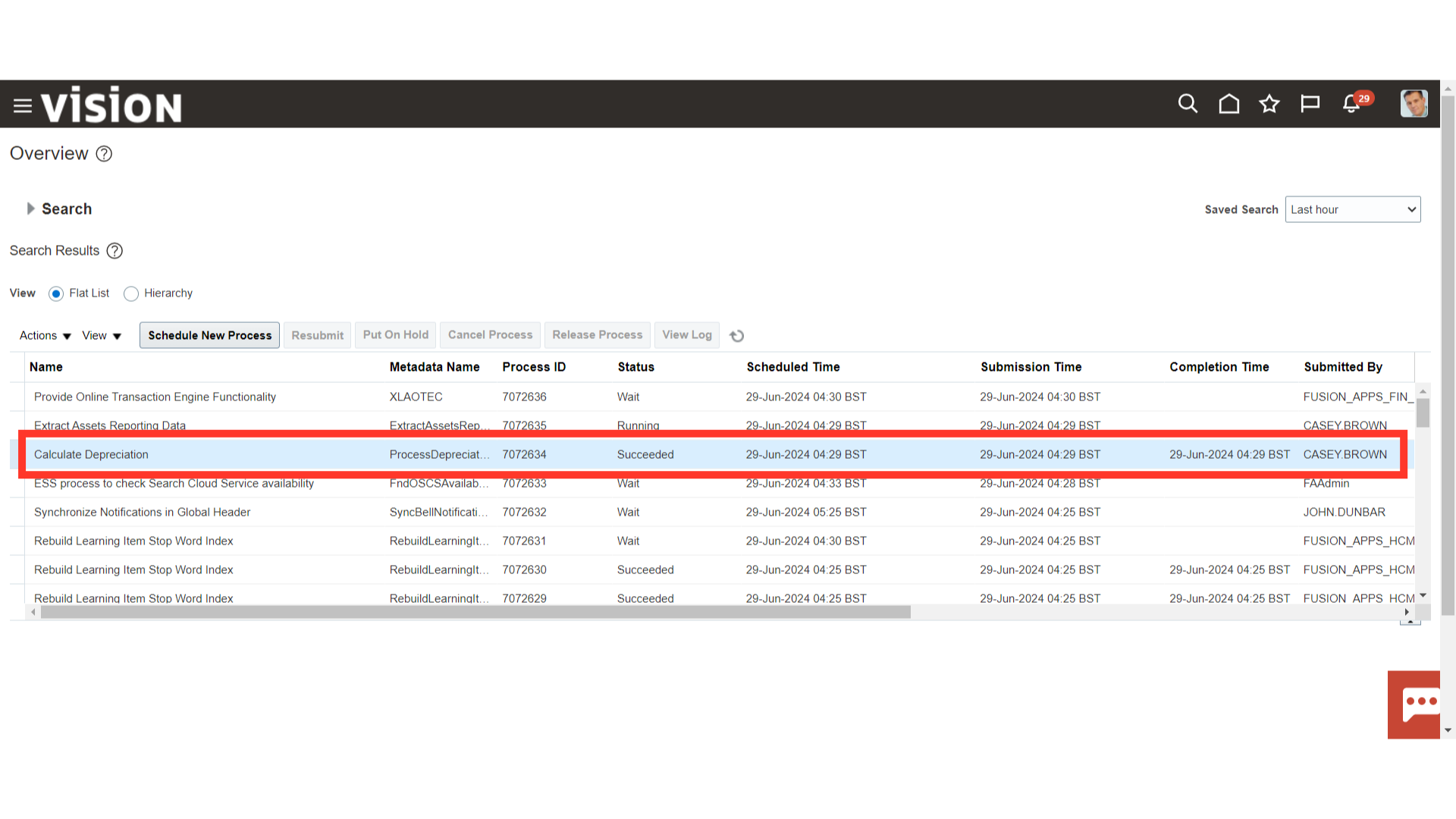

Select the Scheduled Processes submenu under the Tools menu to verify the depreciation process status.

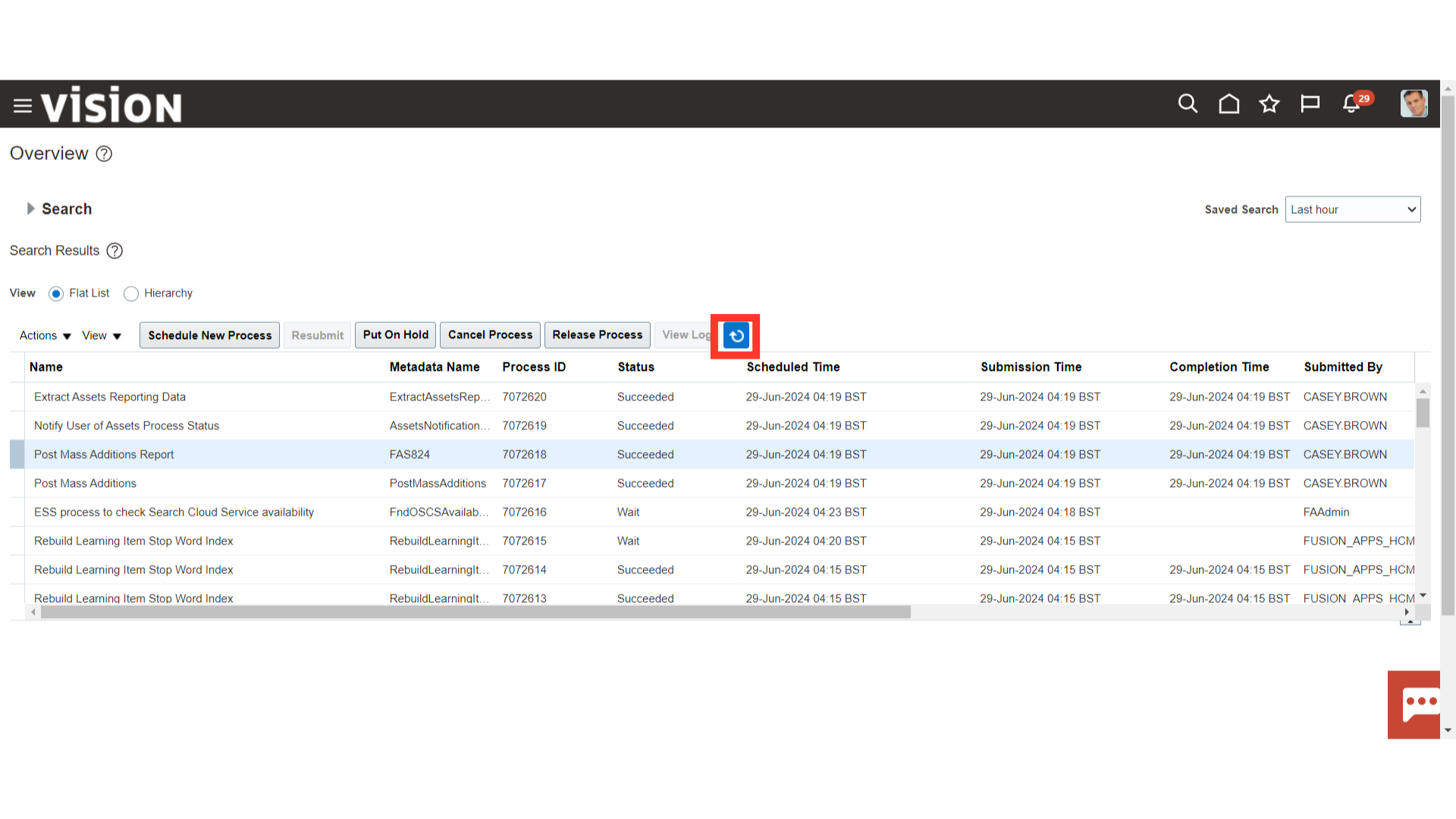

Click on the Refresh Icon to update the process status.

Depreciation would be calculated for all the assets under the specific Asset book selected while running the Depreciation process. Check whether the depreciation process status is succeeded or not.

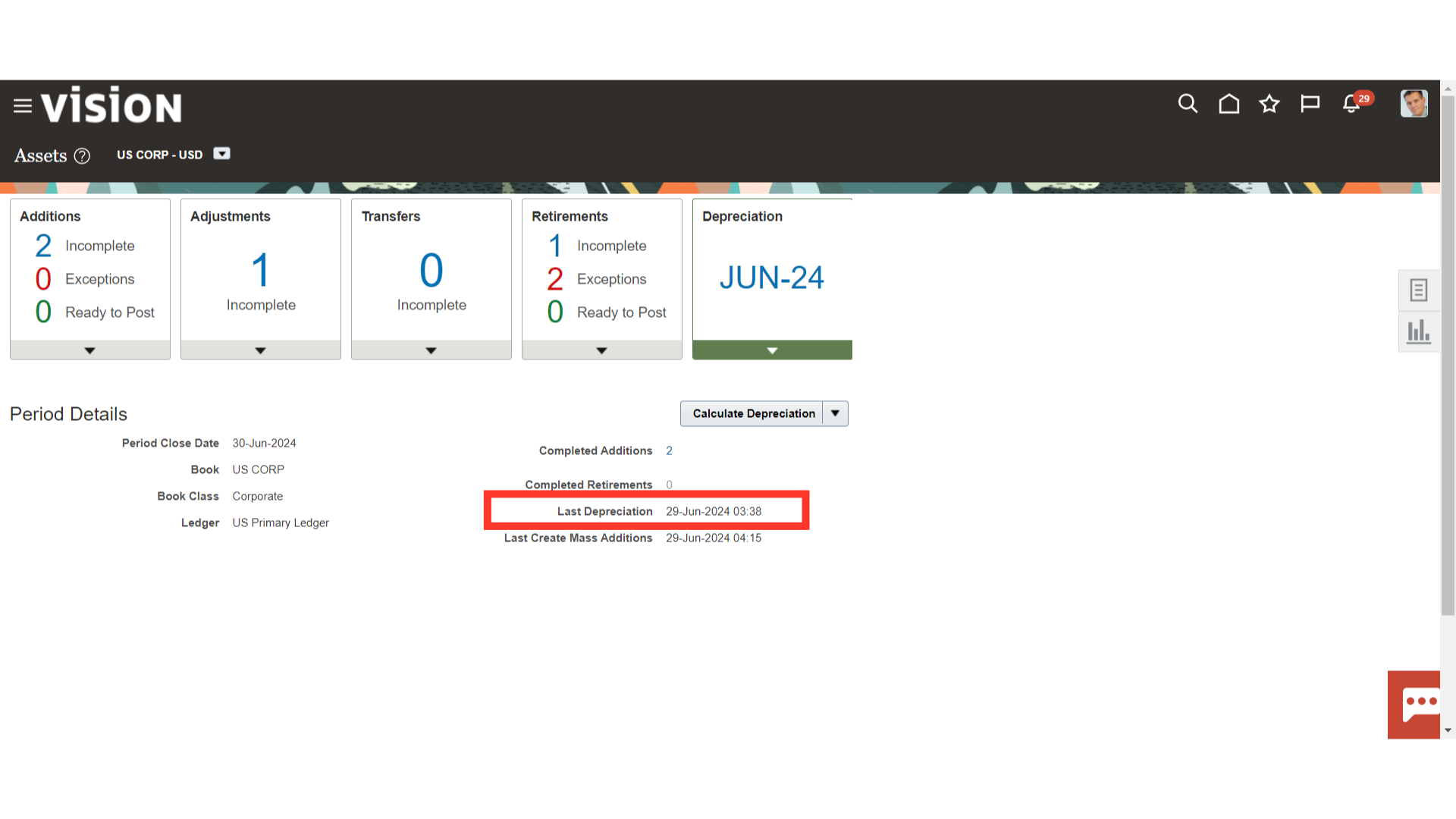

Under depreciation infotile, the date and time of the last run depreciation would be displayed.

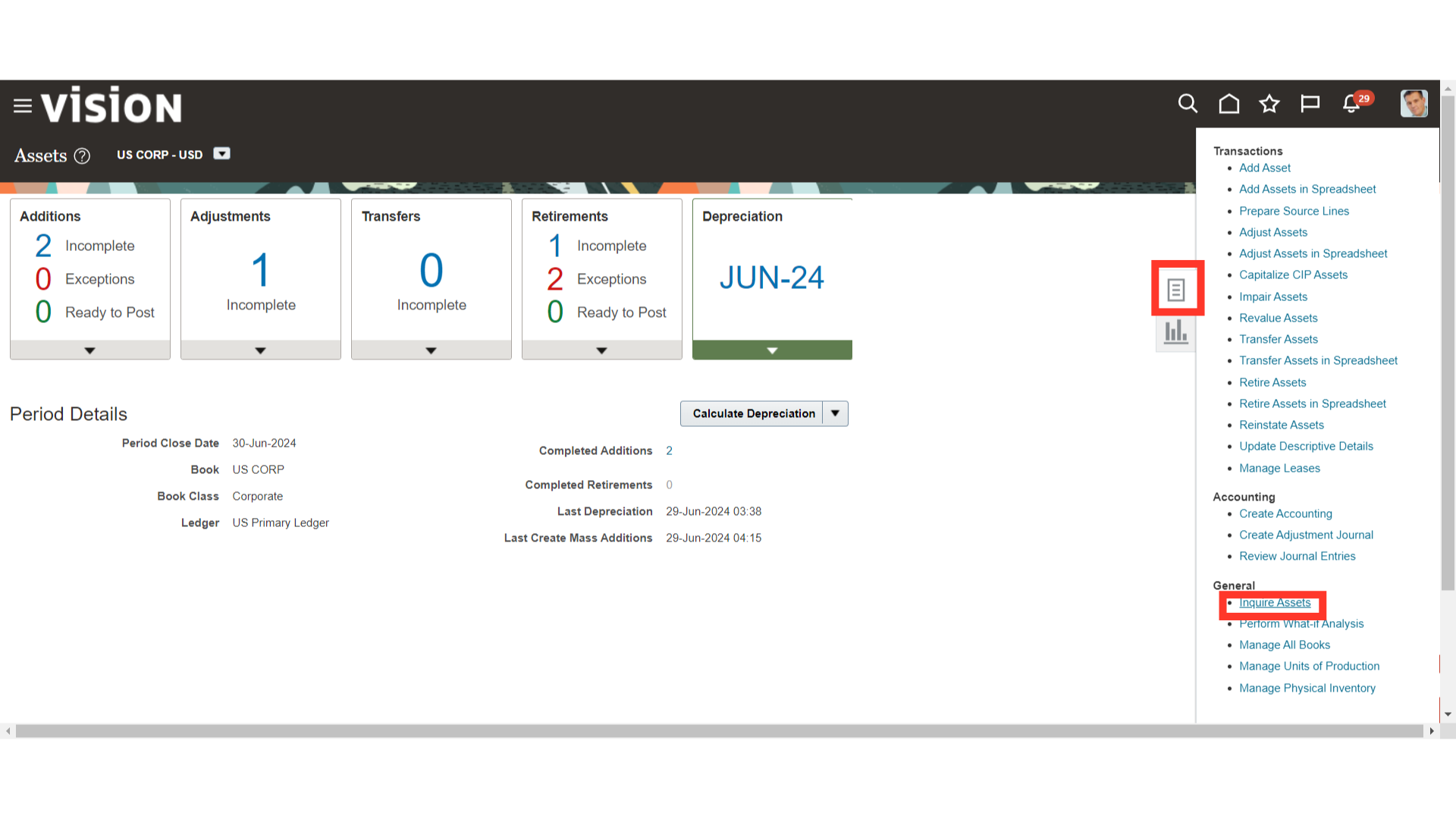

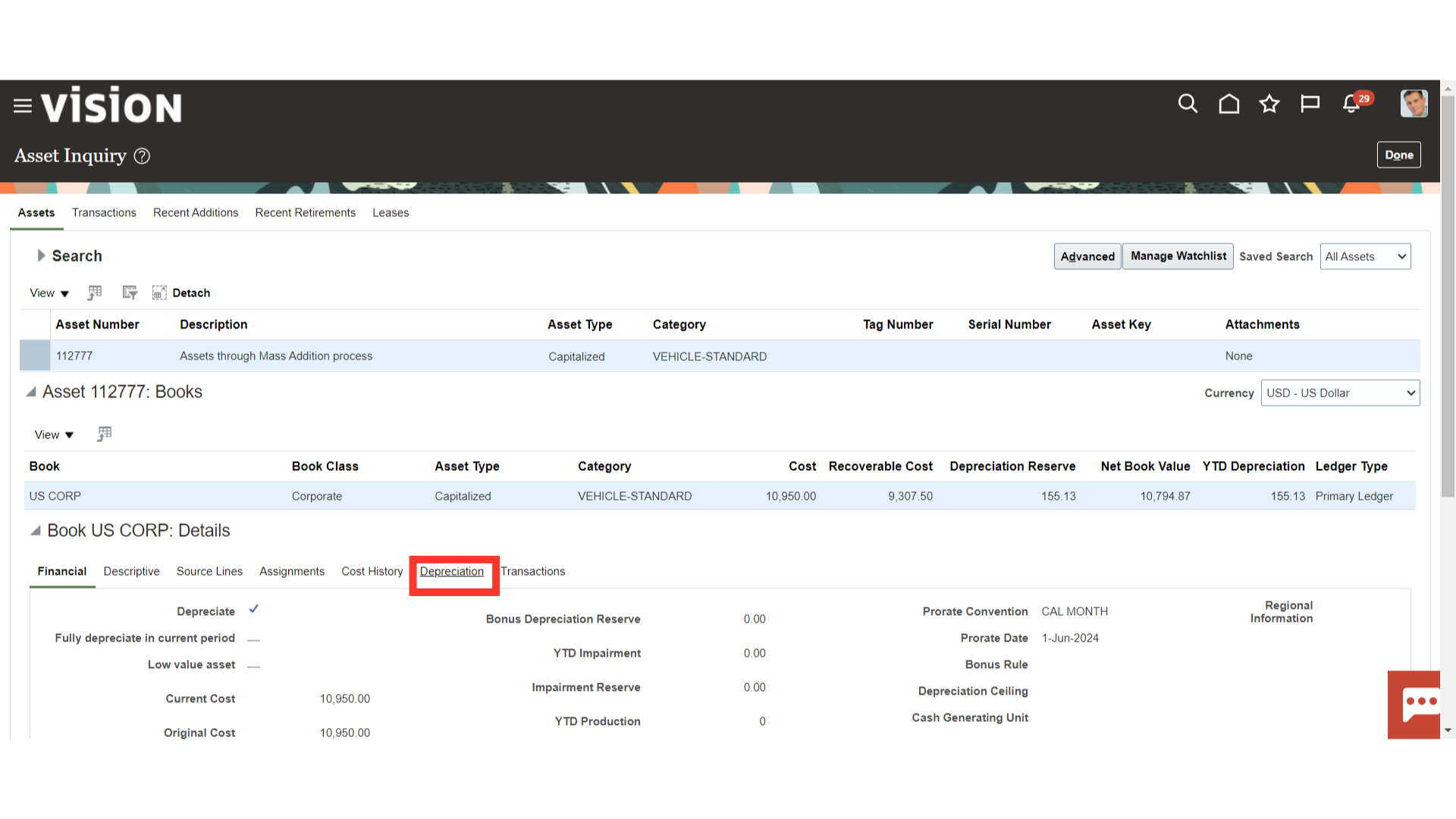

Click on Inquire Assets from the task list to view the amount of depreciation calculated in the Assets.

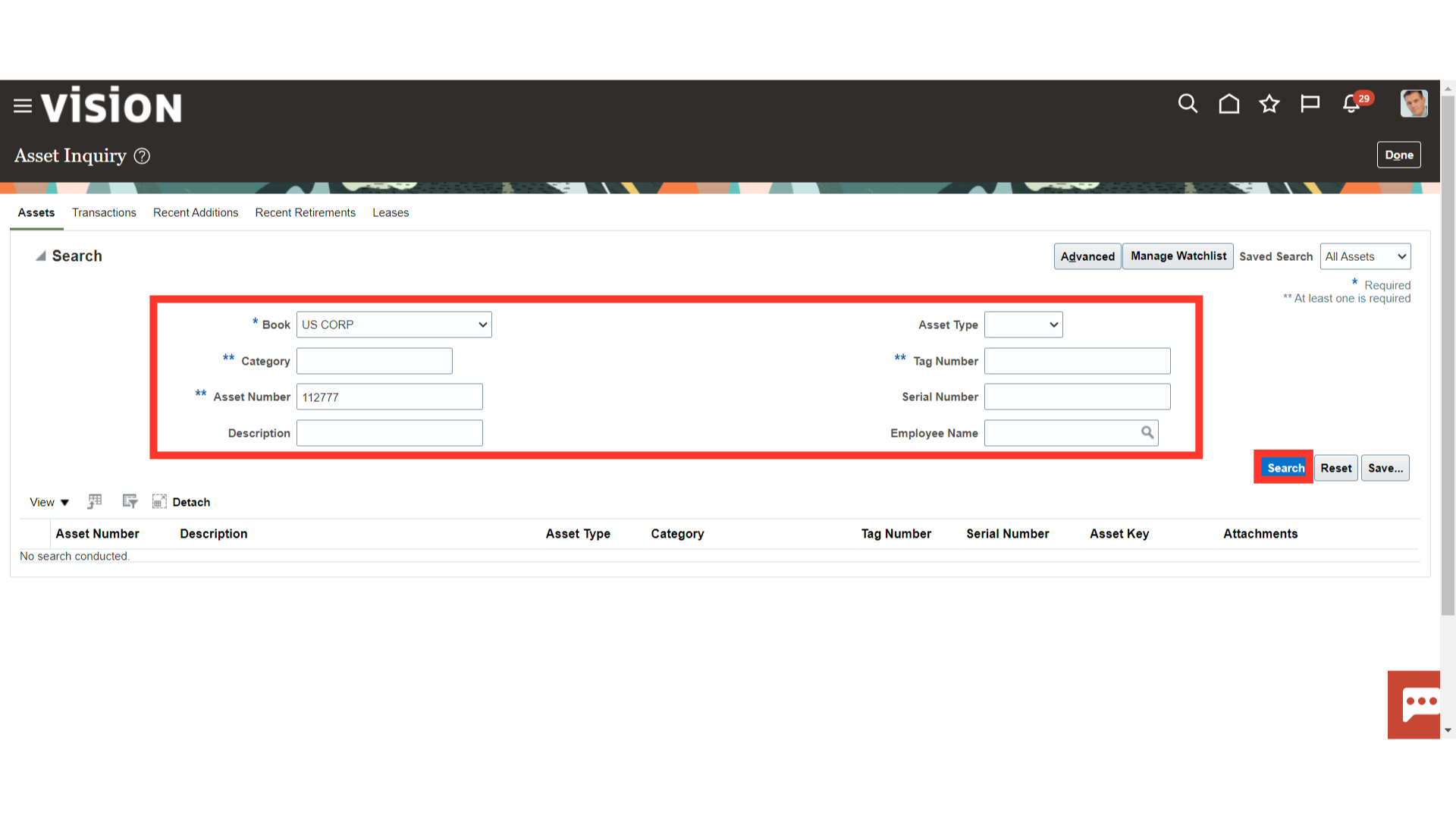

Enter the relevant search parameters, and then click on the search button.

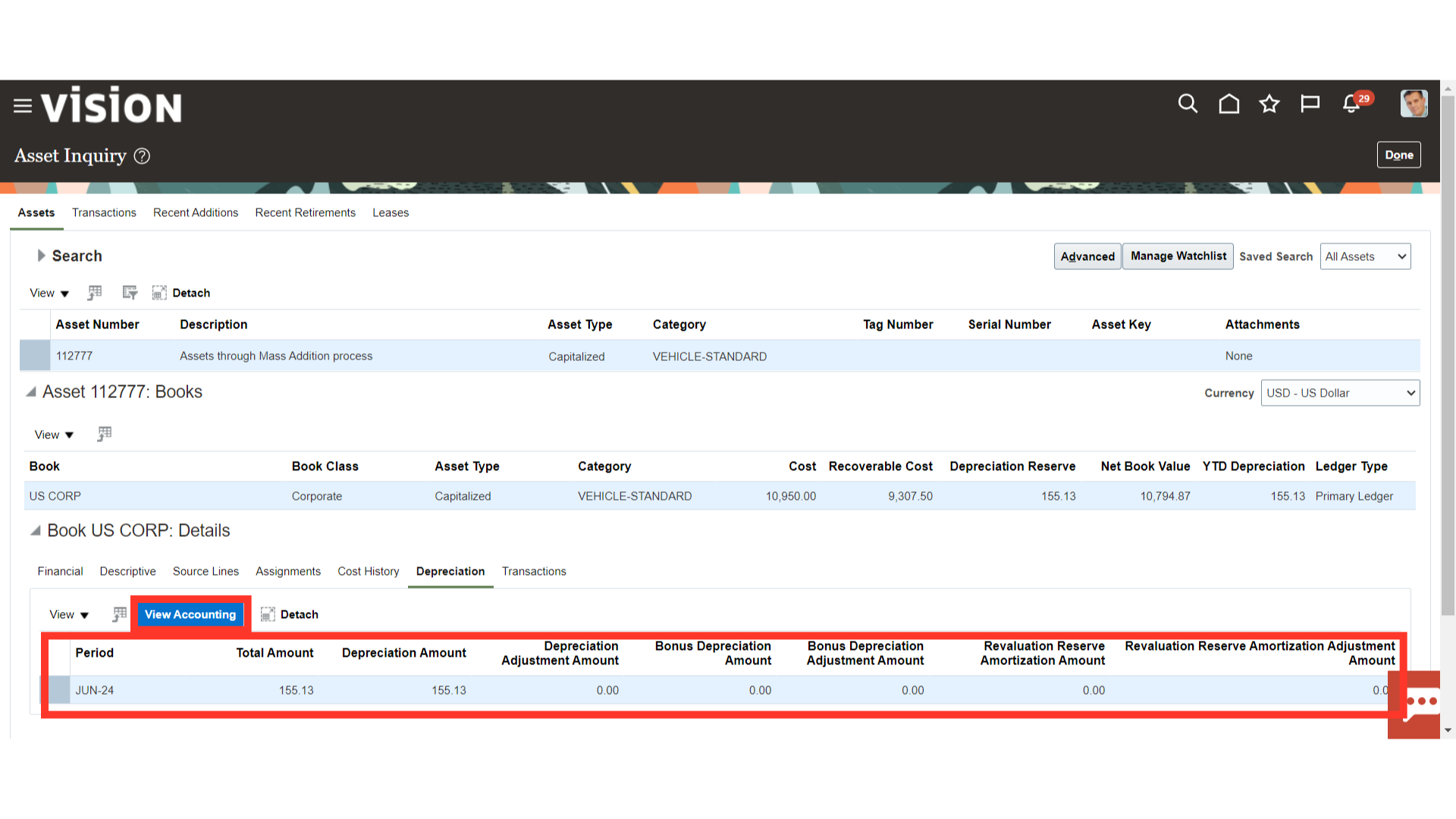

Click on the Depreciation tab under the Assets details to view the depreciation amount calculated.

The Depreciation amount calculated for the asset is shown period-wise. Click on the View Accounting button to see the accounting entry for recording the depreciation entry.

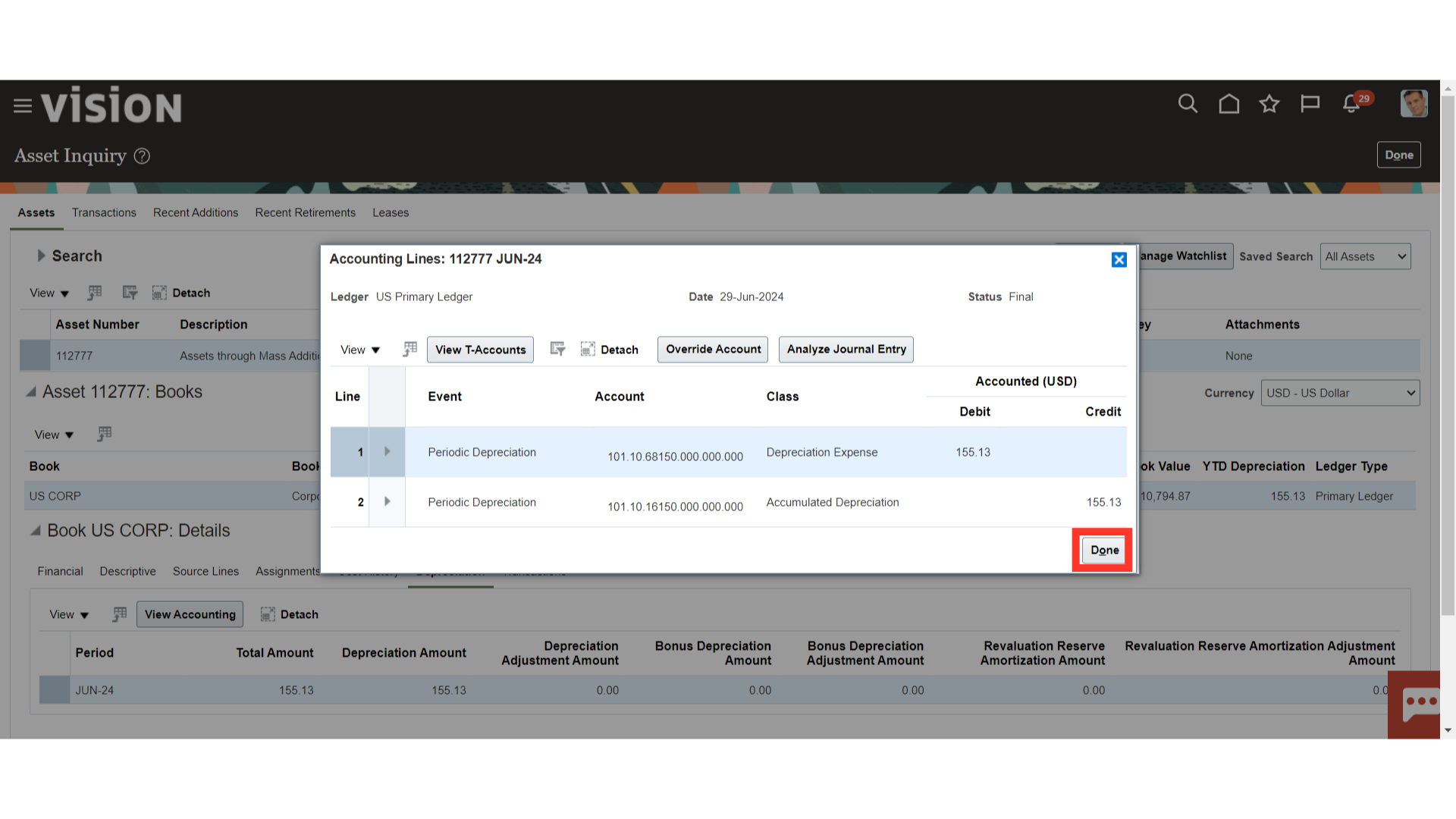

This is the accounting entry generated for recording the depreciation. Click on the Done button to close this Accounting entry’s window.

The steps involved in submitting the depreciation process have been outlined in this guide, beginning with gaining access to the Fixed Asset Workbench, executing the depreciation process, and checking the status of the process. Seeing the accounting entry that was made for the depreciation process is another step in the process.