Asset Additions

This guide will walk you through the process of adding assets in Oracle Cloud. From viewing asset details to generating reports and performing various actions, each step is outlined clearly for a smooth asset addition experience.

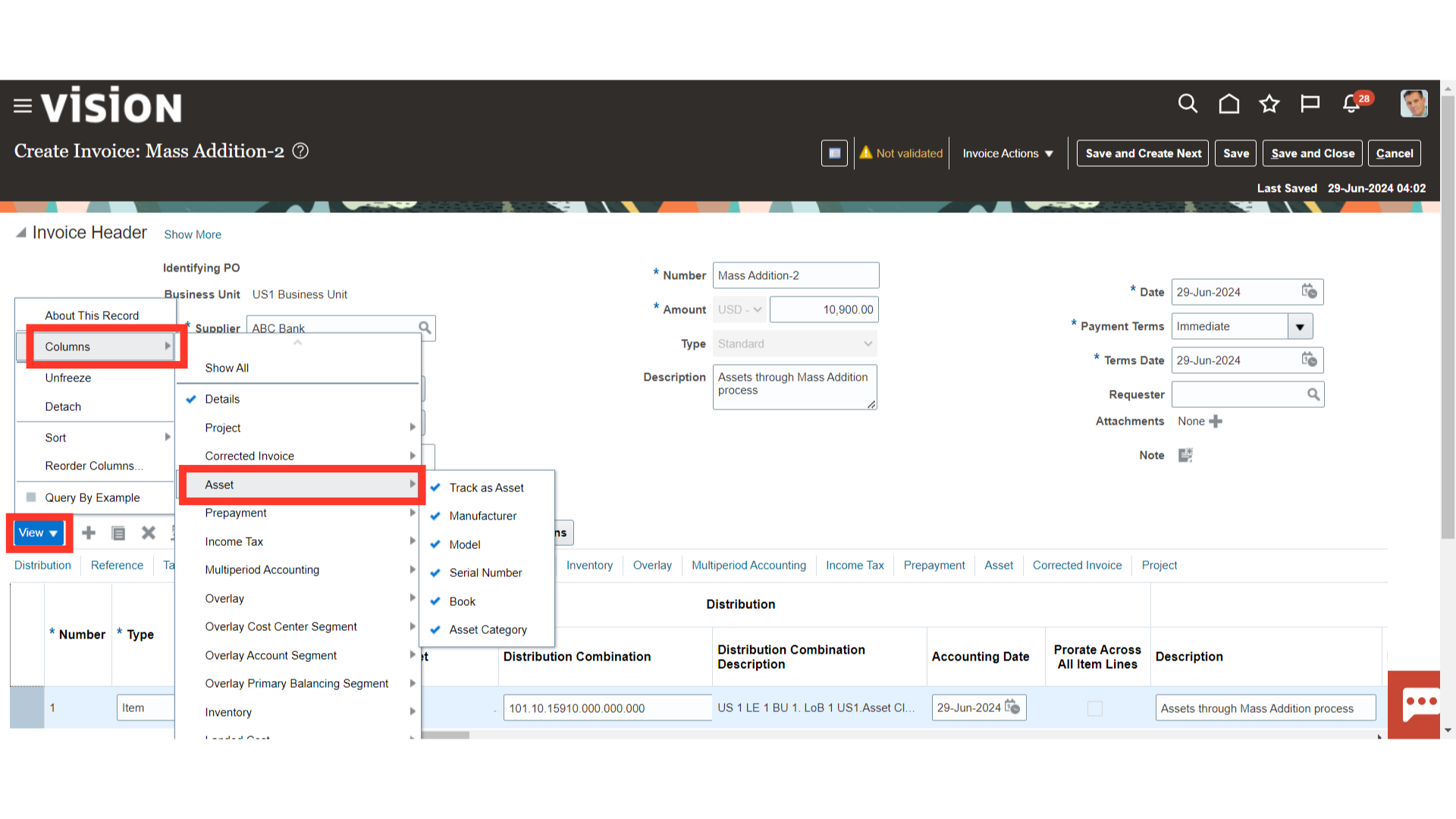

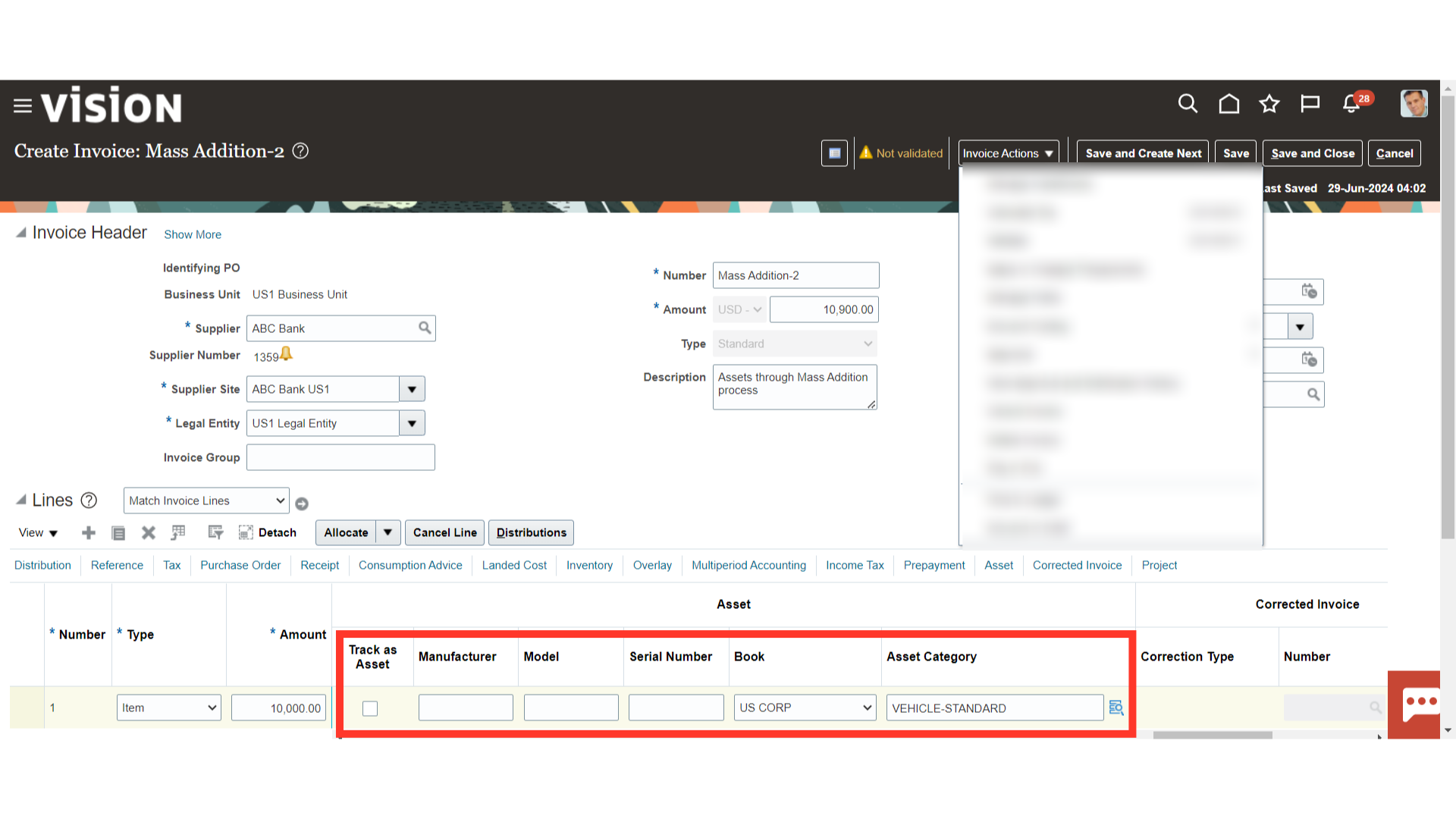

This invoice was made to document the acquisition of fixed assets. After selecting the View tab, expand Asset under Columns to display the appropriate column to enter the asset-related details.

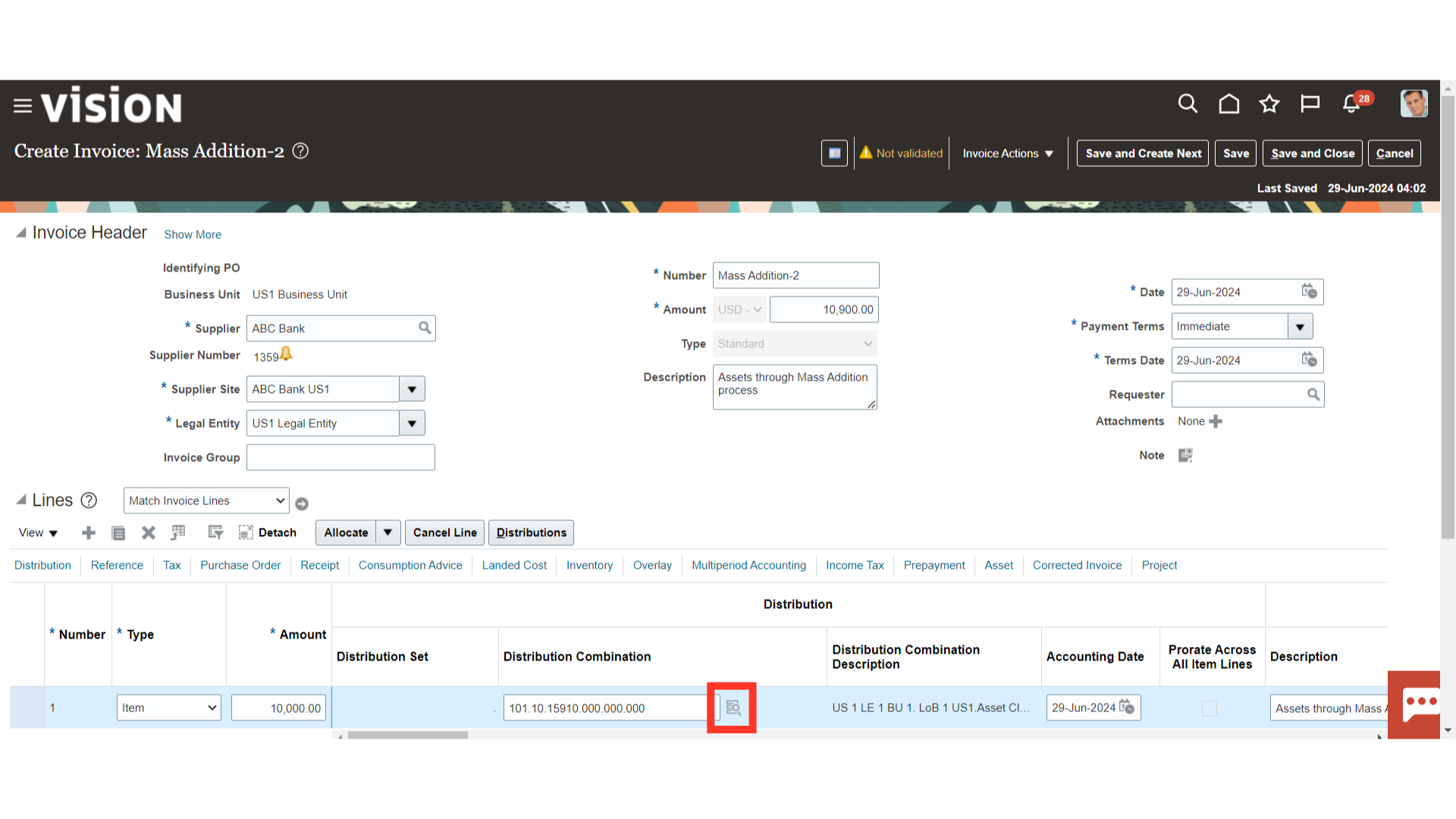

Click on the Account combination icon to view the distribution combinations.

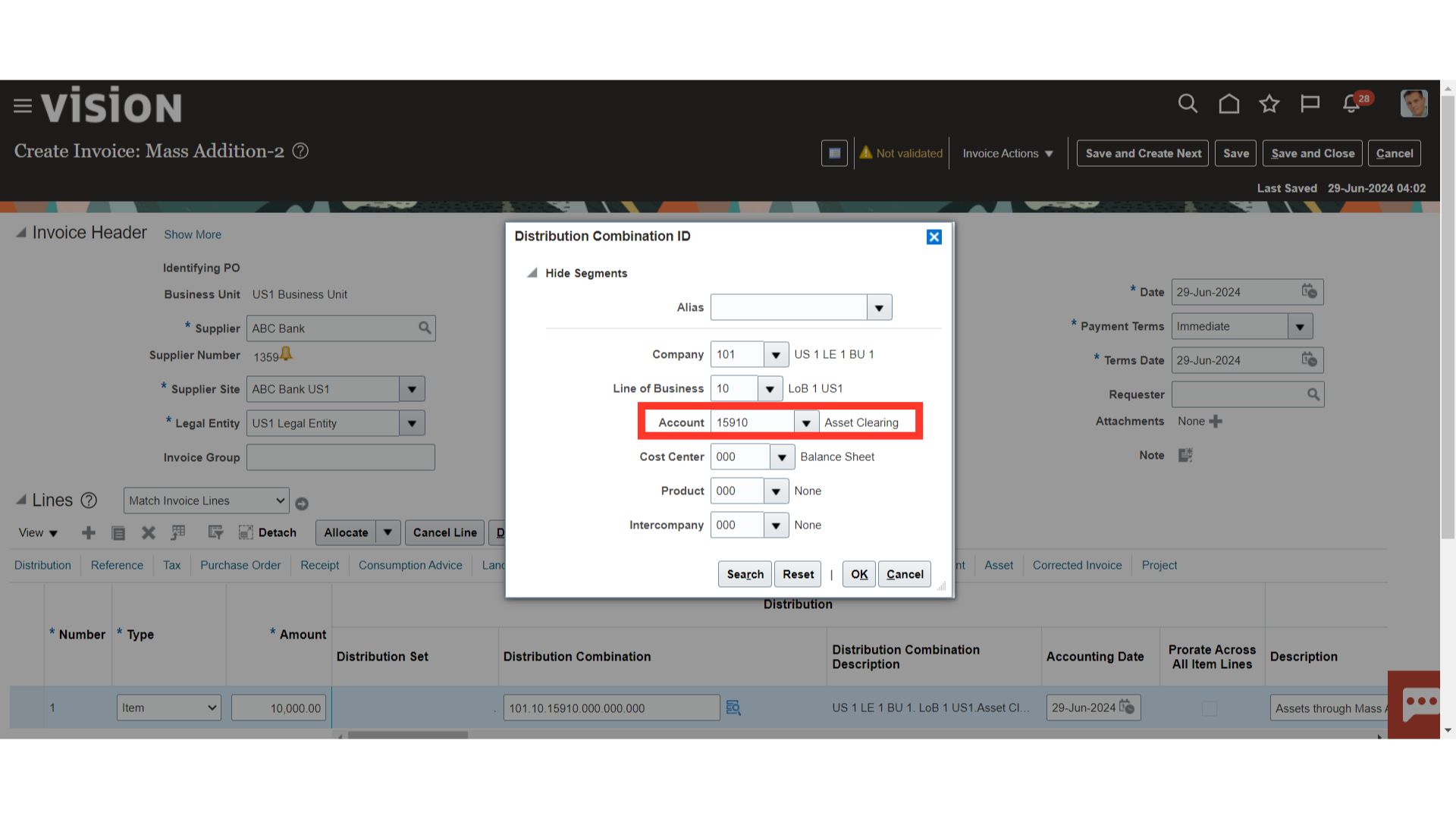

Enter the Asset clearing account that is chosen in the Asset category in order to move the fixed asset invoice from payables to fixed assets.

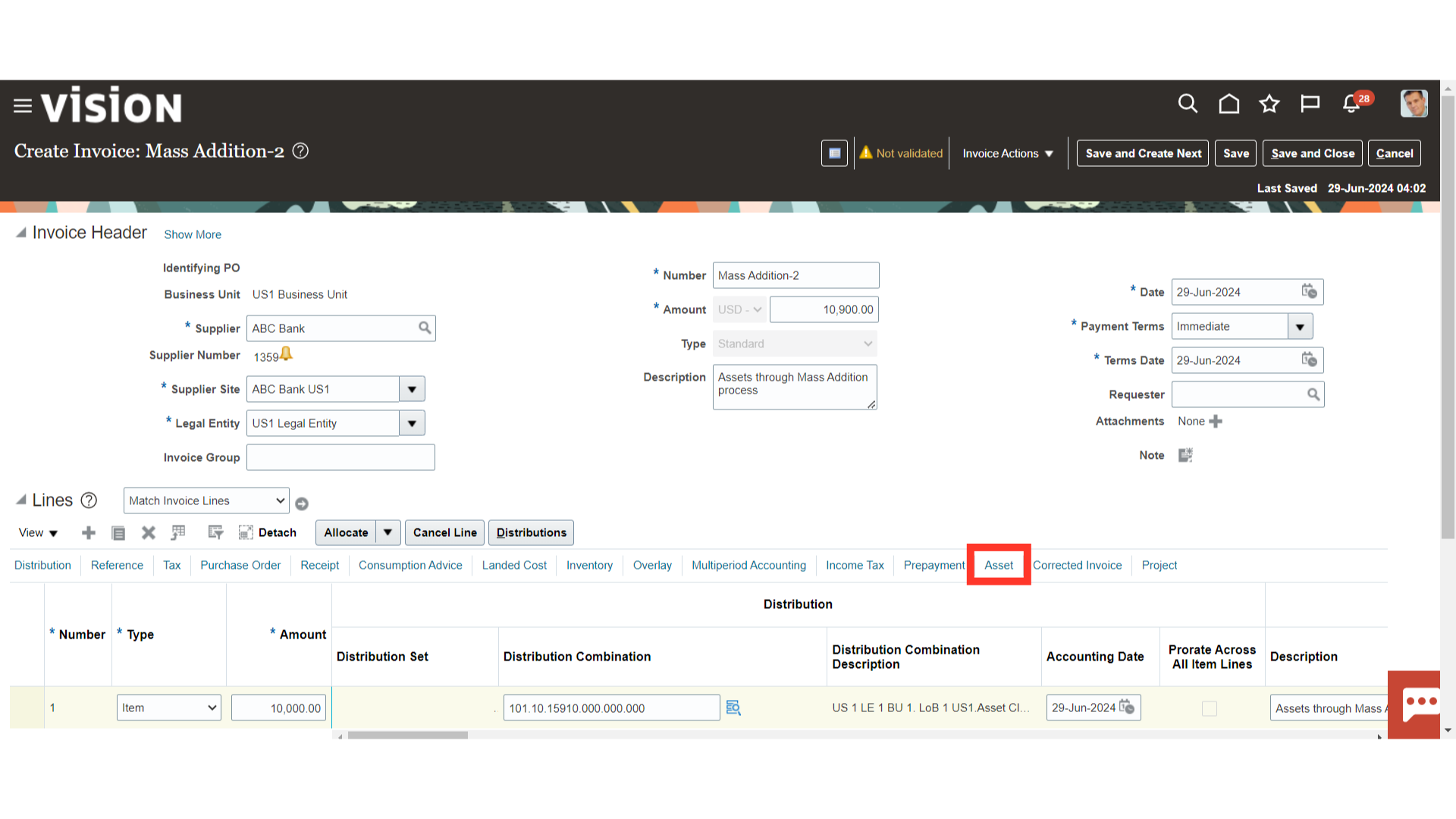

To enter the details related to fixed assets click on the Asset tab.

Enter the Asset related details such as Model, Serial number, Asset Book, and Asset category.

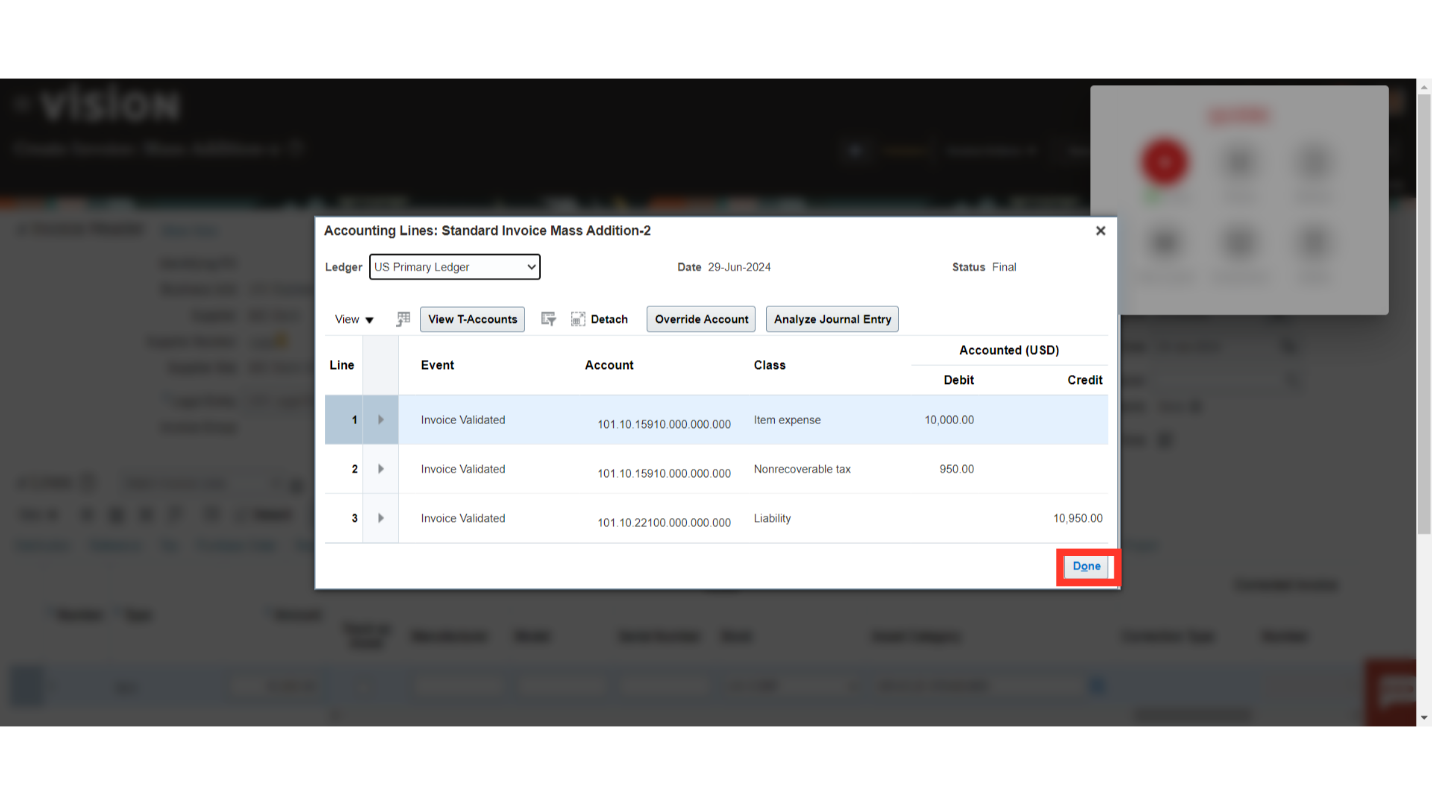

To move the invoices from payables to fixed assets, the invoice must be validated and an accounting entry must be created.

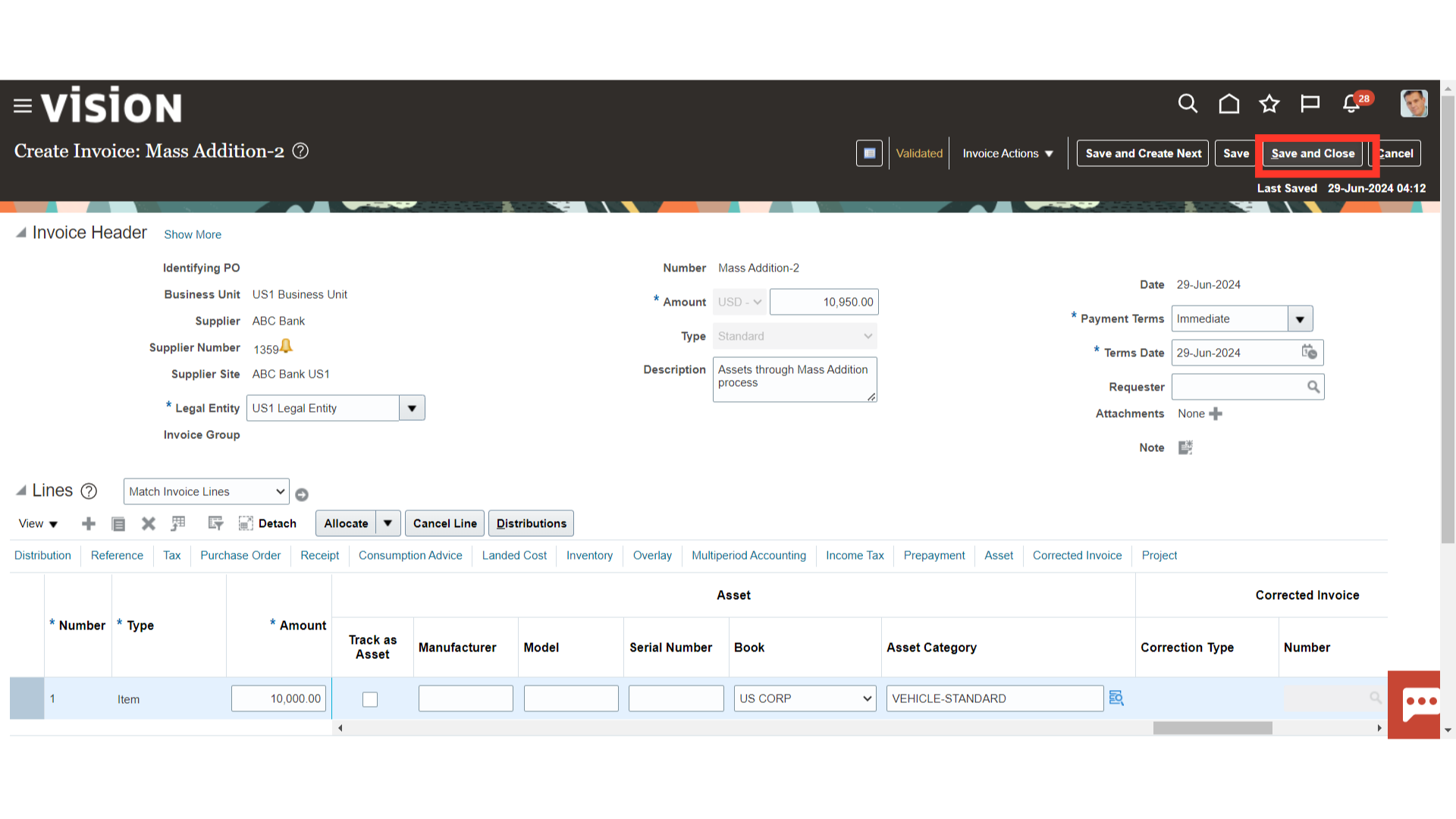

In order to get back to the invoice workbench, click the Save and Close button.

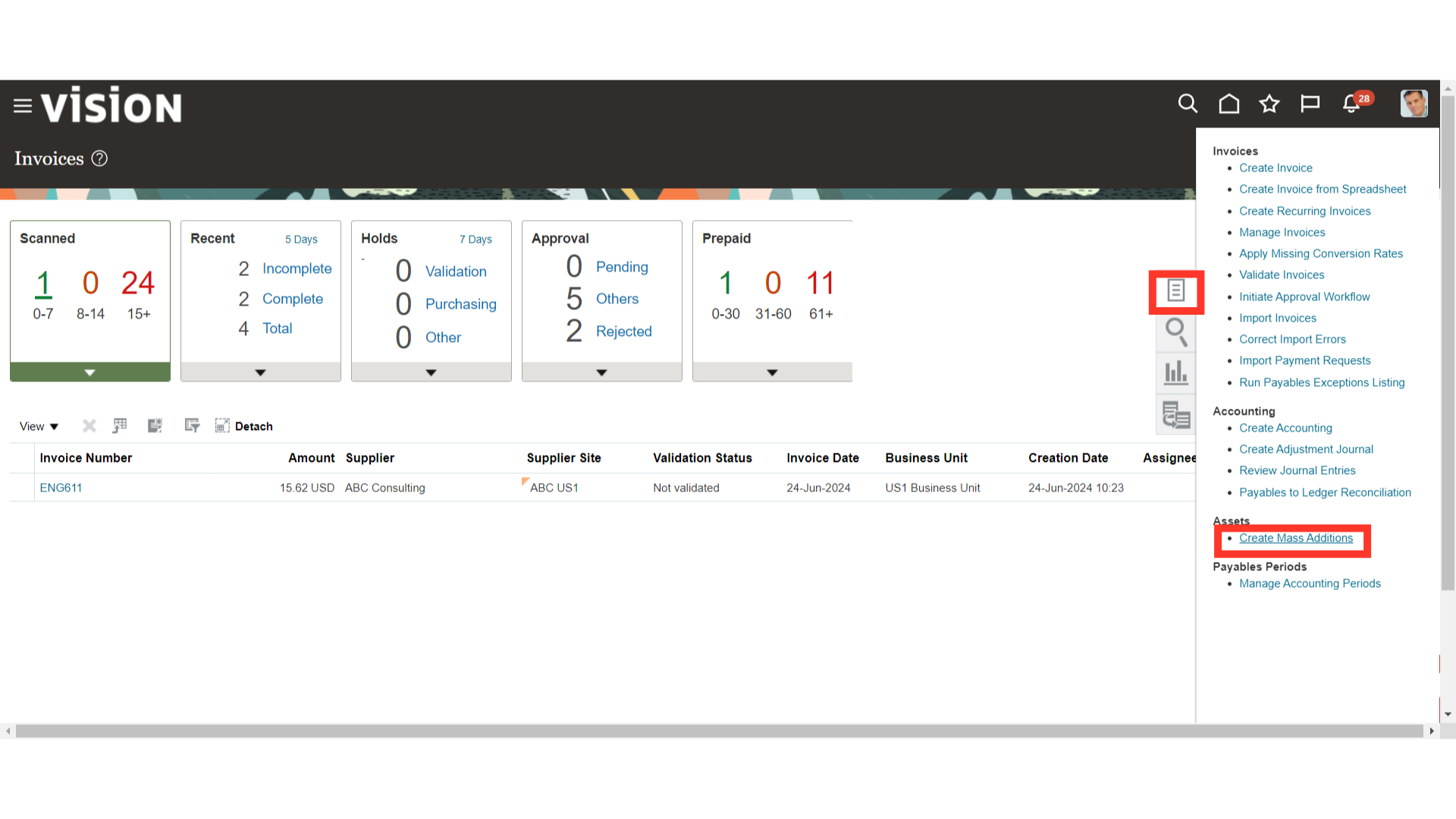

Click on the Create Mass Additions process from the task list.

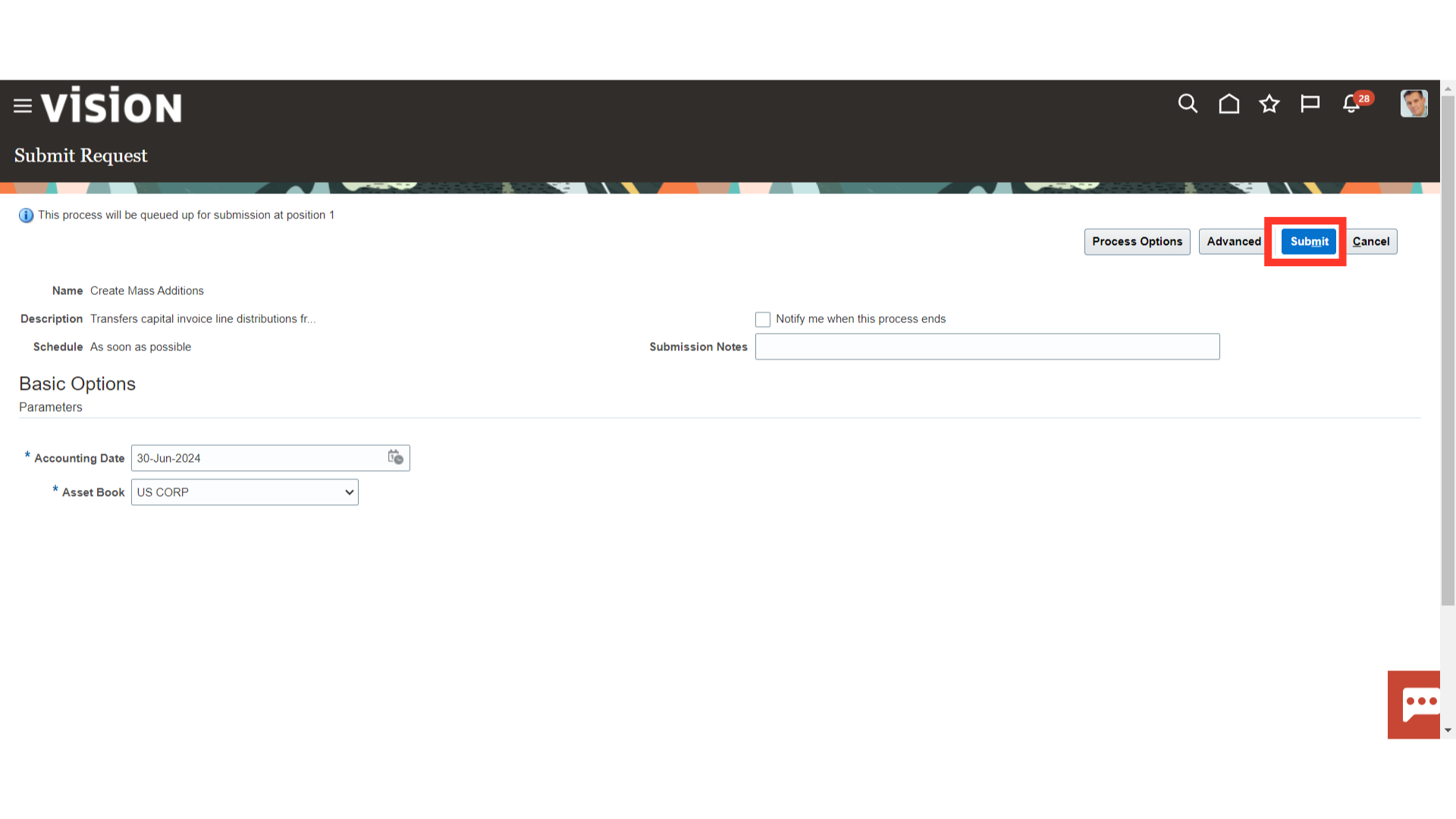

Run the Mass Additions Create program to create mass additions for Oracle Assets from invoice line distributions in Payables. Choose the asset book as well as the accounting date that invoices must be submitted by in order for the mass addition process to take place. At last, click on the Submit button.

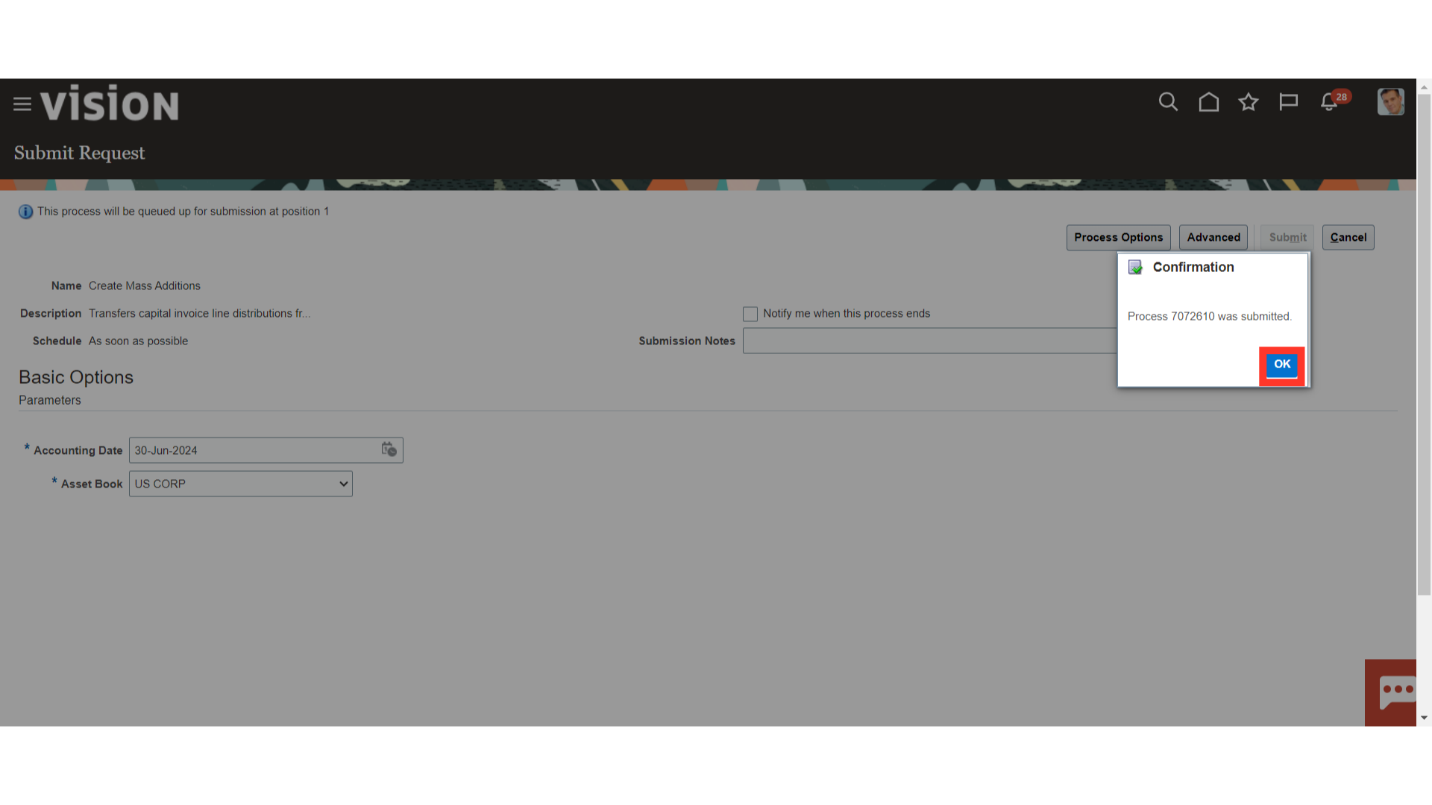

A Confirmation message is displayed along with the Process ID. Click on the OK button to continue.

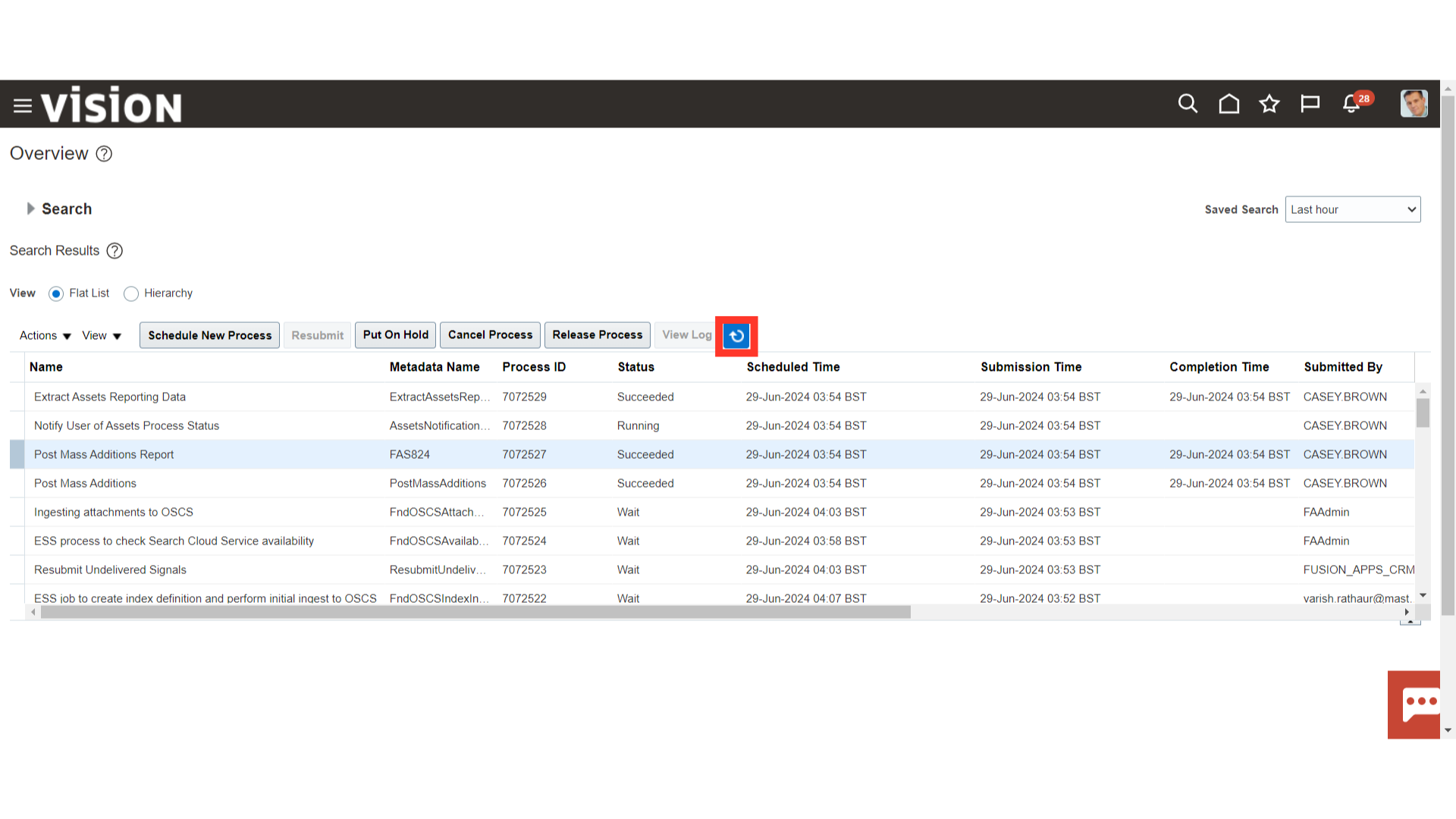

Navigate to Scheduled Process to check the Create Mass addition process result. Click on the Refresh icon to update the process status.

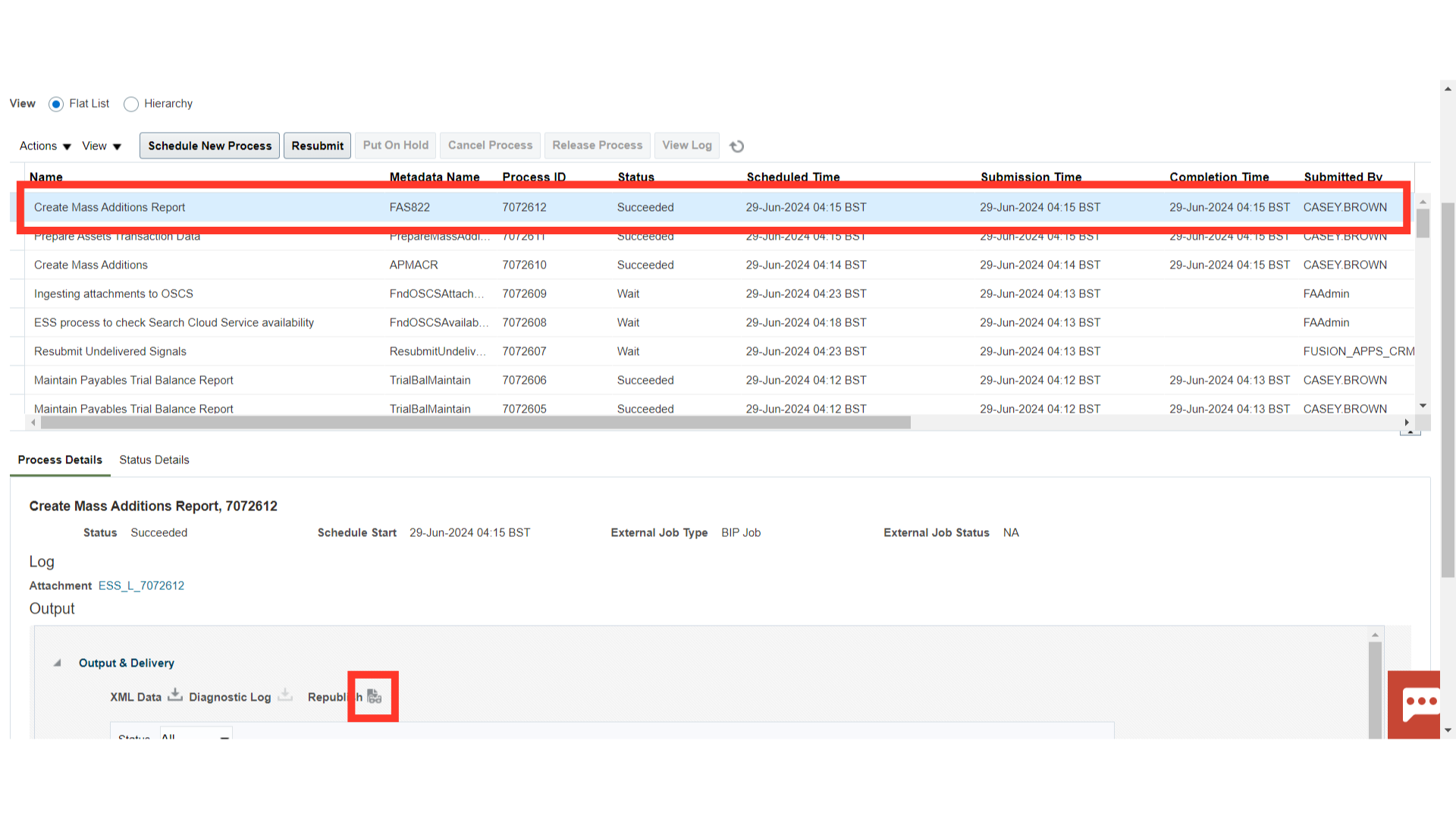

When you submit the Create Mass Addition process, the Create Mass Addition Report is submitted automatically. Now, to download the report select the “Create Mass Addition Report” process, and then click on the Republish button.

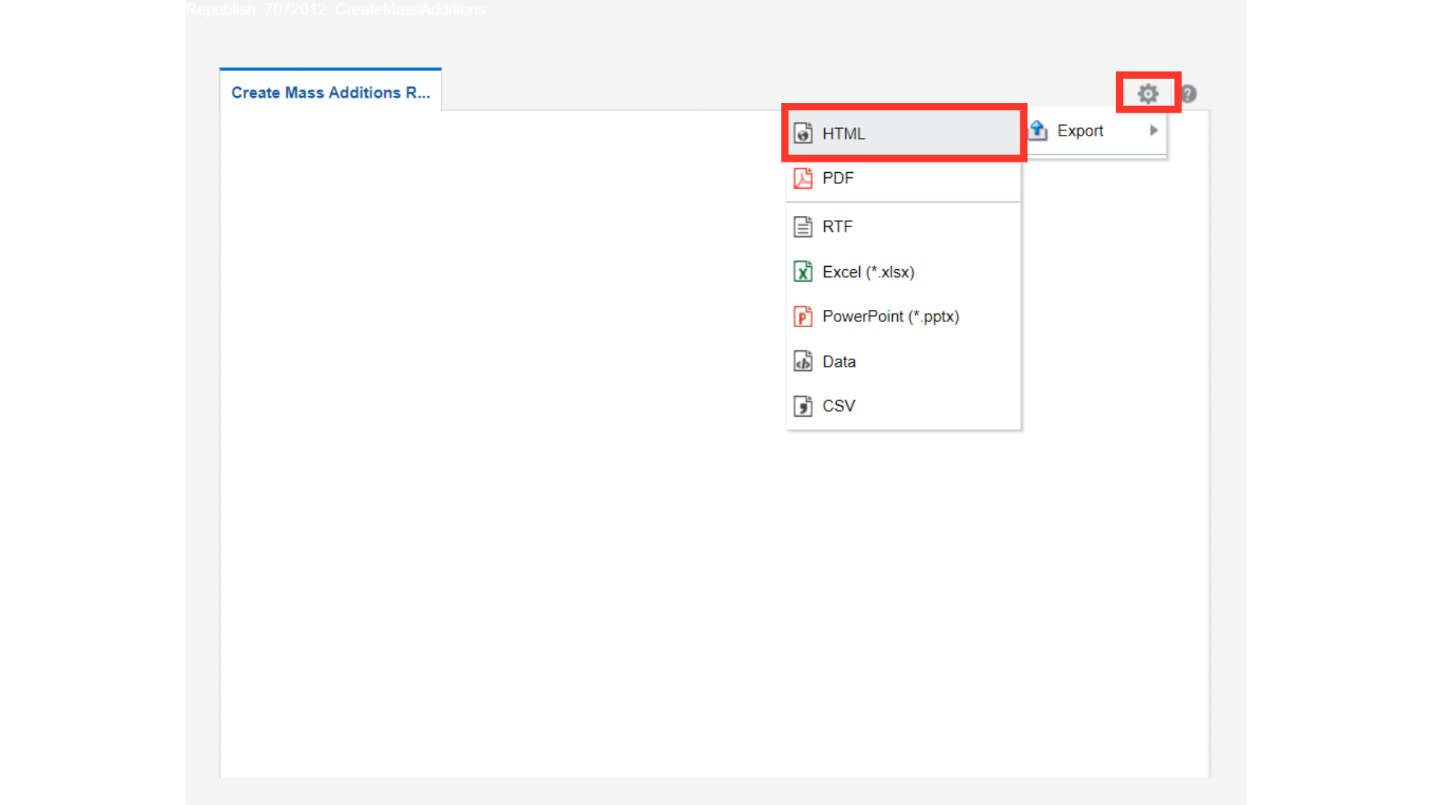

Click on the Gear icon, and then click on the HTML view option under Export.

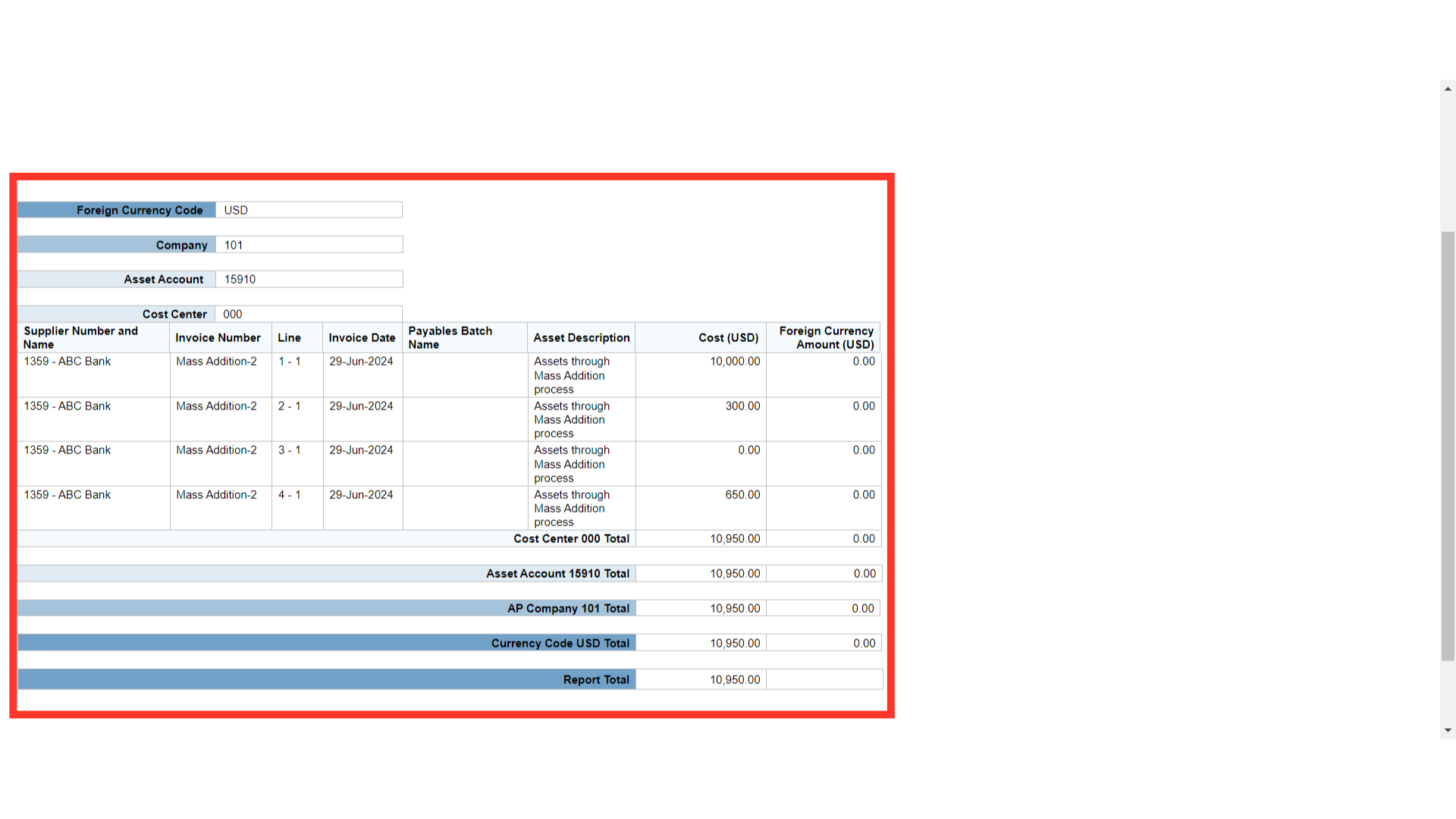

Use this report to review mass additions created from invoice distribution lines in Payables for the Book you choose. The report provides you with a complete audit trail of the mass additions created by Payables. Oracle Assets sorts the report by, and prints the total cost in both the functional and foreign currency for each currency, company, asset account, and cost center.

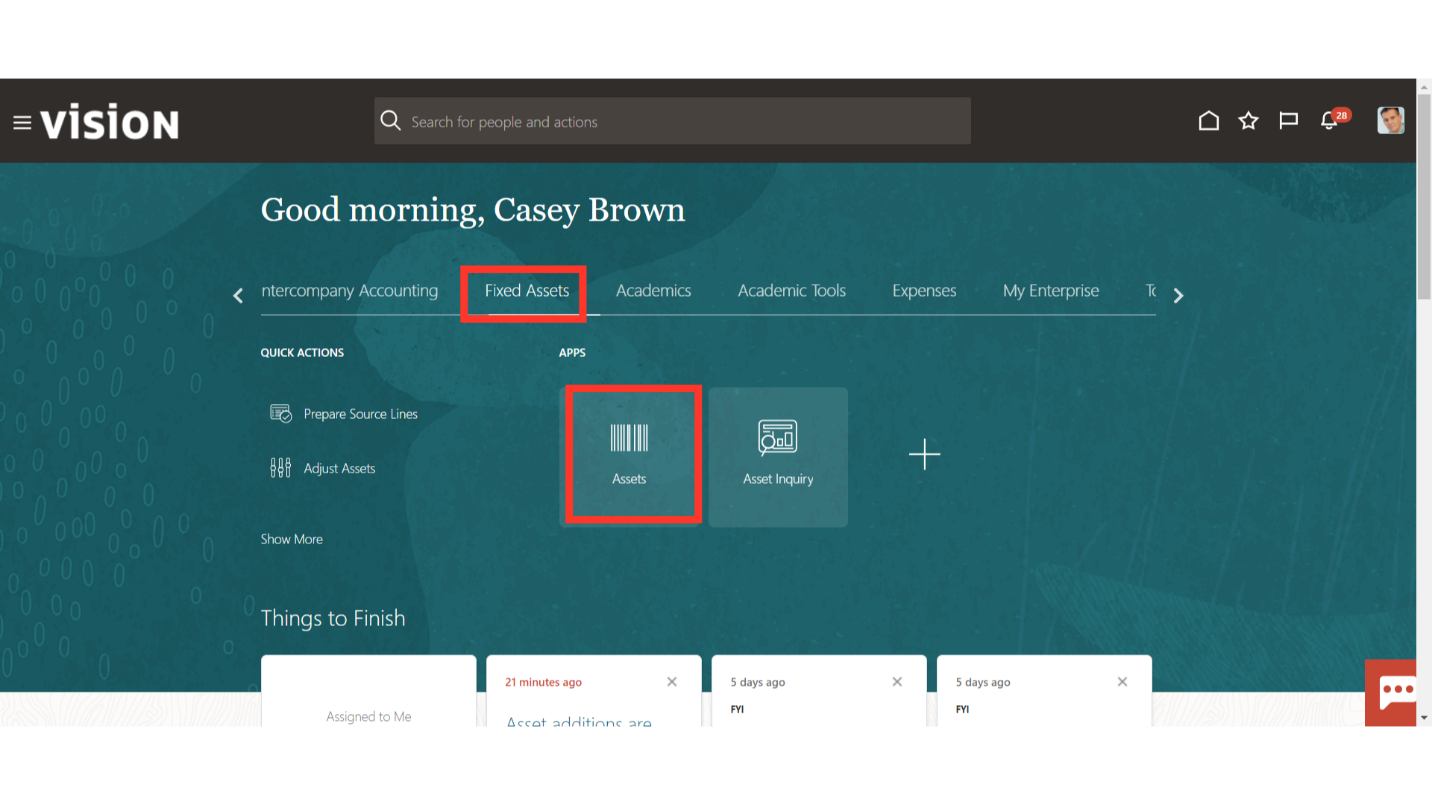

To access the Asset workbench, click on the Assets submenu under the Fixed Assets menu.

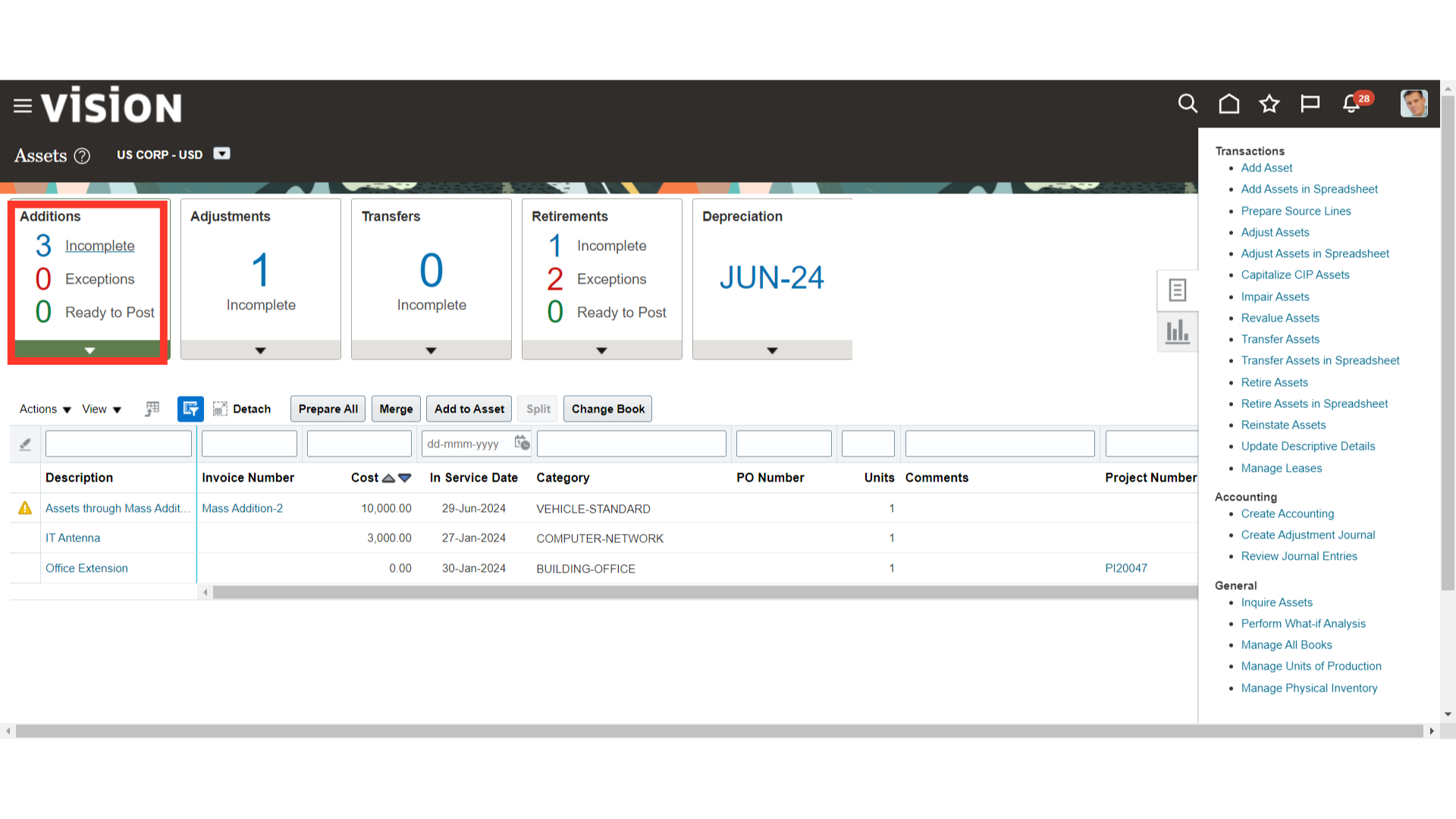

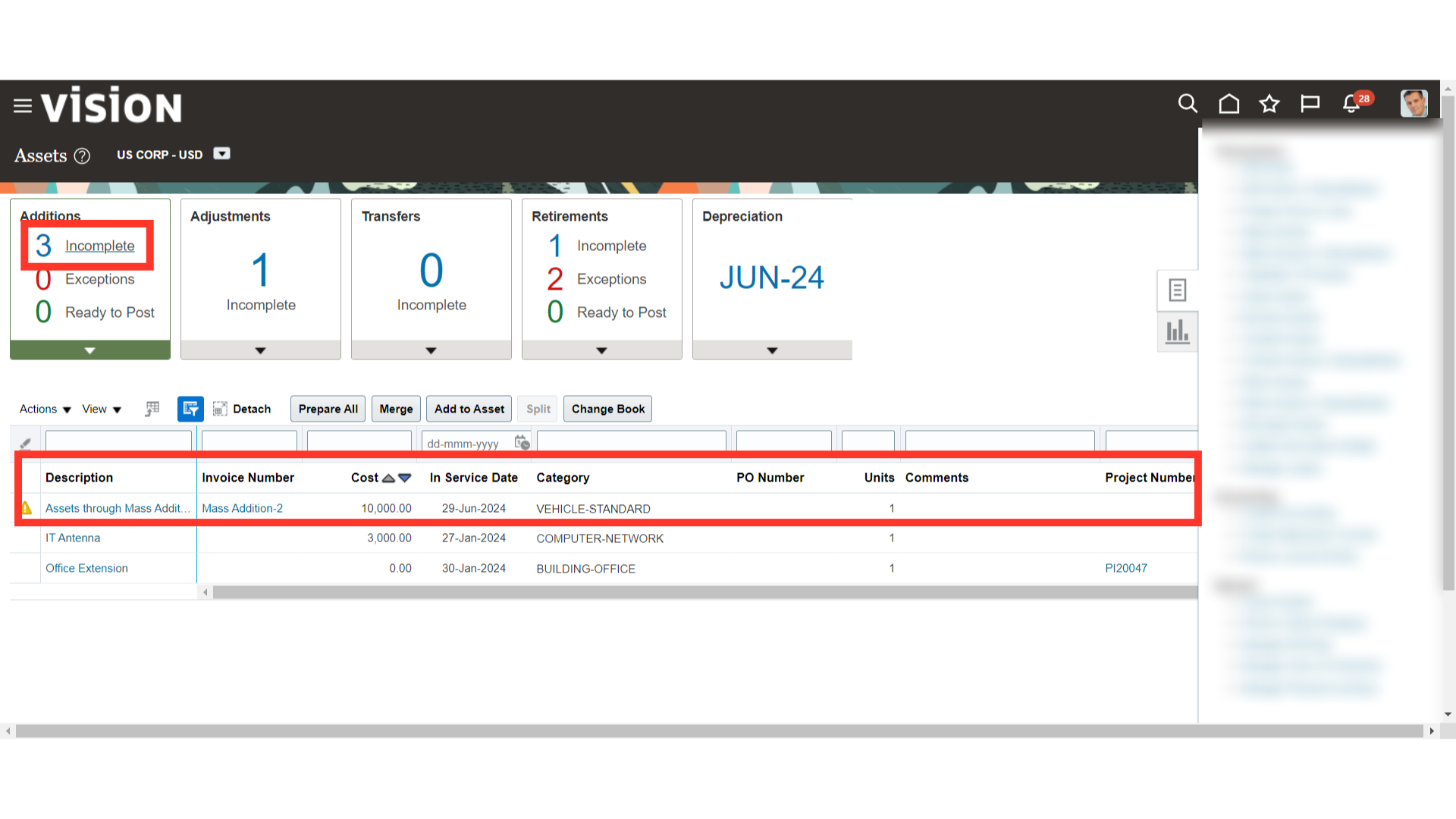

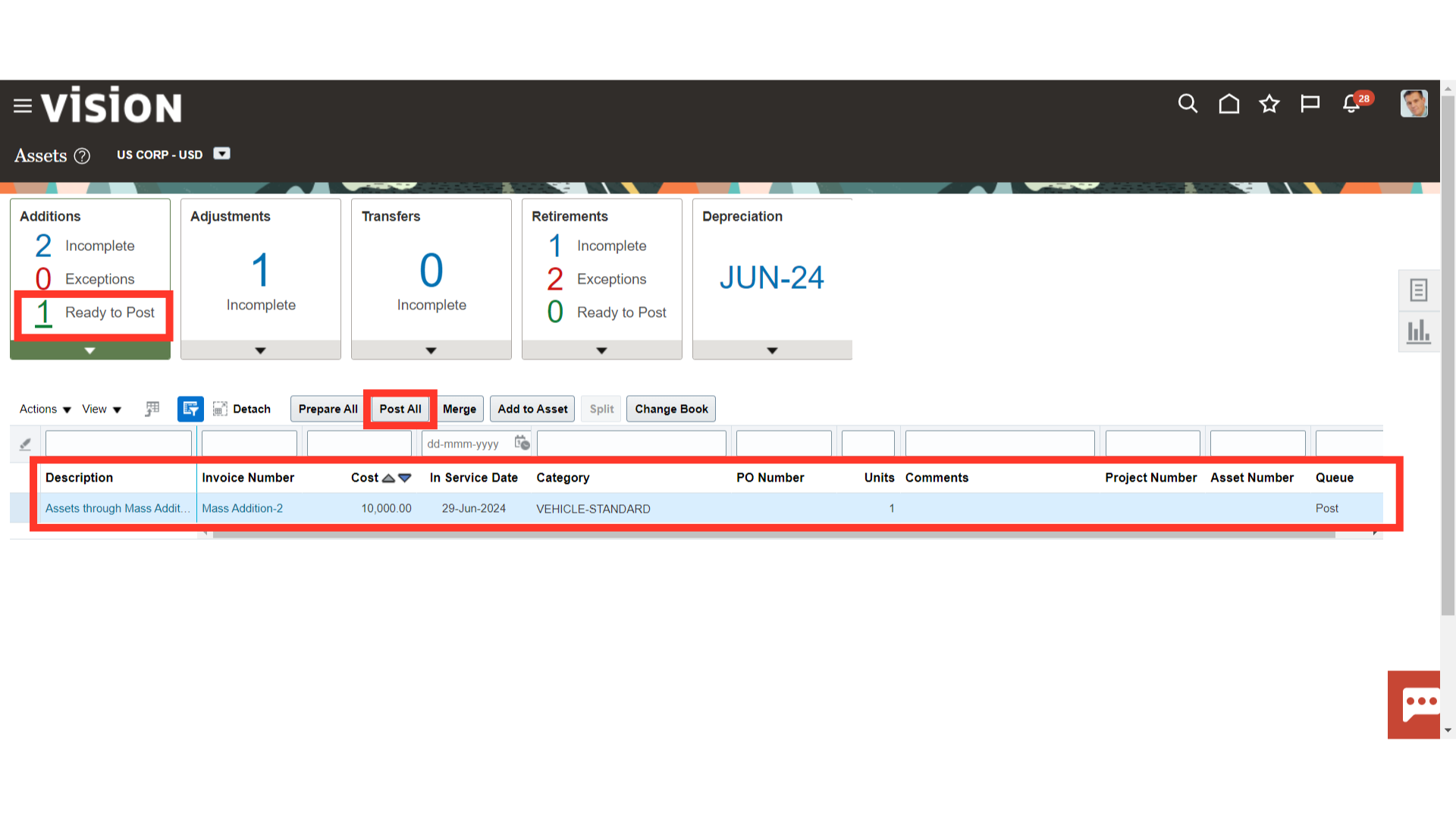

The Additions infotile depicts the number of transactions that require action. Transactions that require action are assigned one of the following three statuses: Incomplete, Exceptions, and Ready to Post.

Click on the Incomplete hyperlink to see the list of invoices received from payables for Asset creation.

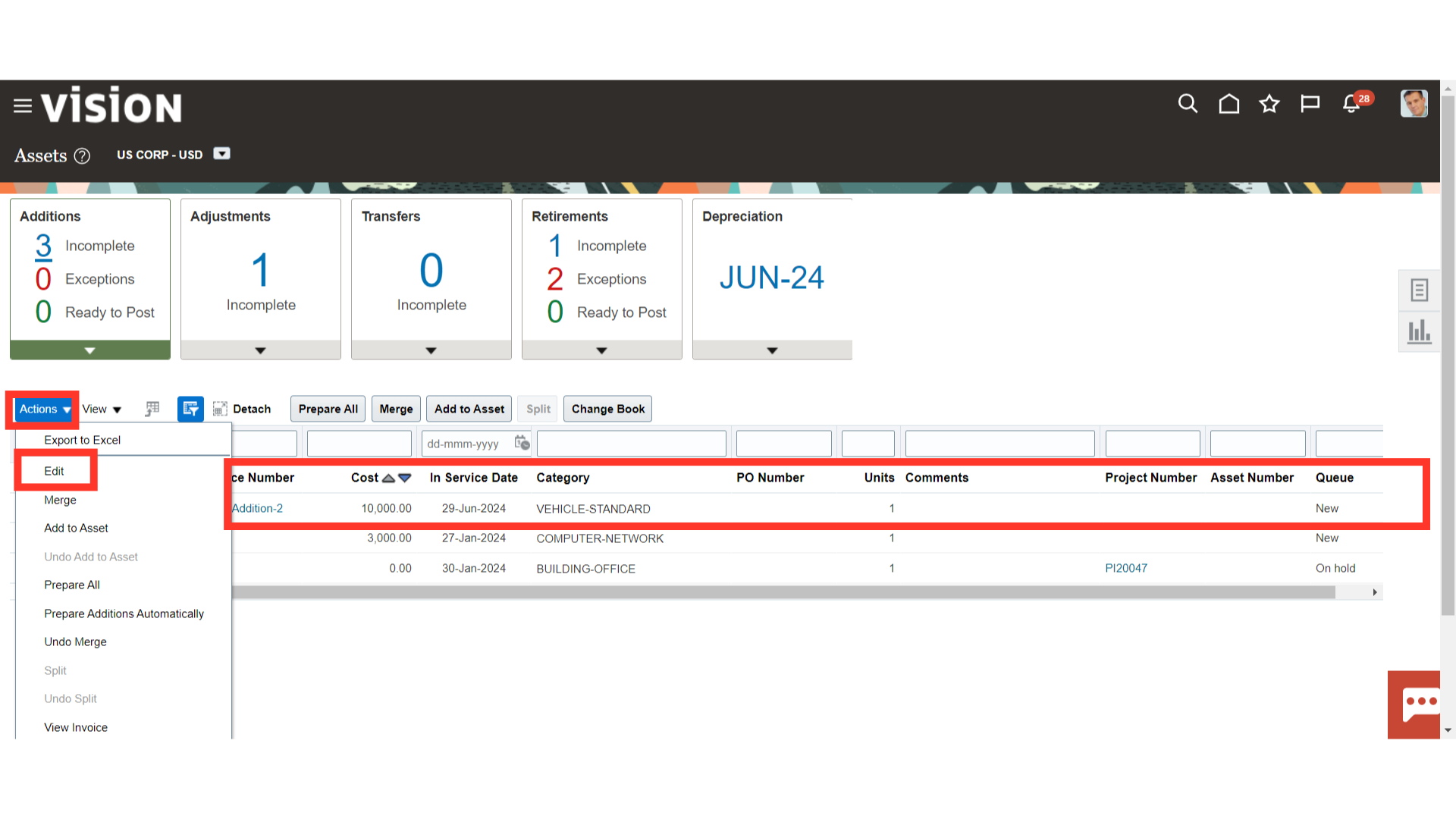

Click on Edit under Actions after selecting the Mass addition line to open it.

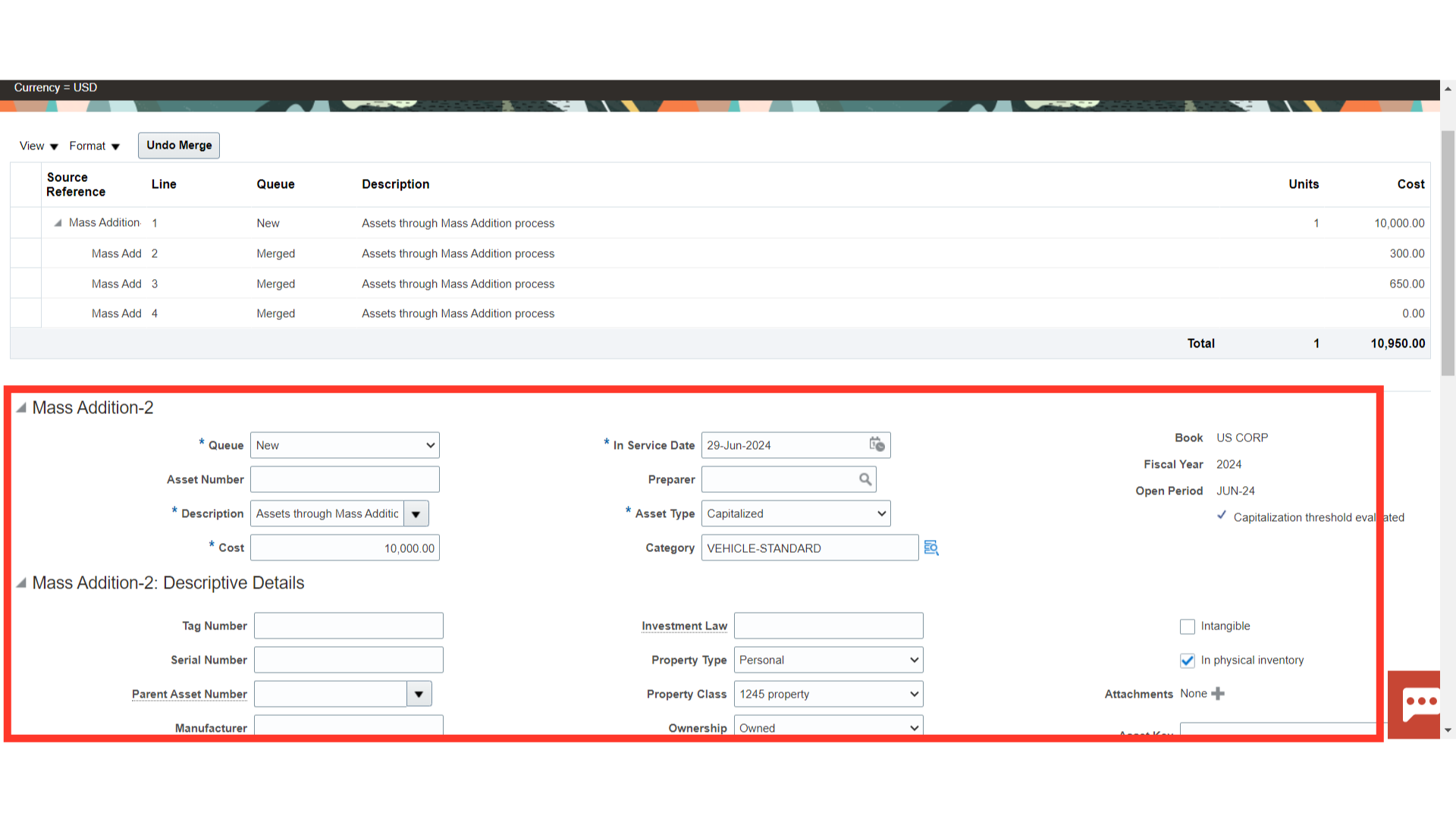

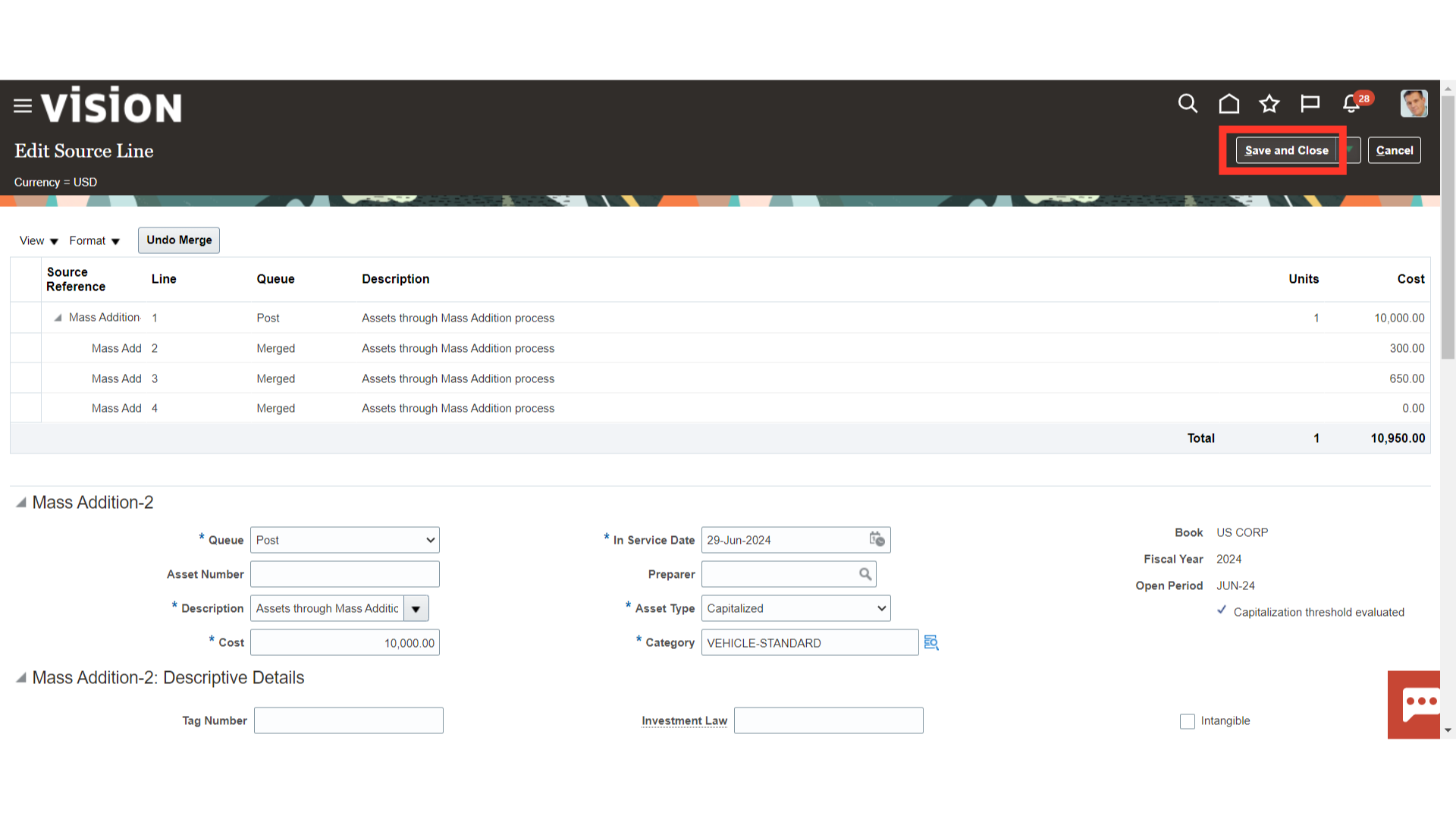

Enter the mandatory details of the Asset such as Asset cost, Asset type, Category, and Description of the Asset.

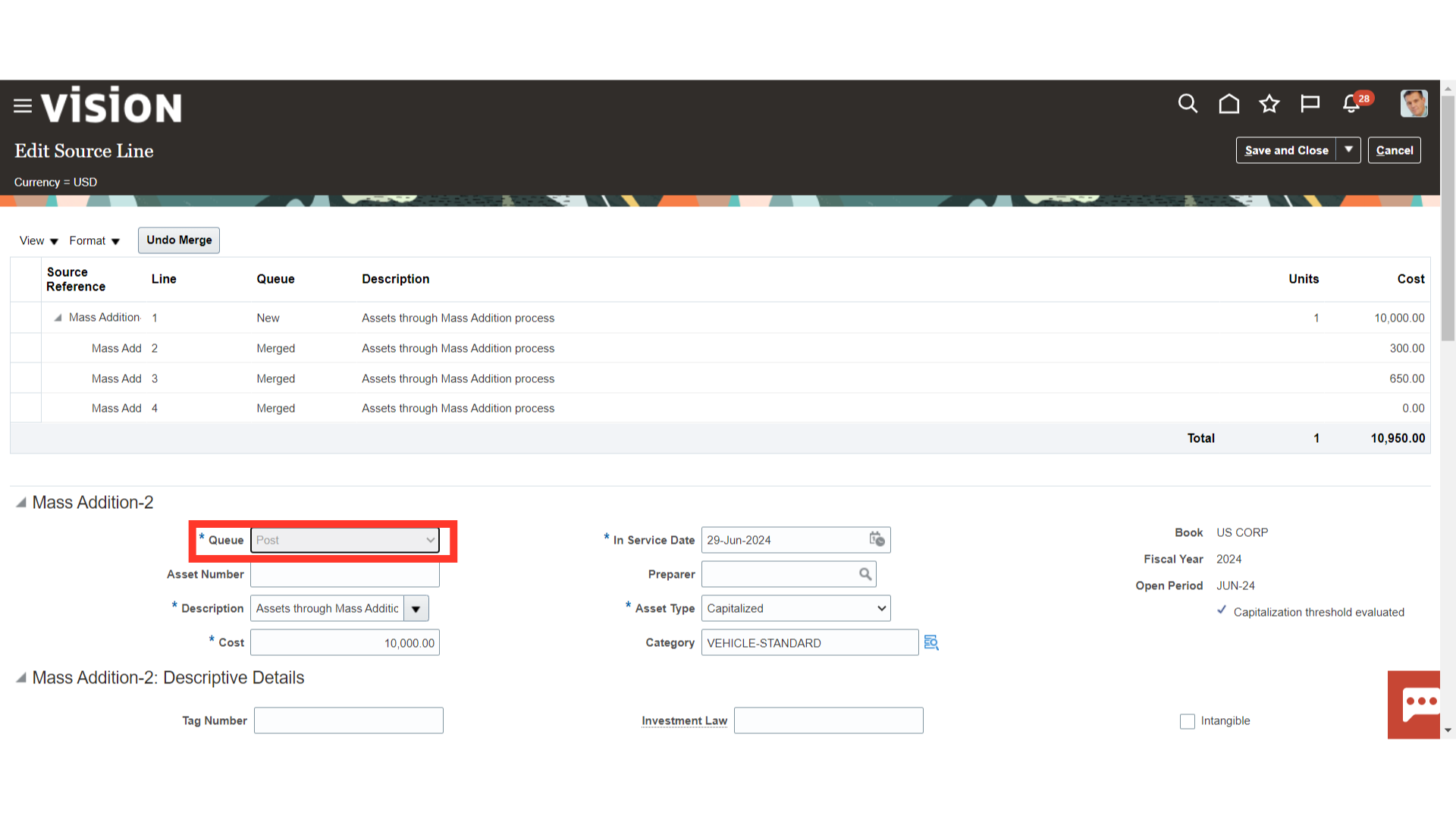

To post the mass addition lines to the asset register select the Queue status as Post from the list of values.

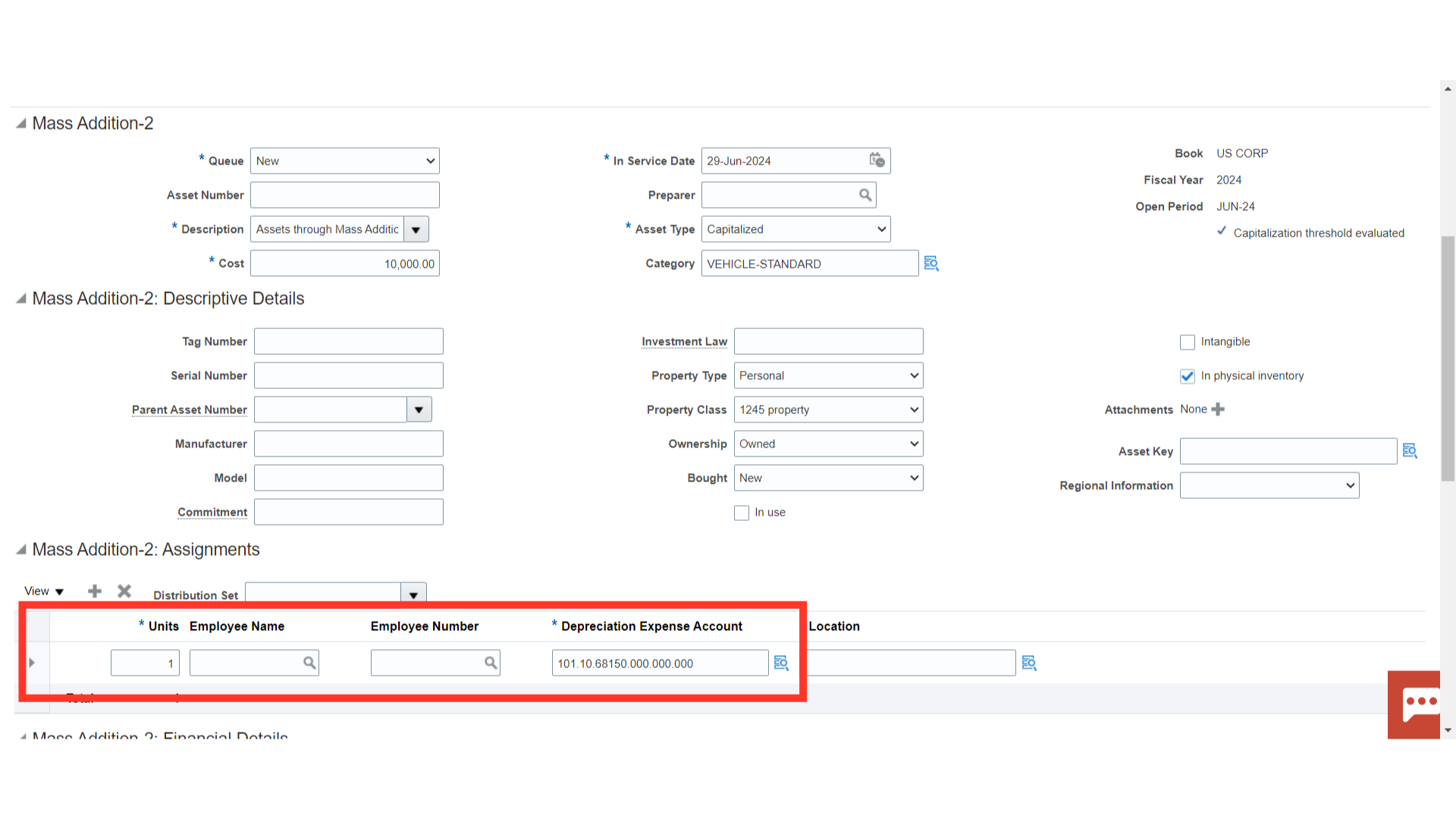

In the Assignment sections enter the name of the employee to whom the asset is assigned, and depreciation expenses account combination from defaulted the Asset category.

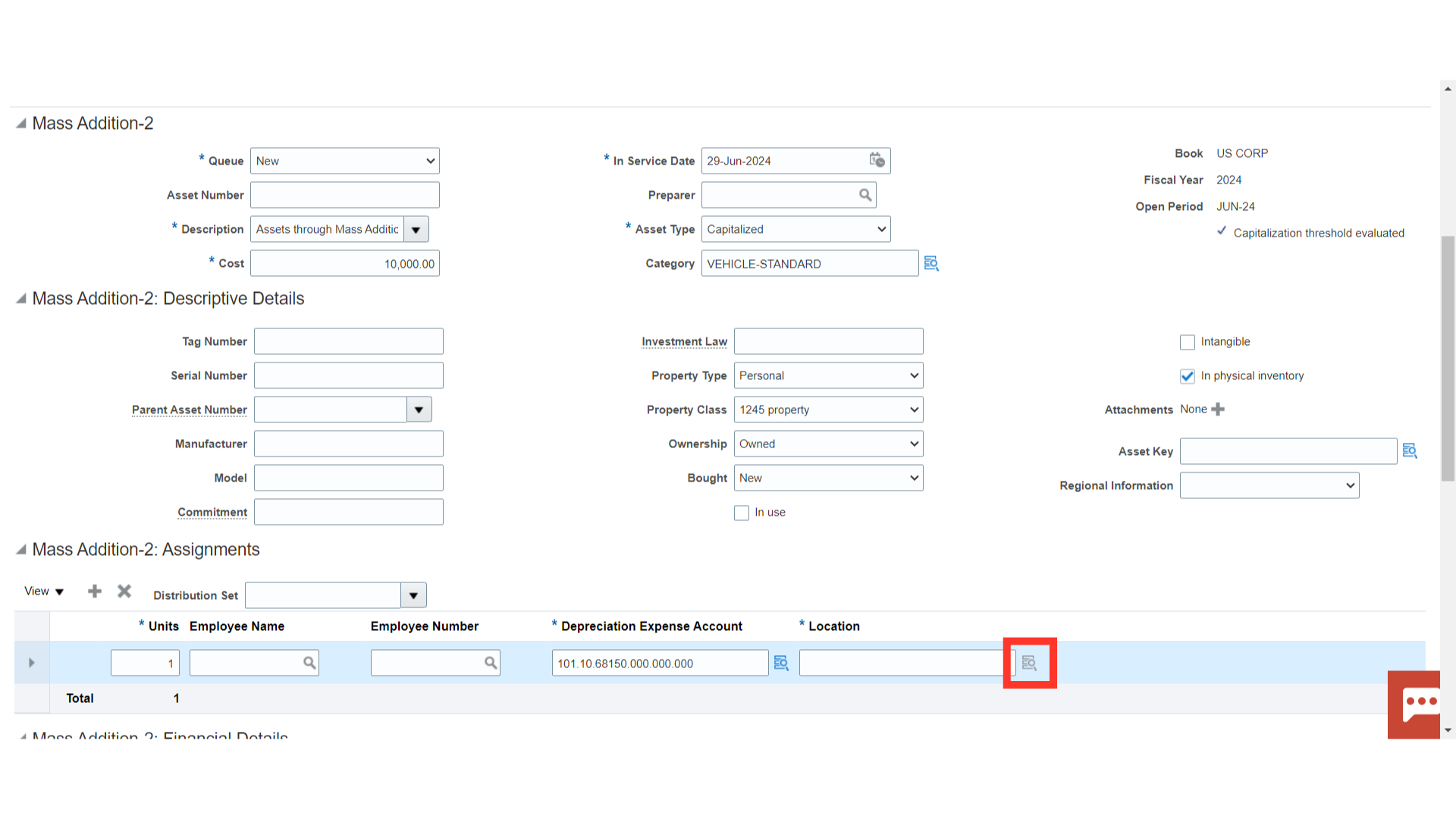

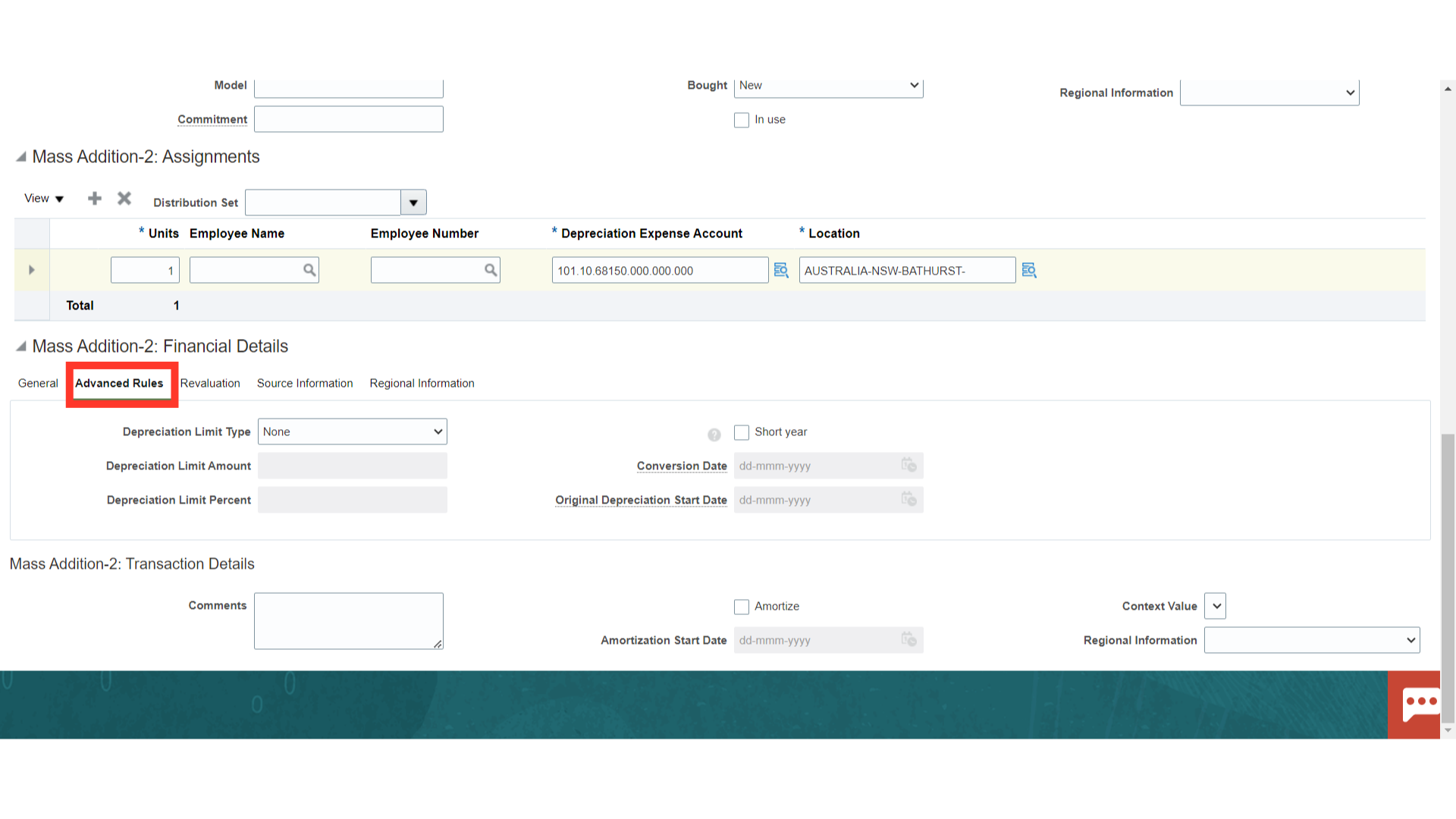

To enter the location combinations, click on the highlighted Icon. Enter the location segments manually or select from the list of values.

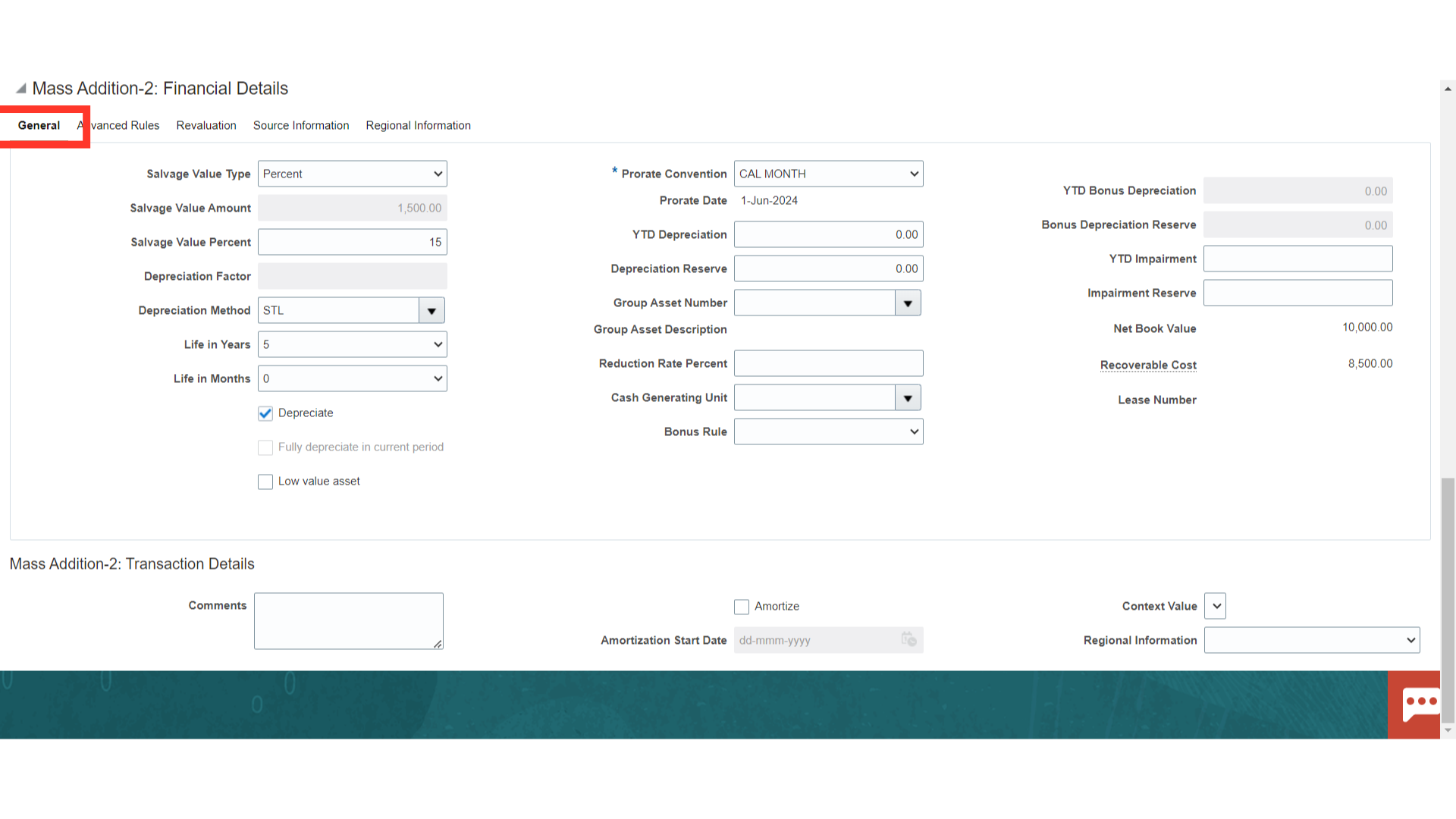

Click on the General tab under the Mass Additions to enter the asset’s financials details such as Prorate Convention, Depreciation Method, Useful life, etc. To depreciate the Asset enable checkbox against the Depreciate Field.

While under the Advanced Rules, the advanced calculation related to depreciation is mentioned.

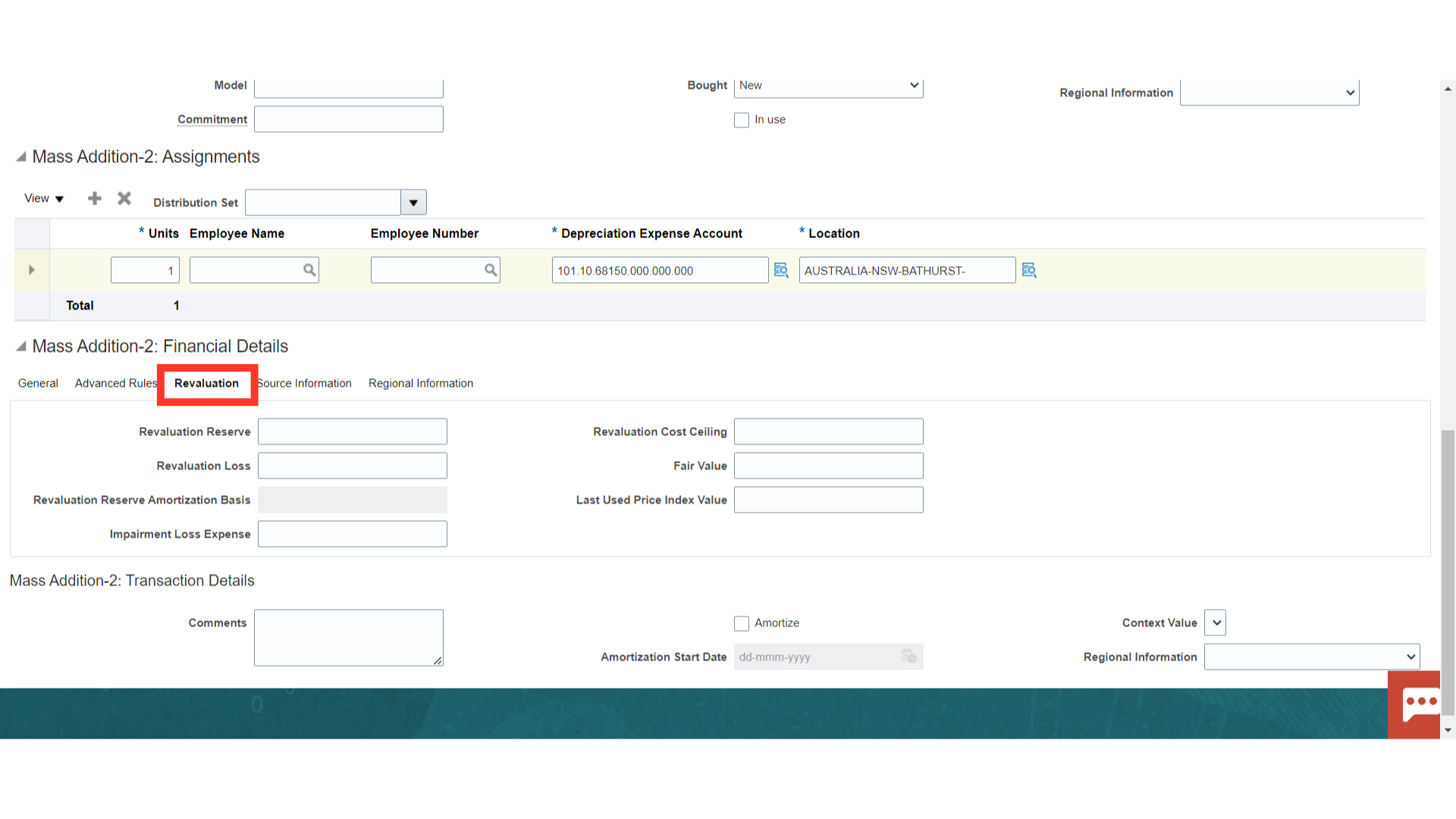

In the Revaluation tab, the details useful for calculating the revaluation of the assets are mentioned.

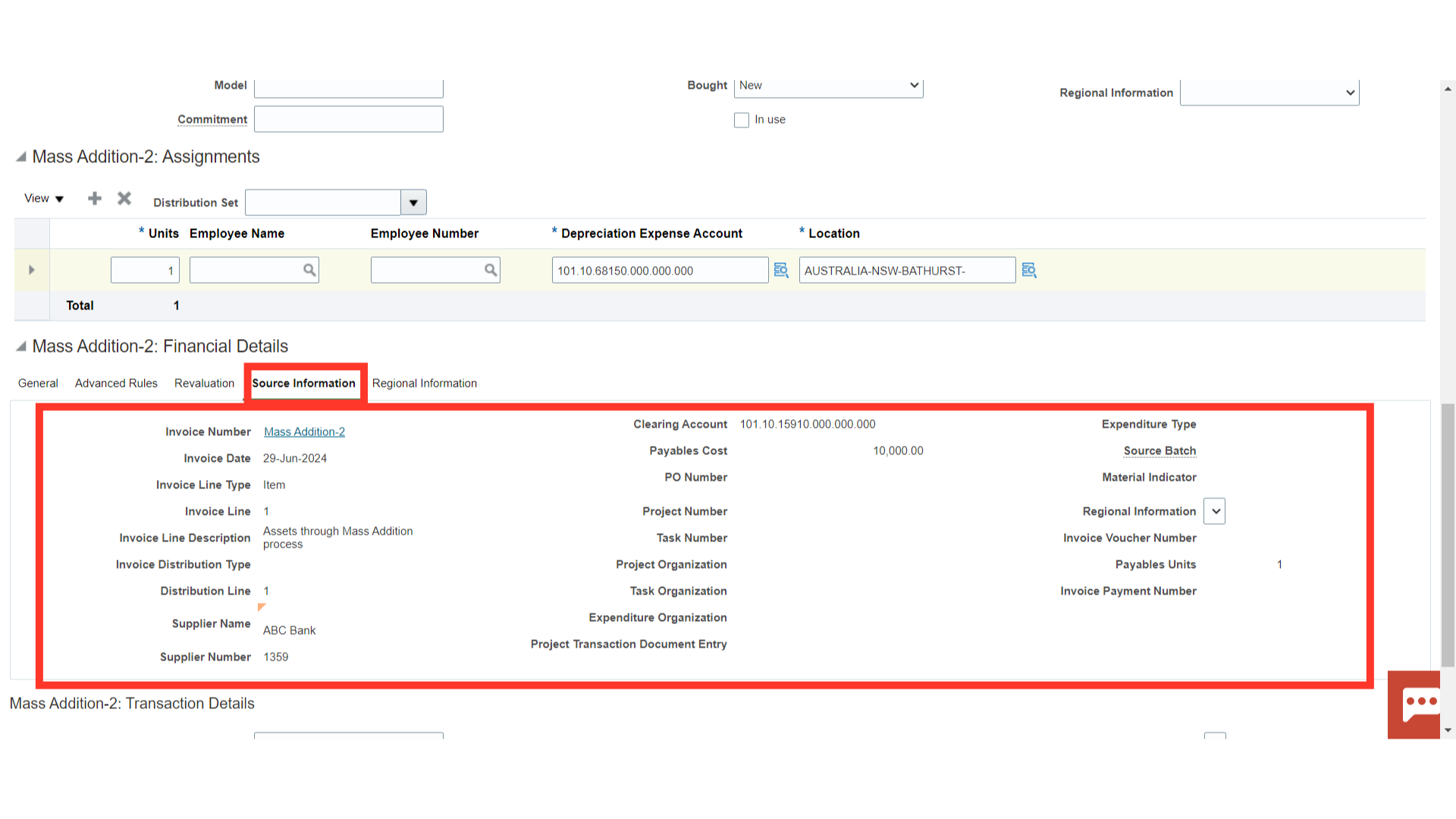

Under the Source Information tab, details of Vendor, invoice, PO details, etc displayed. Click on the Invoice number hyperlink to view the details of fixed assets.

After entering all the details, click on the Save and Close button.

The Mass Addition line would move under the Ready to Post section. Click on the POST All button to post the asset lines to the asset register.

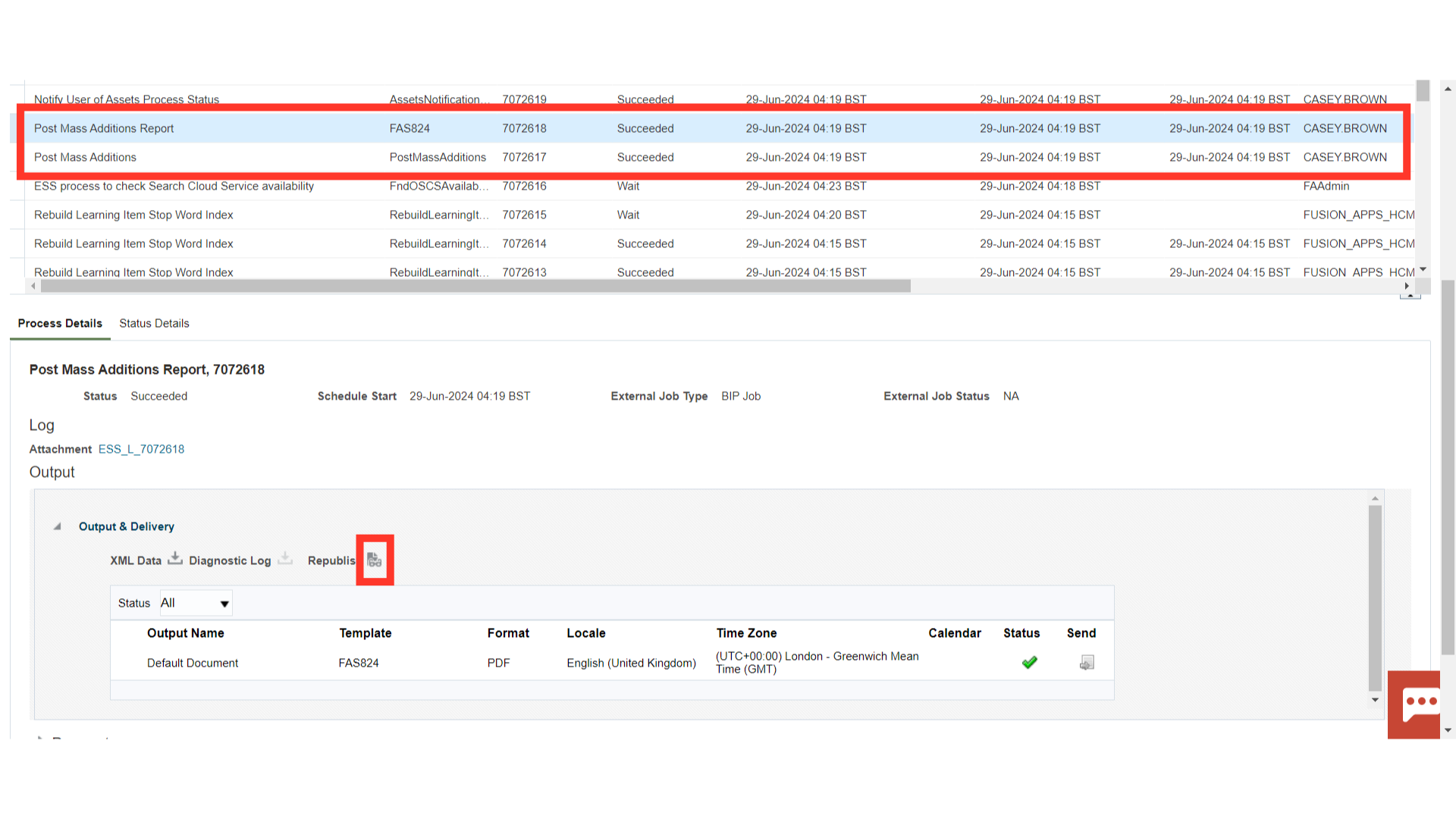

To find out how the Post Mass Addition process is progressing, navigate to Schedule Processes. Click the Republish button to download the Post Mass Additions Report from the scheduled process.

To find out how the Post Mass Addition process is progressing, navigate to Schedule Processes. Click the Republish button to download the Post Mass Additions Report from the scheduled process.

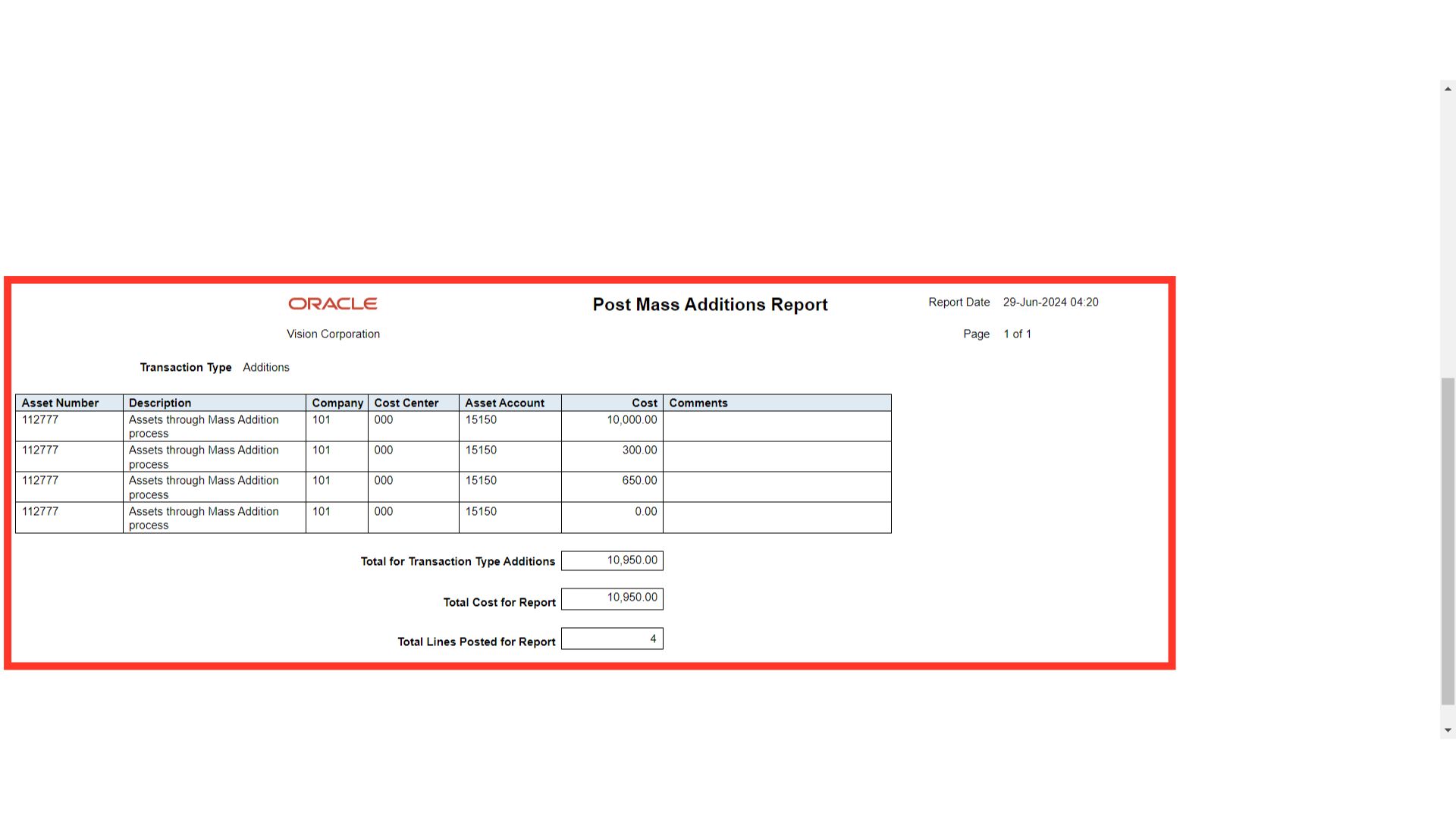

Lists all the asset additions and cost adjustments processed by the Post Mass Additions process. The report is sorted by transaction type.

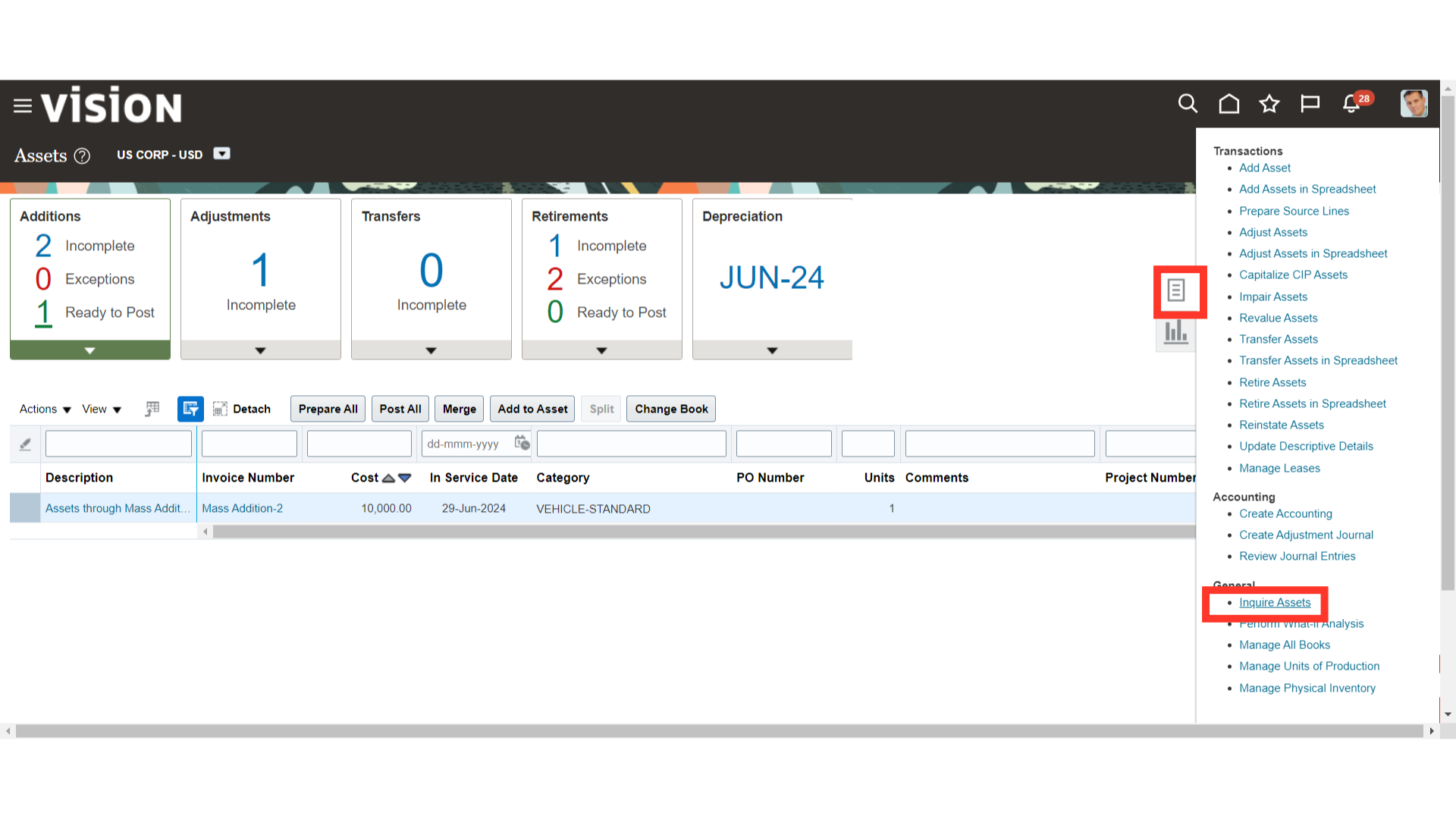

Click on the Inquire Assets from the task list to search the assets created.

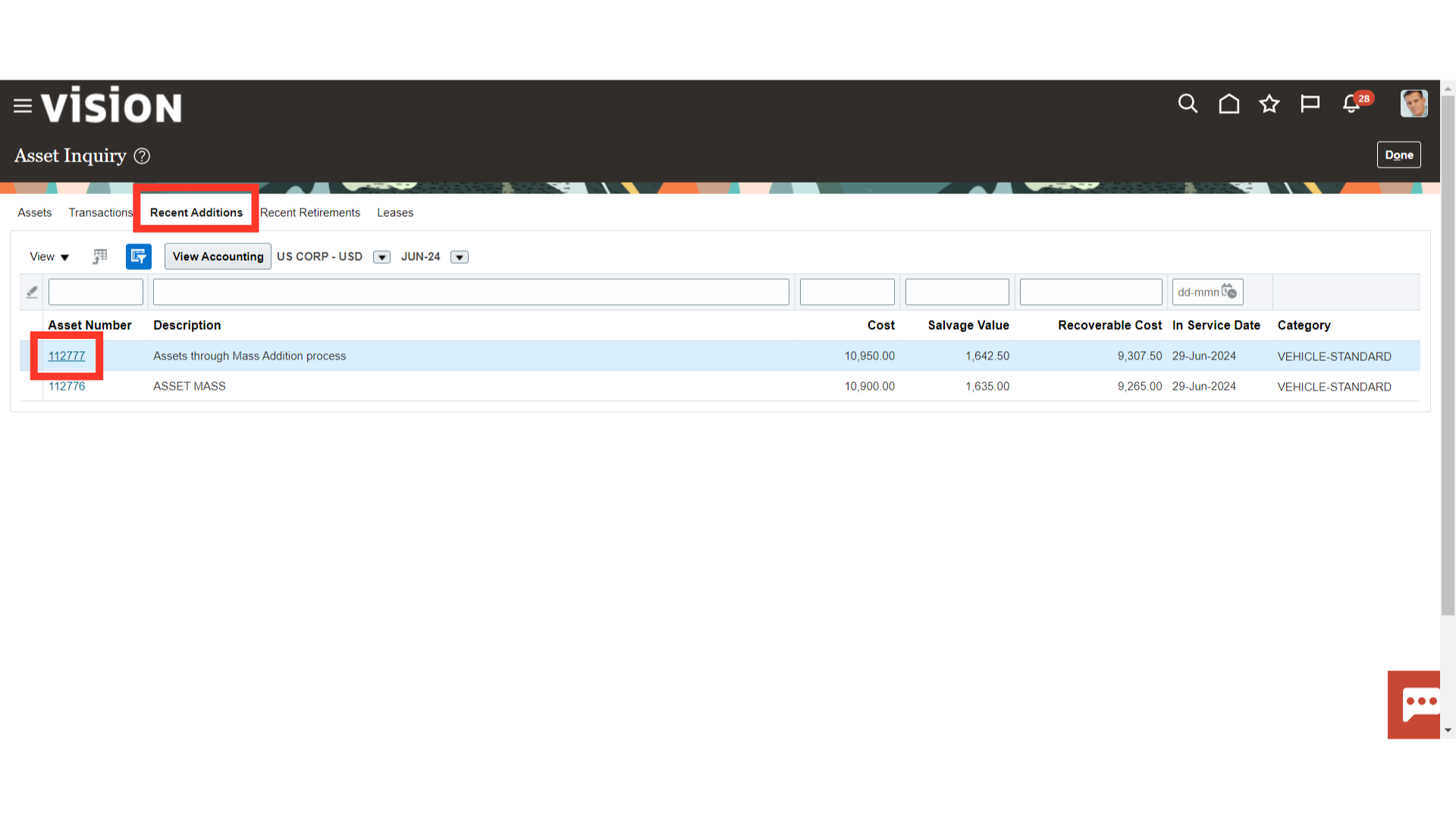

Under the Recent Additions, the details of the Asset recently added are displayed. To open the Asset, click on the Asset number hyperlink.

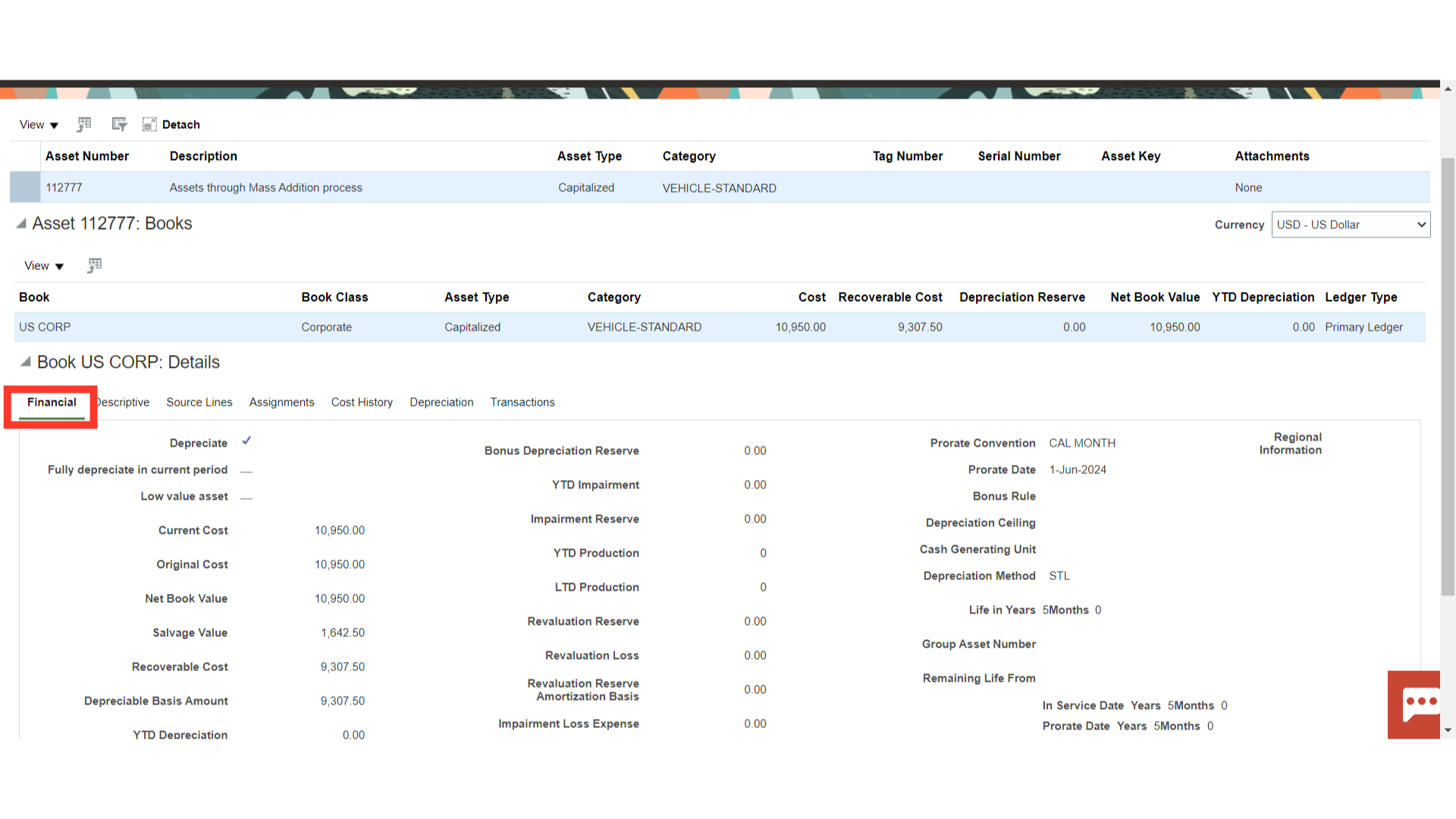

The asset’s details, including its cost, salvage value, YTD depreciation, useful life, and depreciation method, are listed under the Financial Details tab.

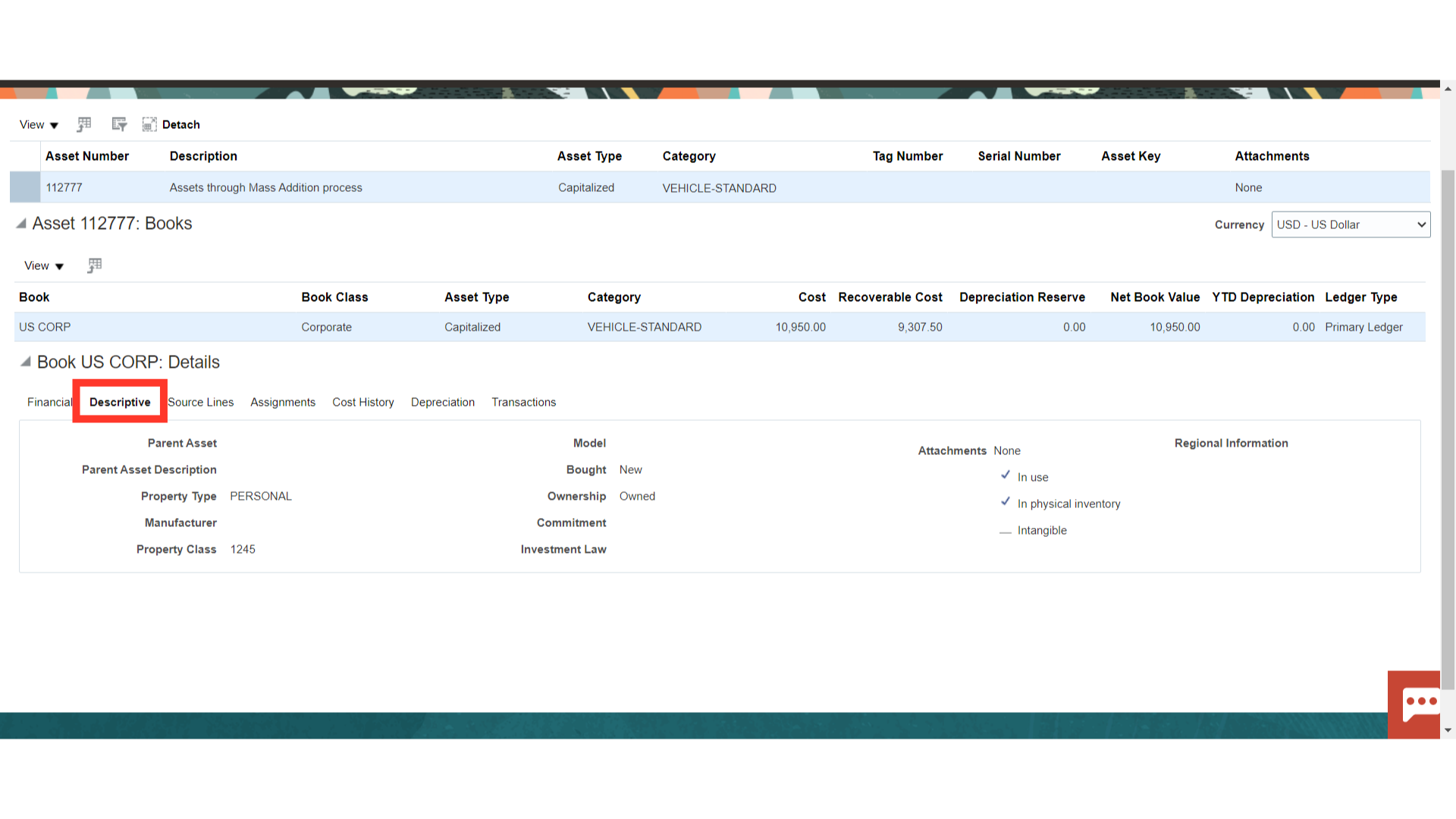

Non-financial descriptive information about the asset, such as the tag number, serial number, manufacturer details, etc., is displayed under the descriptive.

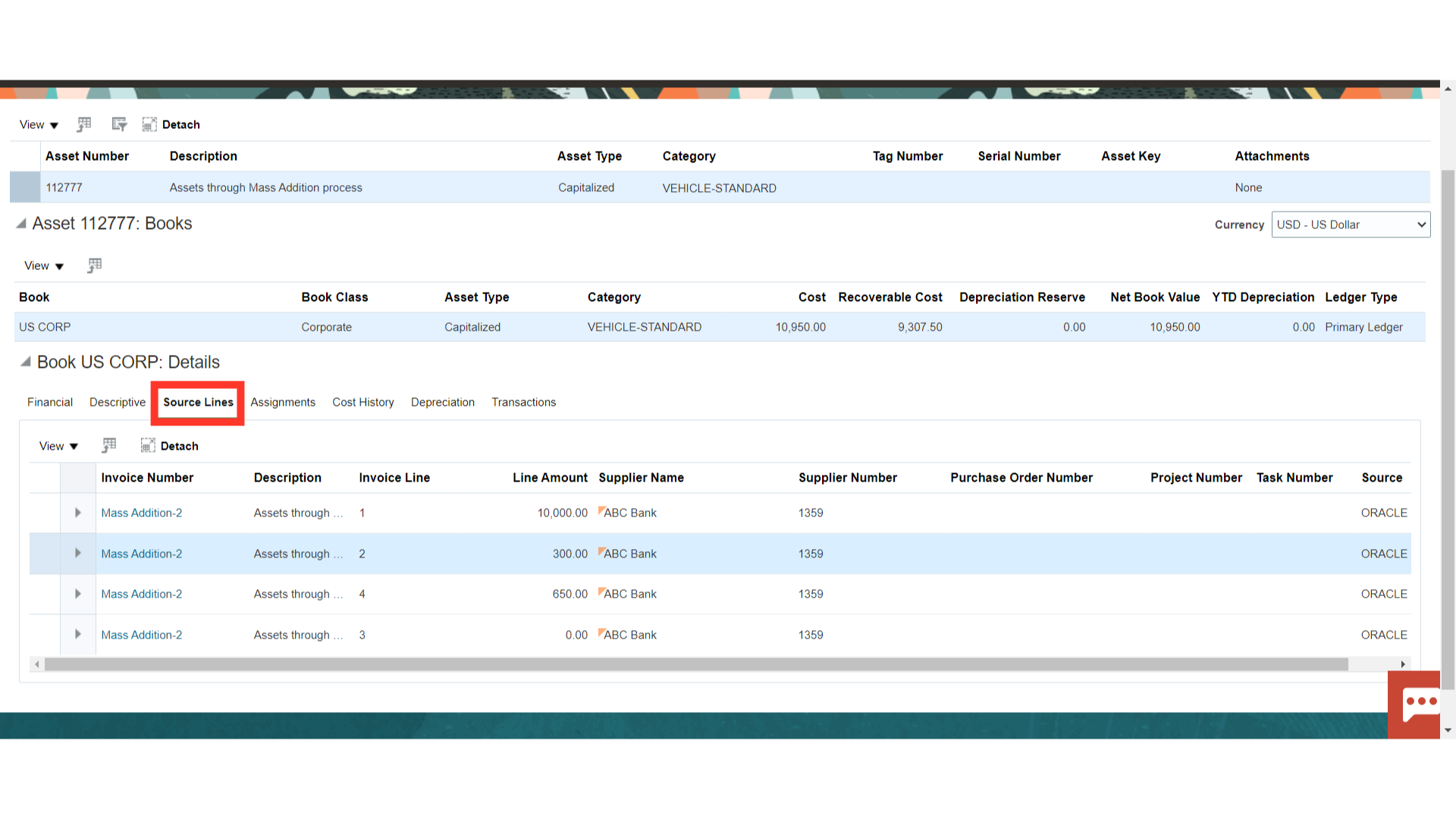

The asset’s source line details, including the invoice number, line, source name, and so forth, are displayed under Source lines.

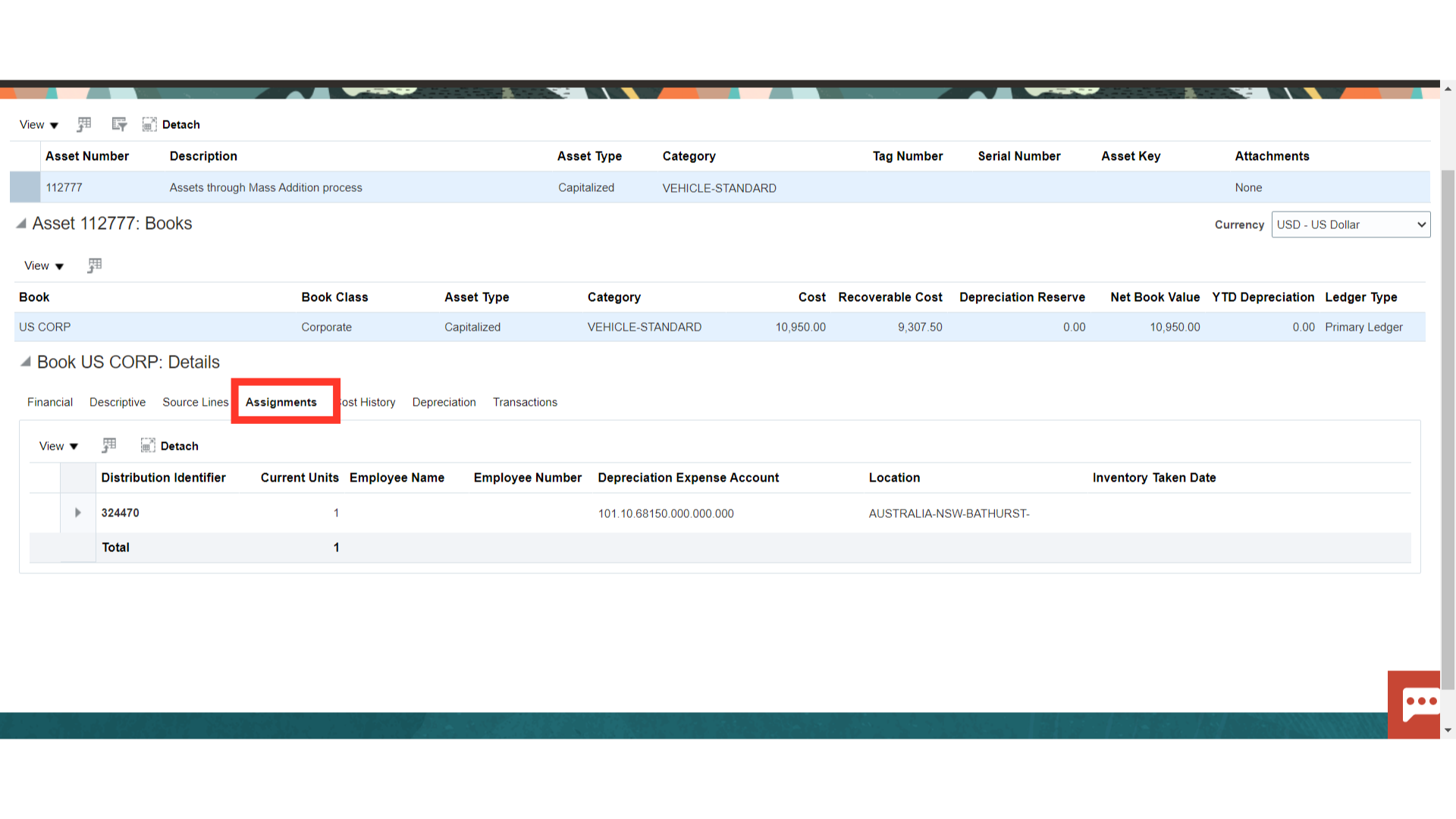

The details of the assets unit, depreciation, location combination, and employee assignment are shown under the Assignments tab.

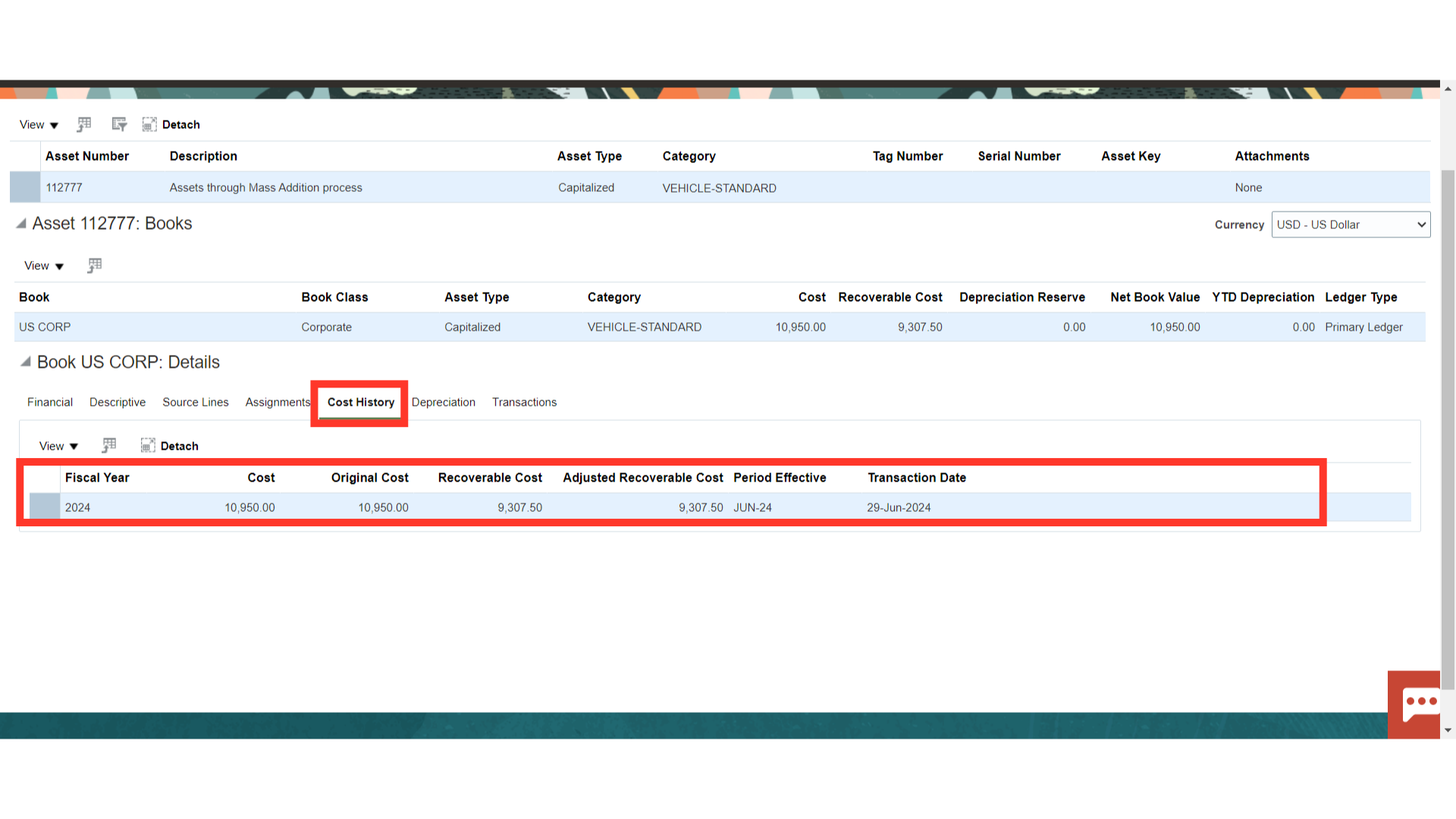

Click on the Cost History tab to see the details of the asset cost.

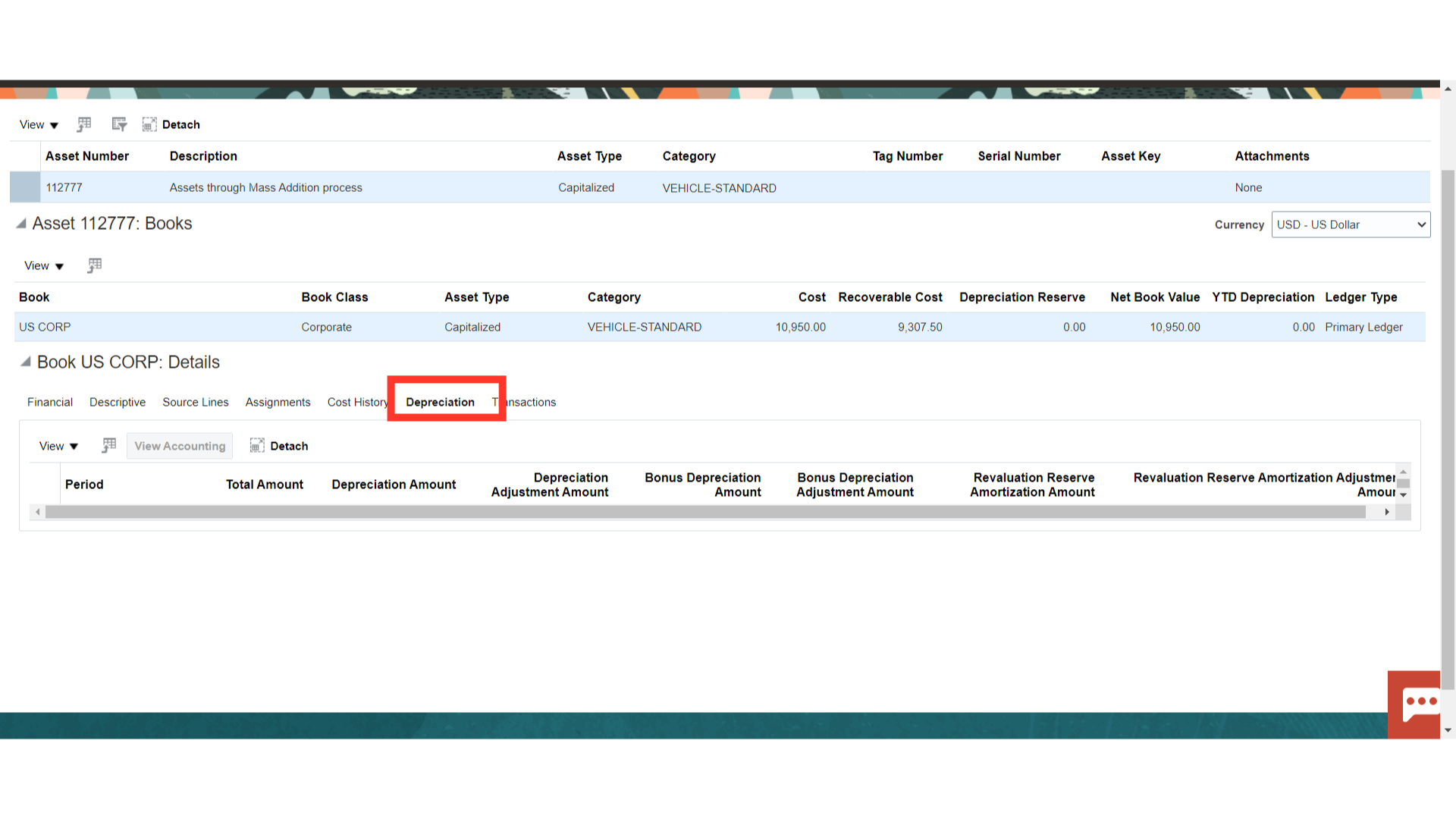

In the Depreciation tab, the details of the depreciation amount calculated period-wise are displayed, and accounting entries of the depreciation can be seen by clicking on the View Accounting button.

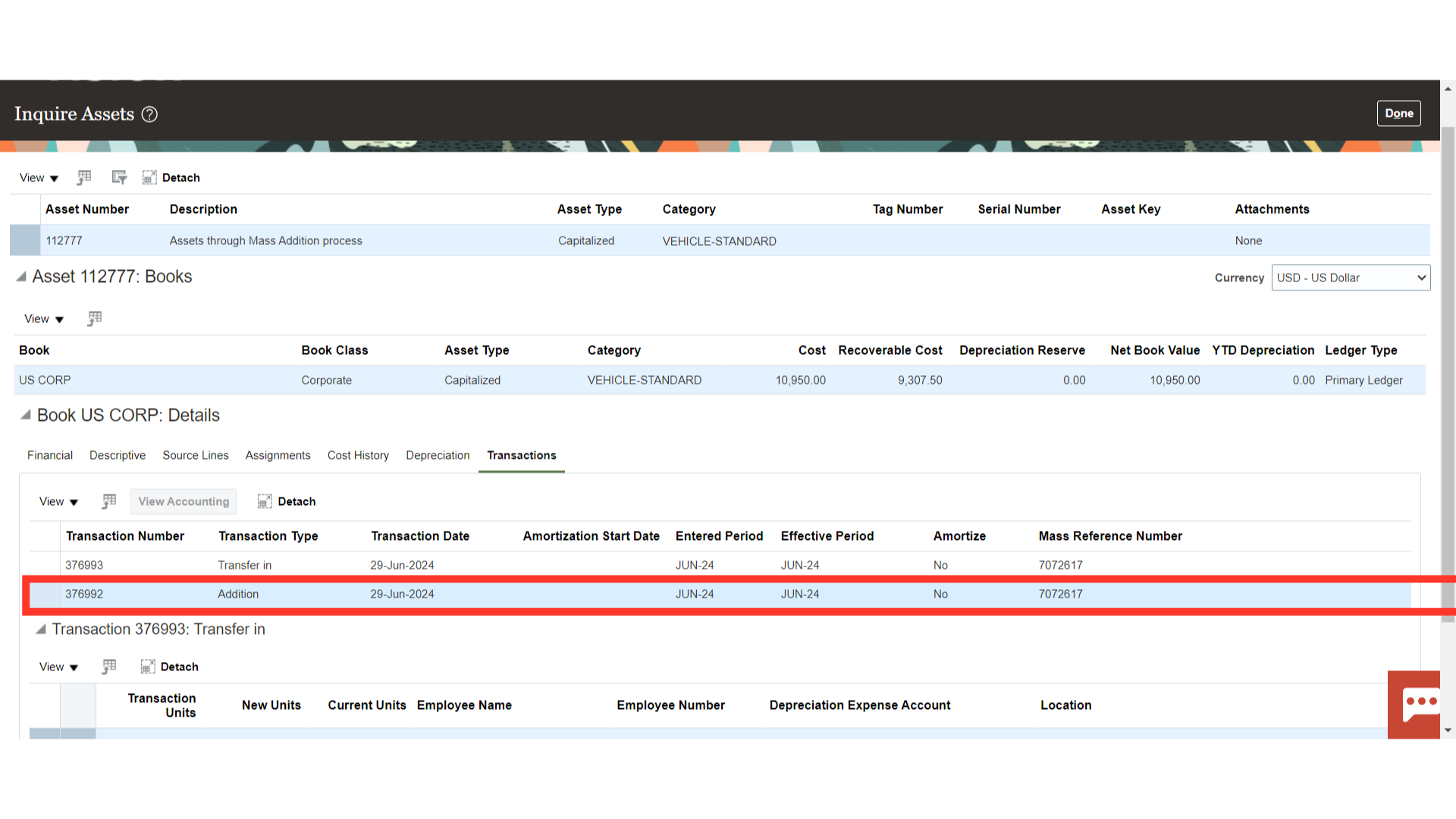

Under the Transactions amount, the accounting entry of asset additions is displayed. Click on the Addition Transaction type, and select the View Accounting button to see the details of the accounting entry.

Under the Transactions amount, the accounting entry of asset additions is displayed. Click on the Addition Transaction type, and select the View Accounting button to see the details of the accounting entry.

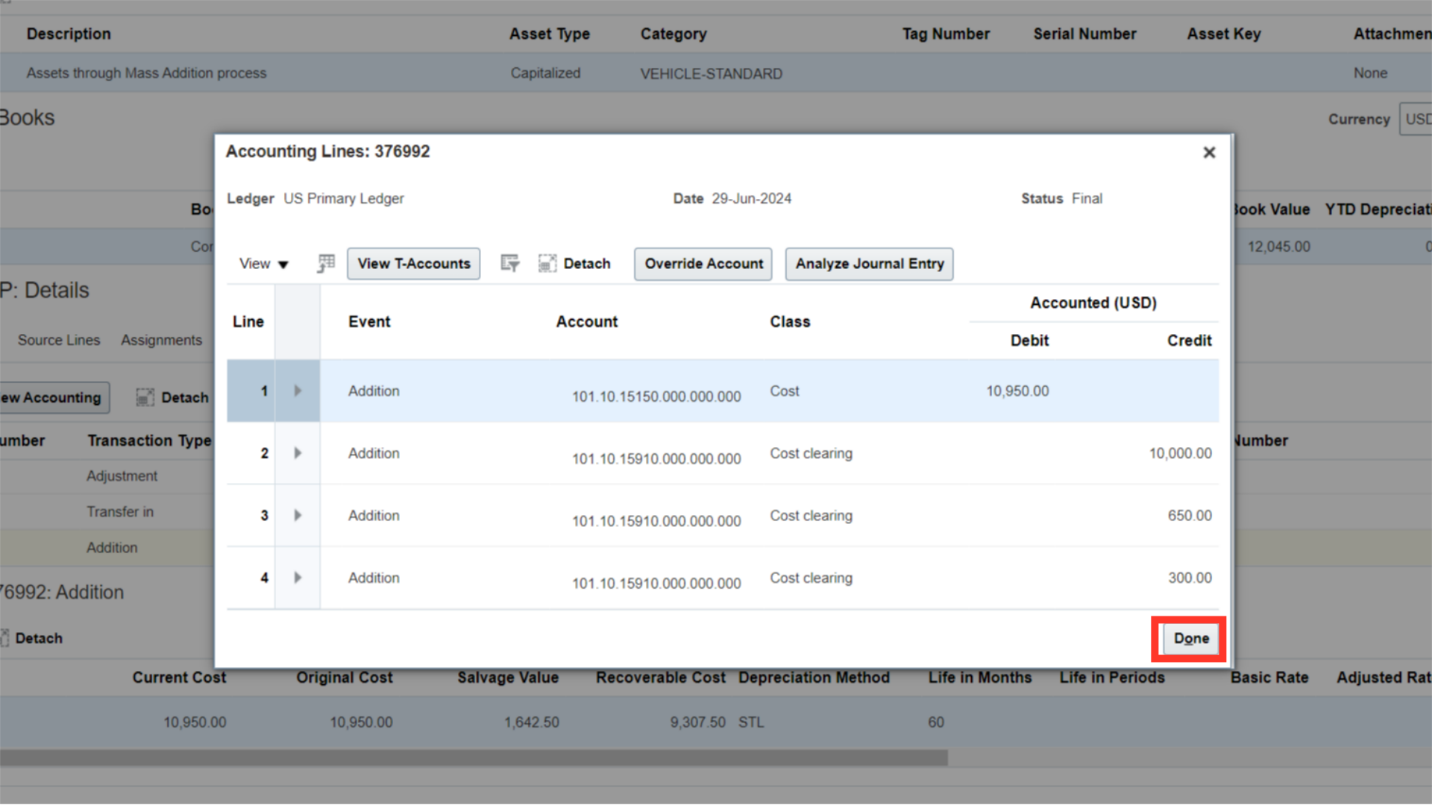

This is the accounting entry generated for the Asset creation in which the asset cost is debited and Cost clearing is credited. Click on the Done button to close this window.

The creation of Fixed Assets through a Mass Addition process has been exemplified in this guide, beginning with the execution of the Create Mass Addition process and ending with the editing and posting of the mass addition lines to the Fixed Asset module in Oracle Fusion cash management.